Robert Kiyosaki Predicts $500K BTC Price as Hyperinflation Looms

Highlights

- Robert Kiyosaki predicts Bitcoin could surge to $500K–$1M as trust in U.S. debt erodes.

- Despite strong bond auction demand, Kiyosaki warns of hyperinflation and collapsing dollar value.

- Bitcoin hits $109,424 ATH as institutions buy in; Kiyosaki calls BTC the best hedge.

Robert Kiyosaki, author of Rich Dad Poor Dad, has issued a strong warning about the state of the U.S. economy. Amid these concerns, Kiyosaki has predicted BTC price could surge to between $500,000 and $1 million amid Bitcoin setting a new all-time high today.

Robert Kiyosaki Concerns Over U.S. Bond Auction

Robert Kiyosaki’s recent comments were triggered by a U.S. Treasury bond auction held on May 20. The Rich Dad Poor Dad author stated that no buyers appeared at the auction and alleged the Federal Reserve had to purchase $50 billion worth of bonds itself.

The U.S. Treasury Department, however, released data showing a bid-to-cover ratio of 2.97, with $212.58 billion in bids and $74.38 billion accepted. Only $4.38 billion was awarded to the Federal Reserve’s account, according to the official records. This suggests participation was higher than Kiyosaki implied.

Despite this, Robert Kiyosaki warned that this event signals a deeper issue in the financial system. He described the Fed’s action as “fake money buying fake assets” and said it marked the breakdown of trust in U.S. debt.

Hyperinflation Warning Amid Rising Market Pressures

Robert Kiyosaki claimed that the United States has entered a phase of hyperinflation. He believes continued money printing by the government will quickly reduce the dollar’s value.

“Hyperinflation is here,” he stated on X. “Millions, young and old, to be wiped out financially.” According to him, savings will lose value rapidly, and traditional financial systems may not be able to protect wealth.

He previously warned that the US credit rating downgrade and excessive debt could trigger a major financial crisis. His latest comments follow this same theme of economic breakdown.

Bitcoin, Gold, and Silver as Wealth Protection

As a response to what he sees as a collapsing dollar, Rich Dad Poor Dad author Robert Kiyosaki believes investors will shift toward assets with limited supply. Despite his earlier BTC prediction to $250k, predicted Bitcoin could reach between $500,000 and $1 million. Gold, he said, may climb to $25,000 per ounce, and silver to $70 per ounce.

He considers these assets better stores of value in times of high inflation. “Buy more. Do not sell,” he advised, urging followers to keep holding Bitcoin. He also warned against relying on Bitcoin ETFs, calling them “toilet paper” in an earlier post.

Robert Kiyosaki has long supported Bitcoin and regularly advises followers to invest in “real gold and silver and Bitcoin” to preserve wealth.

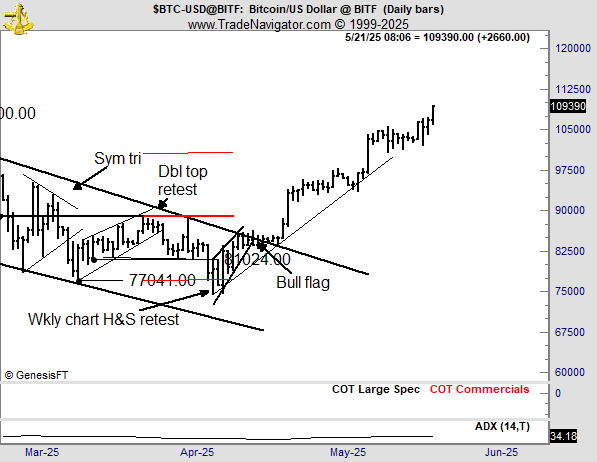

BTC Price Hits New All-Time High

Bitcoin price has now reached a record price of $109,424, as of press time. The milestone reflects growing institutional interest, including from Bitcoin ETF inflows. Analysts say the cryptocurrency has entered price discovery mode, with new highs possible.

Bitcoin analyst Peter Brandt added that Bitcoin reaching all-time highs is a normal part of a bull market cycle. He suggested a potential top of $125,000 to $150,000 by the end of August. Amid this trend, Jim Cramer also encouraged calm amid rising U.S. debt concerns and mentioned gold and Bitcoin as safe options.

Consequently, while Robert Kiyosaki’s upper forecast of $1 million is more extreme, it aligns with broader bullish sentiment in the crypto space. He believes the current financial crisis will accelerate this rise.

- Wall Street Giant Citi Shifts Fed Rate Cut Forecast To April After Strong U.S. Jobs Report

- XRP Community Day: Ripple CEO on XRP as the ‘North Star,’ CLARITY Act and Trillion-Dollar Crypto Company

- Denmark’s Danske Bank Reverses 8-Year Crypto Ban, Opens Doors to Bitcoin and Ethereum ETPs

- Breaking: $14T BlackRock To Venture Into DeFi On Uniswap, UNI Token Surges 28%

- U.S. Jobs Report: January Nonfarm Payrolls Rise To 130k, Bitcoin Falls

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates