Solana, DOGE, SUI & These Altcoins To Avoid As $625M Token Unlock Looms

Highlights

- SOL price soared despite massive token unlock looms this week.

- A total of $625 million in major altcoins are scheduled to get unlocked this week.

- DOGE & SUI prices also soared despite upcoming unlocks worth $17 million and $262 million, respectively.

The investors are keeping close track of Solana (SOL), Dogecoin (DOGE), SUI, and other top altcoins to avoid as major token unlock looks ahead. Usually, the token unlocks tend to impact the value of the assets due to the supply-demand mechanism. Having said that, let’s explore some of the top crypto that the traders might avoid for the ongoing week.

Solana, SUI, & DOGE & Other Top Altcoins To Avoid

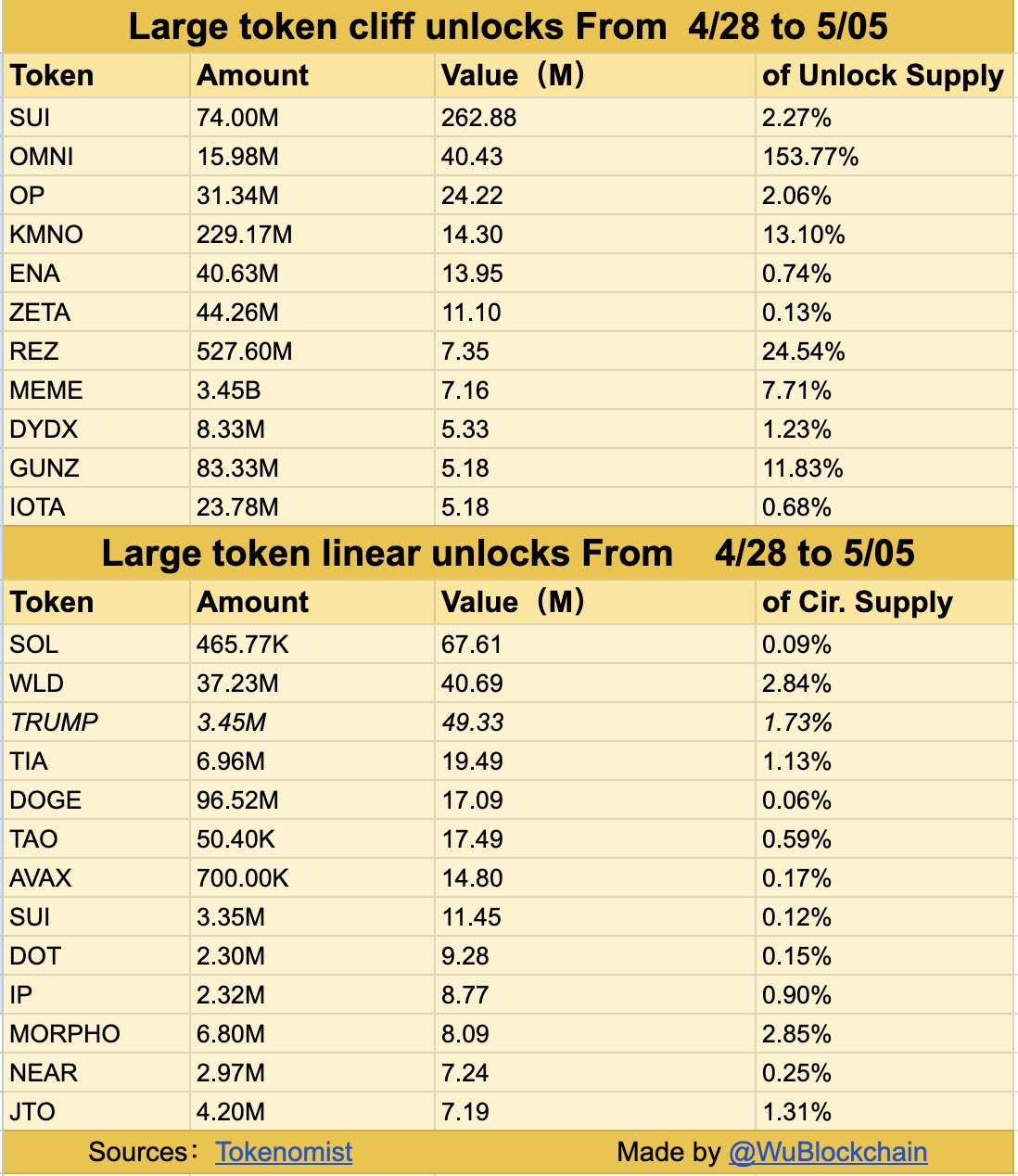

The latest data from Tokenomist reveals a storm brewing in the crypto space. Over the next seven days, tokens worth more than $625 million are set to hit the market. This includes both cliff unlocks (one-time large releases) and linear unlocks (steady daily releases, which might force investors to tread cautiously ahead.

Major cliff unlocks are lined up for SUI, OMNI, IOTA, and others. These cliff unlocks involve heavy selling risks, as large volumes are released at once, shaking supply-demand dynamics.

On the other hand, Solana, WLD, TRUMP, TIA, DOGE, TAO, AVAX, and others are facing significant linear unlocks. Each of these projects is scheduled to unlock over $1 million worth of tokens daily, further pressuring their respective markets.

Quick Tour Of The Top Altcoins To Avoid Ahead

As token unlocks, they often flood the market with supply, and traders tend to exercise caution to avoid sudden price drops. Let’s explore the major altcoins to avoid this week as a massive unlock is incoming.

Solana Unlock & Price

The image compiled by WuBlockchain from Tokenomist’s data outlines the looming unlocks for this week. SOL faces major pressure with a $67.61 million unlock looming for the crypto this week.

However, the recent SOL performance indicates that the investors might have shrugged off concerns amid a broader market recovery. SOL price today rose more than 2.5% to reach $151 from its 24-hour low of $144.89.

Meanwhile, Solana tops the list of major coin this week with a substantial $67 million worth of tokens entering circulation. Although it represents only 0.09% of SOL’s circulating supply, large holders could still trigger sell-offs.

DOGE Unlock & Price

Apart from Solana, another leading player in the digital assets space might also face pressure. Dogecoin (DOGE) will face a $17.09 million release this week. While relatively smaller in percentage terms, unexpected selling could easily sway the top memecoin’s highly sentiment-driven price.

However, DOGE price also rose around 0.7% to $0.1807, accompanied by a falling trading volume of 12% to $1.08 billion. Notably, the investors will keep close track of its upcoming movements, with many waiting on the sidelines before understanding the unlock’s impact on its value.

SUI Unlock & Price

SUI is another altcoin that the investors might avoid for now, with notable cliff and linear unlocks totaling around $262.88 million. With both cliff and linear unlocks, the total value hitting the market is massive. Cliff unlock alone will release $262 million worth of SUI, roughly 2.27% of its supply.

Meanwhile, SUI price today also jumped alongside Solana, DOGE, and others, rising 2% to $3.69.

Bottom Line

Although the crypto market is resting in the green with renewed investors’ confidence, investors should exercise due diligence before putting their bets this week. With the massive token unlocks, it appears that the traders might avoid these top altcoins, which might create bearish pressure on the assets.

Besides, the movement of whales also plays a crucial role in the coming days. Last week, a whale put its bet on 3 coins, resulting in massive price surges. This reflects how these large investors influence the broader market sentiment.

- CLARITY Act: Crypto Group Challenges Banks Proposal With Its Own Bill Suggestions

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- Trump Tariffs: U.S. Supreme Court Sets February 20 for Potential Tariff Ruling

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch