September 50 BPS Fed Rate Cut Odds Climb Ahead of CPI, PPI Data

Highlights

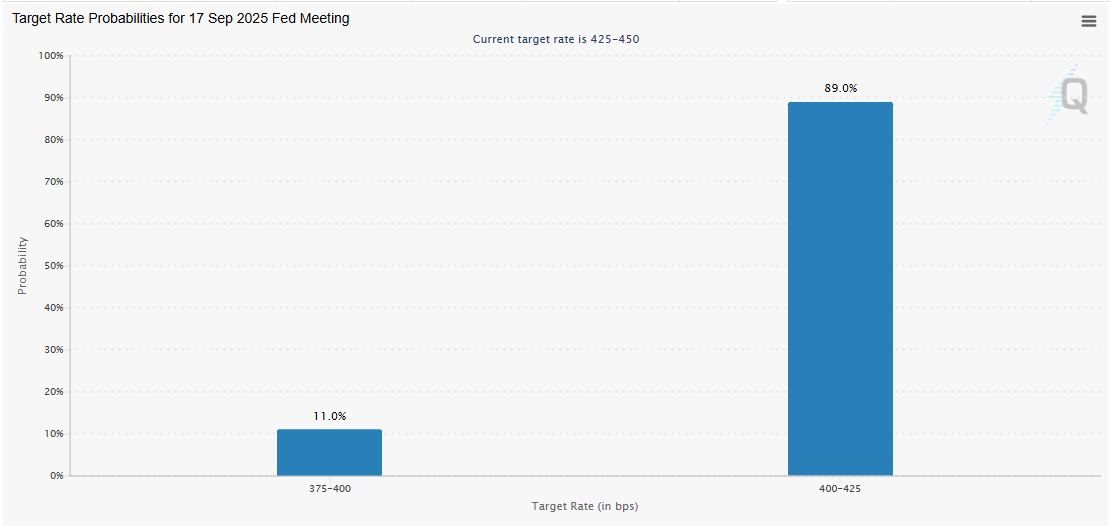

- There is an 11% chance of the Fed making a 50 bps rate cut at its upcoming FOMC meeting.

- This comes ahead of the CPI and PPI data release.

- Fed’s Goolsbee said that he wants to see the inflation data before he makes up his mind on a rate cut decision.

Traders are beginning to price in the possibility of a 50 basis points (bps) Fed rate cut at the upcoming FOMC meeting. This comes ahead of the CPI and PPI inflation release next week, which could also impact the Fed’s decision.

Odds Of a 50 BPS Fed Rate Cut Rise Ahead of Key Inflation Data

CME FedWatch data shows that there is an 11% chance that the Fed will lower rates by 50 bps at the upcoming FOMC meeting. This comes ahead of the PPI and CPI inflation, which the Labor Department will release on September 10 and 11, respectively.

Notably, traders began pricing in the possibility of a 50 bps Fed rate cut following the release of the U.S. jobs data yesterday. The U.S. added only 22,000 jobs in August, well below expectations of 75,000. Meanwhile, the unemployment rate rose to 4.3%, which is near a four-year high.

This latest jobs data has again suggested that the labor market is weakening and that the Fed needs to adjust its monetary policy. Jerome Powell had signalled at the Jackson Hole conference that they might need to make a Fed rate cut with the downside risk in the labor market rising.

However, the Fed also has a mandate to keep inflation steady, which is why the upcoming PPI and CPI data will be key in their decision on a rate cut at the September 17 meeting.

If both data show that inflation remains steady, then it could further boost the odds of a 50 bps Fed rate cut since Powell and some Fed officials have, before now, indicated that they were holding off on a cut because of the inflation risk from the Trump tariffs.

Goolsbee Waits On Inflation Data Before Making Decision

According to a Bloomberg report, Federal Reserve Bank of Chicago President Austan Goolsbee said that he hasn’t decided on what course of action he will support during the upcoming FOMC meeting. He remarked that he wants to get more information, hinting at the inflation next week.

He noted that the committee also has to look at the inflation side before determining whether to make a Fed rate cut or not. Meanwhile, Fed Governor Chris Waller has said that they need to make a rate cut at the September 17 meeting.

Waller remarked that he is not worried about the inflation side and warned that they need to get ahead of a sharp slowdown in the labor market. The Fed Governor also suggested that the market could see multiple cuts over the next three to six months.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs