Silver($SLV) Price Soars to 8-year High; Spot, ETF and Microcaps all Rise in the Wake of Silver Squeeze Calls

The Silver ($SLV) price is breaking an eight-year-long downtrend and reached a price of near $30 today for the first time since March 2013. The sudden rise in the price of the old-age traditional asset seems to be fueled by the wallstreetbets (the Reddit group behind GME pump) call for short squeezing the market to bring down JP Morgan who holds billions in short position against the Silver market.

Silver SPOT, ETF, Microcaps All Rise Amid Short Silver Frenzy

The call for a Silver squeeze has transitioned across all Silver markets be it Futures market, ETF, Microcaps, and even stocks of the Silver miner has registered a healthy surge.

$SLV and silver miner stocks surging this morning. @TheDomino breaks it down: pic.twitter.com/35iE4PnRDo

— Squawk Box (@SquawkCNBC) February 1, 2021

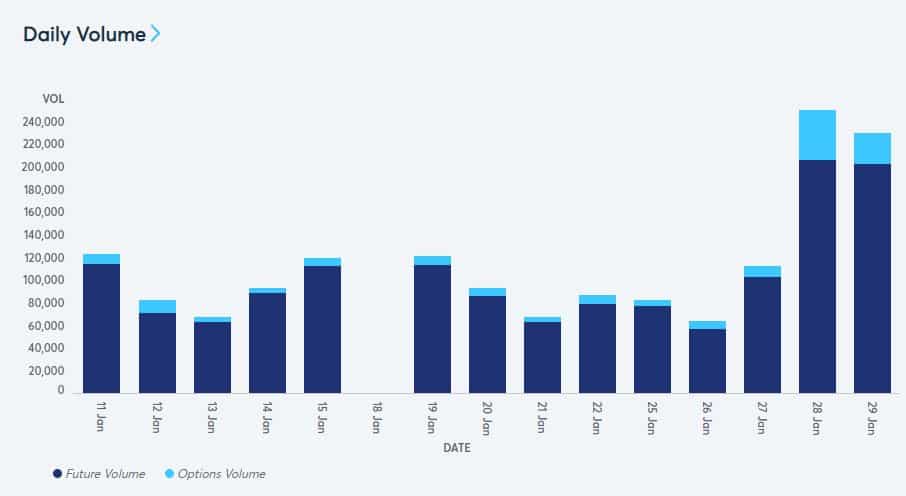

The Silver futures market is up by 10% led by soaring volume for the CME Futures and Options market.

The largest silver ETF on Friday brought in a record $922 million, indicating the rising demand for a highly shorted market led by retailers.

The largest silver ETF, $SLV, took in $944 million on Friday — a recordhttps://t.co/4ZhpsIzGZC pic.twitter.com/TQUwKBOaSE

