Russian Crypto Volumes Slump After Binance Blocks Visa, Mastercard

Russian crypto trading volumes sank after Binance blocked cards issued by Visa and Mastercard in the country. While Russian citizens still have access to crypto exchanges, it appears that sanctions on conventional payment systems are affecting their ability to trade.

While most crypto exchanges have opposed blanket bans on Russian users, they have stopped accepting payments from sanctioned banks and services, limiting the channels through which Russians can invest in crypto. This has also made people wary of storing their wealth in crypto, fearing a loss of access.

Payment operators Visa, Mastercard and American Express have all suspended their services in Russia citing American sanctions. Most foreign banks have also ceased operations in the country.

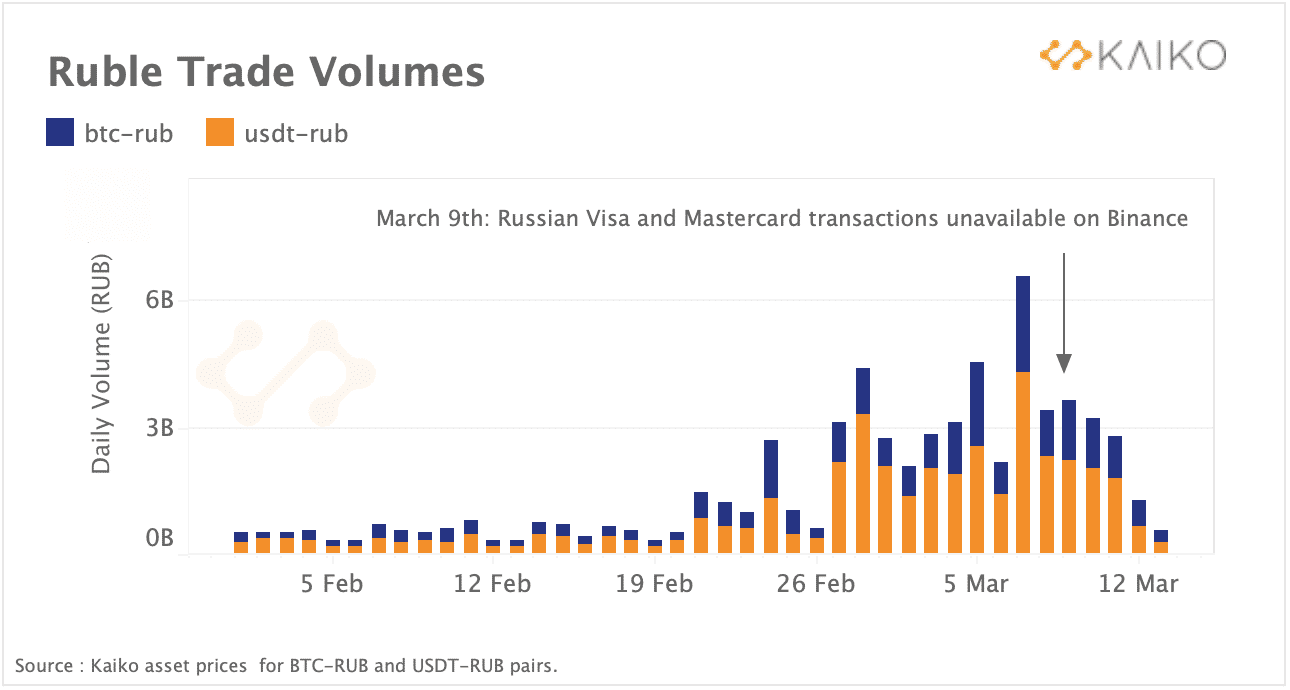

Data from digital assets data provider Kaiko showed that ruble-denominated trading volumes of Bitcoin and Tether had steadily dropped after Binance’s move last week, and were now at levels seen prior to Russia’s invasion of Ukraine.

Kaiko also noted a divergence between ruble and hyrvnia- denominated crypto trade. BTC-UAH buying surged in the wake of the invasion, indicating that Ukrainian traders were piling into crypto amid financial uncertainty.

Ukrainian trading volumes have remained elevated, with Tether seeing high demand in the country. Citizens were seen paying an up to 20% premium for the stablecoin, as the hyrvnia collapsed.

But BTC-RUB volumes only budged after the imposition of sanctions, specifically the banning of Russian banks from the SWIFT network. Western sanctions against Moscow are the strictest they’ve ever been, and effectively block Russia from most global financial markets.

The United States recently also blocked imports of Russian oil, with Europe considering a similar move. This would further unsettle the Russian economy, given that oil is its largest export.

Ruble recovers from record low against Bitcoin

Lower BTC-RUB trading activity helped the Russian ruble recover from record lows against Bitcoin. One Bitcoin is now worth about 4.6 million rubles, a slight improvement from the over 5 million peg seen last week.

Still, the ruble faces immense pressure in exchange markets. It is trading around record lows to the dollar and the euro.

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?