Satoshi Fund CEO Spotlights Elizabeth Warren’s ‘Fake’ 1% Crypto Tax Letter

Highlights

- An alleged letter from Elizabeth Warren proposing a 1% crypto tax sparks debate in the market.

- The proposed legislation calls for mandatory reporting and a 1% wealth tax on crypto holdings.

- Satoshi Fund CEO questions the authenticity of Warren's letter, citing misspellings and absence from the website.

Recent discussions within the cryptocurrency market have been stirred by an alleged letter from Senator Elizabeth Warren proposing a 1% wealth tax on crypto holdings and mandatory reporting. Notably, this development has raised concerns among investors and enthusiasts, particularly given Warren’s historical skepticism toward cryptocurrencies.

However, doubts have emerged regarding the authenticity of the letter, shedding new light on the unfolding situation.

Elizabeth Warren’s Alleged Letter Raises Concern

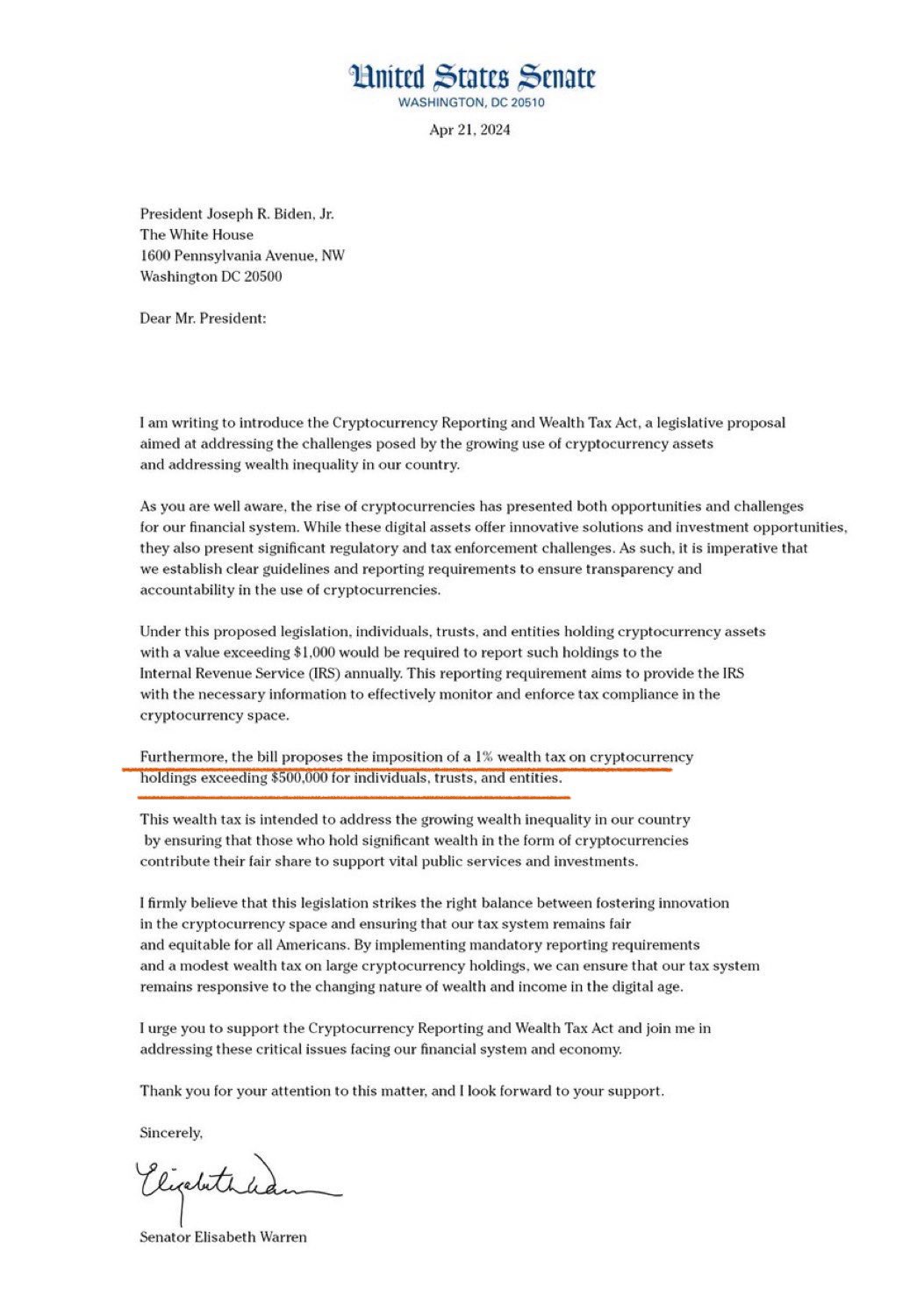

A purported letter from Senator Elizabeth Warren to U.S. President Joe Biden, advocating for the Cryptocurrency Reporting and Wealth Tax Act, has emerged on social media platforms. The letter outlines proposals for mandatory reporting of cryptocurrency holdings exceeding $1,000 and a 1% wealth tax on holdings over $500,000.

Meanwhile, this alleged letter from Senator Elizabeth Warren has sparked discussions in the cryptocurrency sector, given her previous anti-crypto stance. Addressed to President Biden, the letter introduces the Cryptocurrency Reporting and Wealth Tax Act, aiming to tackle challenges posed by crypto’s rise and wealth inequality.

Besides, crypto holders exceeding $1,000 in value must annually report holdings to the IRS, with a 1% wealth tax on holdings over $500,000 under the proposed legislation shared on social media. In addition, Warren allegedly emphasizes the need for transparency and tax compliance, urging support for the bill to balance innovation and fairness in the crypto space.

Also Read: Bitcoin Price Rally To $71K Imminent? Know All Here

Satoshi Fund CEO Offers Clarity

Dennis Porter, CEO and Co-founder of Satoshi Action Fund, has cast doubt on the legitimacy of Elizabeth Warren’s letter. Notably, The Satoshi Fund CEO pointed out misspellings in Elizabeth Warren’s name and the absence of the letter on Warren’s official website.

Meanwhile, Porter remarked that while the policy suggestions seemed plausible given Warren’s stance on crypto regulation, the discrepancies raised suspicions about its authenticity. This revelation has sparked further debate within the cryptocurrency community, underscoring the need for clarity and transparency in legislative matters impacting the industry.

However, the cryptocurrency community has reacted with skepticism to the alleged Warren letter, questioning its validity and implications. Now, as speculation mounts, stakeholders are urging for clarification from official sources to dispel doubts and provide clarity on the proposed legislation. Amid the uncertainty, concerns persist over the potential impact of such policies on crypto investors and the broader market.

Also Read: BitMEX Slams Peter Schiff For Deeming Bitcoin Fee Spike A “Failure”

- XRP News: XRPL Activates Permissioned DEX Upgrade to Boost Institutional DeFi Adoption

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- Veteran Trader Peter Brandt Predicts Bitcoin Price Rebound, Gold Fall to $4000

- Peter Thiel Exits ETHZilla as Stock Slides 3% Amid Token Launch

- Bitwise, Granitshares Eyes $63B Sector With New Prediction Markets ETF Filing

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k