— Sarah Ponczek (@SarahPonczek) February 1, 2021

Silver ($SLV) Premium Rises to 11%

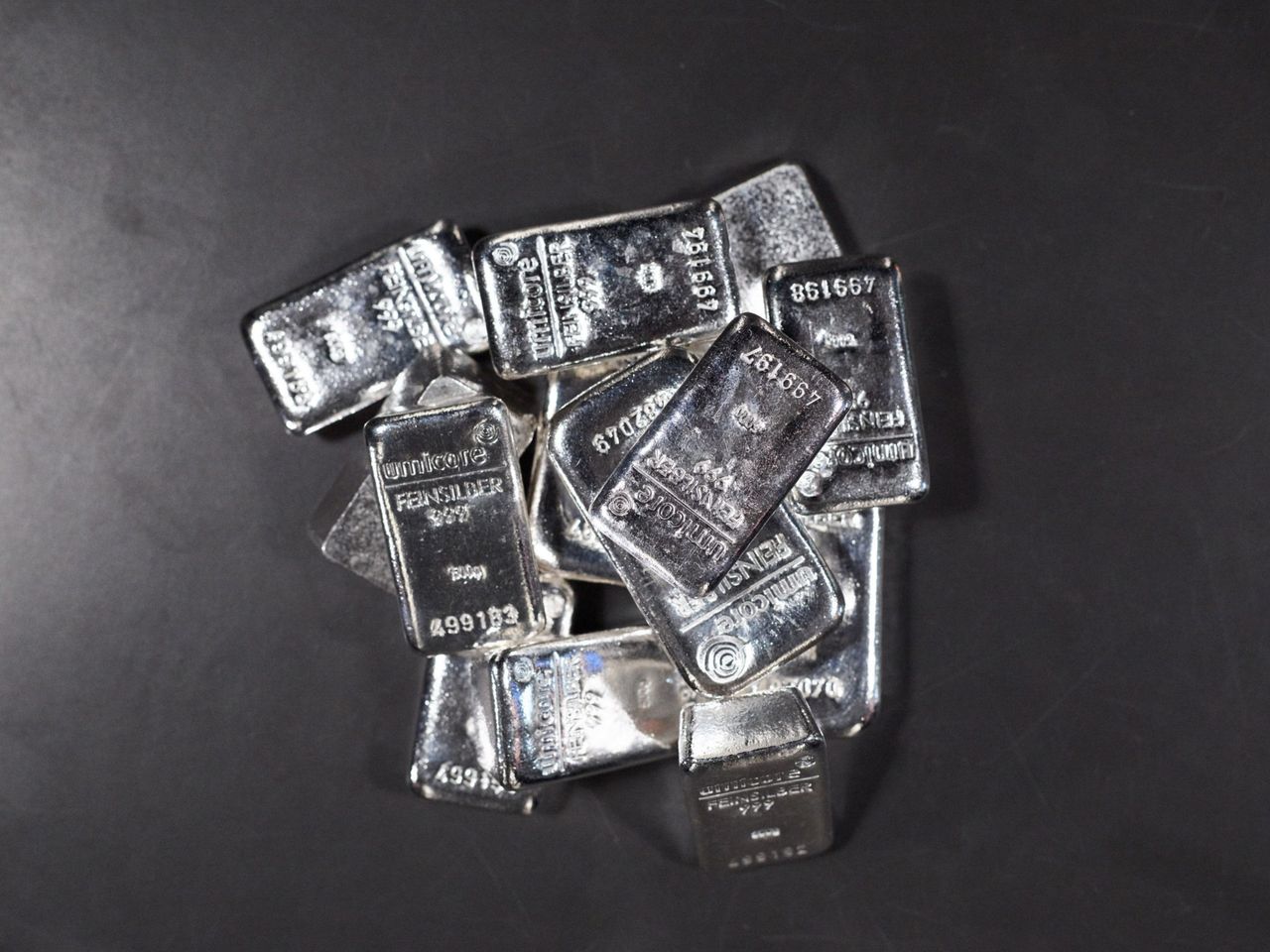

The rise in silver demand has created a supply crunch for physical silver in the market while Silver Trust funds have a nearly 11% premium for Silver.

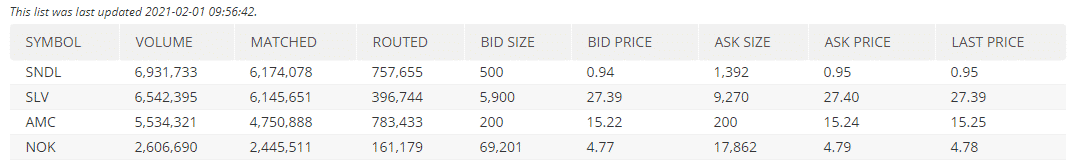

The 8-year price high was aided by significant trading of $SLV across major exchanges.

One Reddit member from the wallstreetbets group supposedly has nearly $231k in $SLV calls.

WallStreetBets user has $231k in $SLV calls. pic.twitter.com/Fuw14F3uNq

— Reddit Investors (@redditinvestors) January 31, 2021

When compared to Gamestop, Silver is a significantly bigger market expanding to futures and physical silver-backed ETF, so it would be quite a task for retailers to swing the price of the asset. However, going by the early trends it seems the price has started to pick up, however with a price target of $1000, it seems quite a daunting task to pull a GME again.

The debate around the Silver Squeeze has started to gain mainstream traction, but recent data from CME suggests that a significant portion of Silver holders are top wall street giants that include the likes of Morgan Stanley and Bank of America.

Btw here's the top holders of $SLV. Not to be a party pooper, but it's pretty Wall Street-y. pic.twitter.com/UnpdimzsqX

— Eric Balchunas (@EricBalchunas) January 31, 2021

A fraction of the social media also believe that the recent calls for Silver Squeeze are not just being propelled by Redditors and retail traders, but wall street also has a say in it.

- Denmark’s Danske Bank Reverses 8-Year Crypto Ban, Opens Doors to Bitcoin and Ethereum ETPs

- Breaking: $14T BlackRock To Venture Into DeFi On Uniswap, UNI Token Surges 28%

- U.S. Jobs Report: January Nonfarm Payrolls Rise To 130k, Bitcoin Falls

- Arkham Exchange Shut Down Rumors Denied as Bear Market Jitters Deepen

- XRP News: Ripple Taps UK Investment Giant to Bring RWA Tokenization on XRP Ledger

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes