Solana, Cardano, Litecoin, Sui ETFs Delay Wipe Out Institutional Interest: CoinShares

Highlights

- Altcoins, including Solana, Cardano, Litecoin, and Sui saw waning institutional flows.

- Buying slows as US SEC missed ETF decisions due to prolonged U.S. government shutdown.

- Crypto funds saw $921 million in inflows, with $931 million flows into Bitcoin.

Institutional investors’ interest in altcoins has almost completely wiped out due to the delay in the U.S. SEC’s decision on multiple exchange-traded funds due to the prolonged U.S. government shutdown. A crypto funds flow report revealed massive outflow from altcoins, including Solana, Cardano, Litecoin, and Sui.

Institutions Lose Interest in Solana, Cardano, Litecoin, Sui

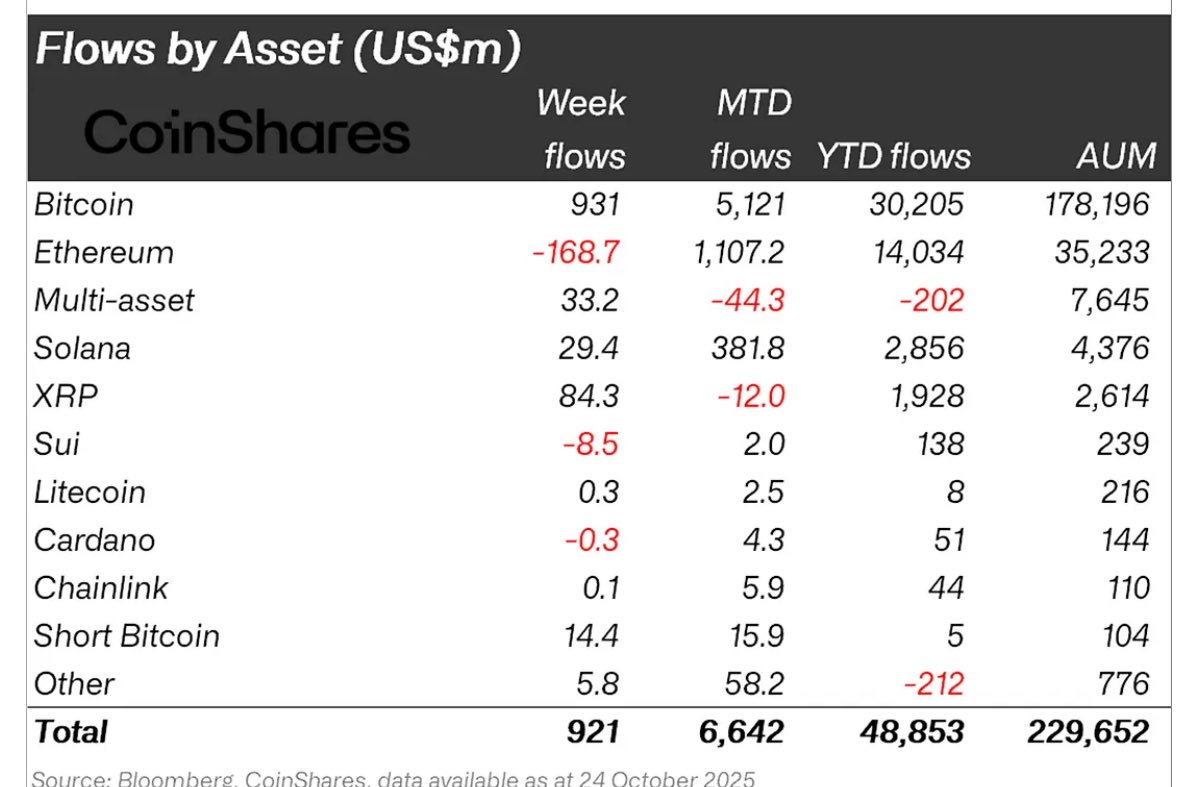

Flows in Solana and XRP have cooled in the run-up to the US ETF launches, with $29.4 million and $84.3 million, respectively, CoinShares reported on October 27. This happens as the U.S. SEC missed final decisions on multiple ETFs amid the government shutdown.

Early October, Solana broke its weekly record, seeing inflows of $706.5 million. Whereas, XRP saw substantive inflows of $219.4 million. In the previous weekly report CoinShares highlighted $156.1 million inflows into Solana and $73.9 million inflows into XRP, indicating cooling inflows amid no signs of end of the government shutdown.

Cardano saw $0.3 million outflows, reversing from $3.7 million inflows in prior week. Sui saw $8.5 million outflow as compared to $5.9 million inflows in previous week. Altcoins such as Chainlink, Litecoin, among others recorded waning capital inflows from investors amid delays in ETF.

Crypto Funds Record $921 Million in Inflows

Crypto funds saw $921 million in inflows, as investor confidence improved after lower-than-expected US CPI data. Buying in the United States and Germany supported a rise in total assets under management (AuM) to $229.65 billion, with trading volume remained strong with $39 billion.

Bitcoin saw inflows of $931 million to bring the cumulative inflows since the Fed rate cut to $9.4 billion. Investors awaits another 25 bps rate cut this week, which can make markets volatile. BTC price has rebounded above $116K today amid growing optimism on the US-China trade deal.

Meanwhile, Ethereum recorded an outflow of $169 million, the first in 5 weeks. Spot Ethereum ETFs in the U.S. saw consecutive outflows for three days despite a rebound in the crypto market. ETH price bounced above $4,200 but whales began profit booking considering upcoming volatility in the markets.

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?