Solana Overtakes Ethereum To Become Leading Ecosystem For Developers

Highlights

- Solana became the leading ecosystem for new developers this year, ending Ethereum's 8-year dominance.

- Solana recorded an 83% year-on-year (YoY) growth.

- Solana currently leads the way in DEX volume over Ethereum.

Solana has recorded another impressive milestone, overtaking Ethereum to become the leading ecosystem for new developers this year. This ends Ethereum’s eight-year streak, having led in this particular metric since 2016.

Solana Becomes Preferred Choice Over Ethereum

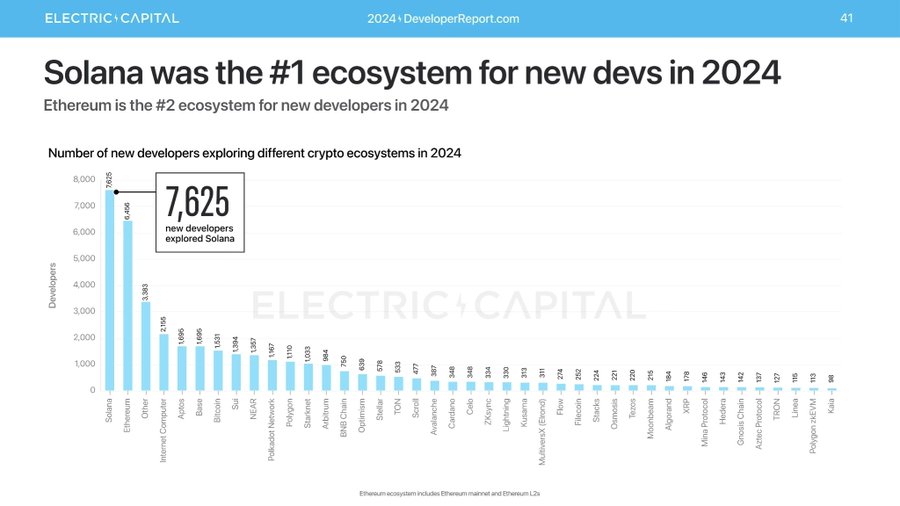

Electric Capital’s Developer Report showed that Solana is the number one ecosystem for new crypto developers in 2024. This marks the first time any other top layer 1 network has surpassed Ethereum for new developers since 2016. 7,625 new developers reportedly built on Solana this year.

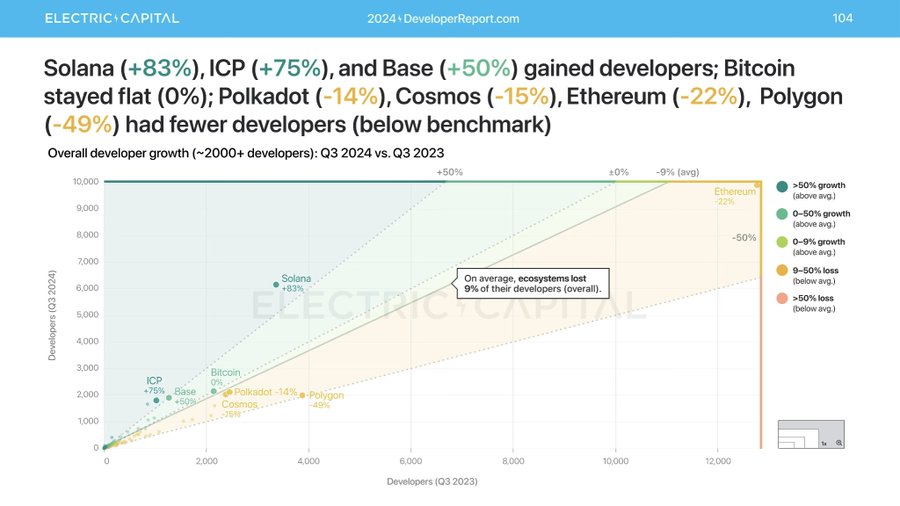

Electric Capital’s report also showed that Solana was the fastest-growing large ecosystem in terms of monthly active developers, with an 83% year-on-year (YoY) growth. Internet Computer (ICP) and Base also gained new developers, with 75% and 50% YoY growth, respectively.

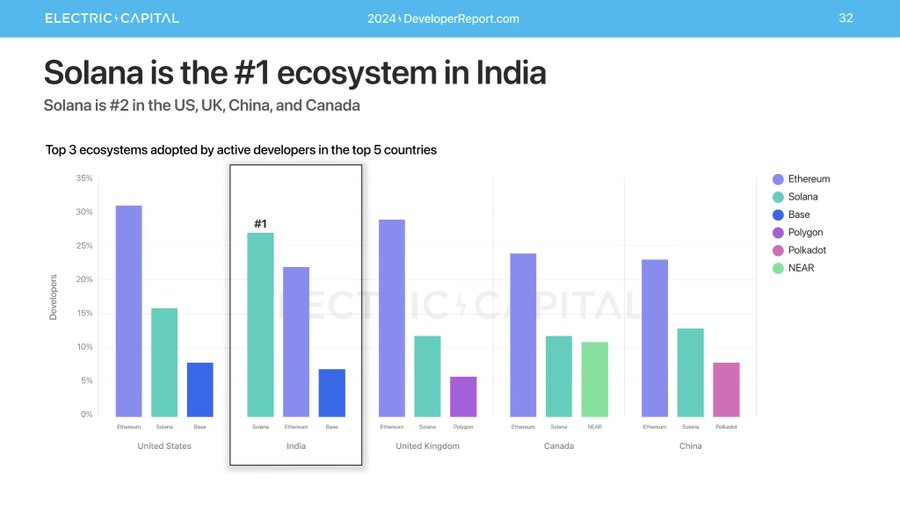

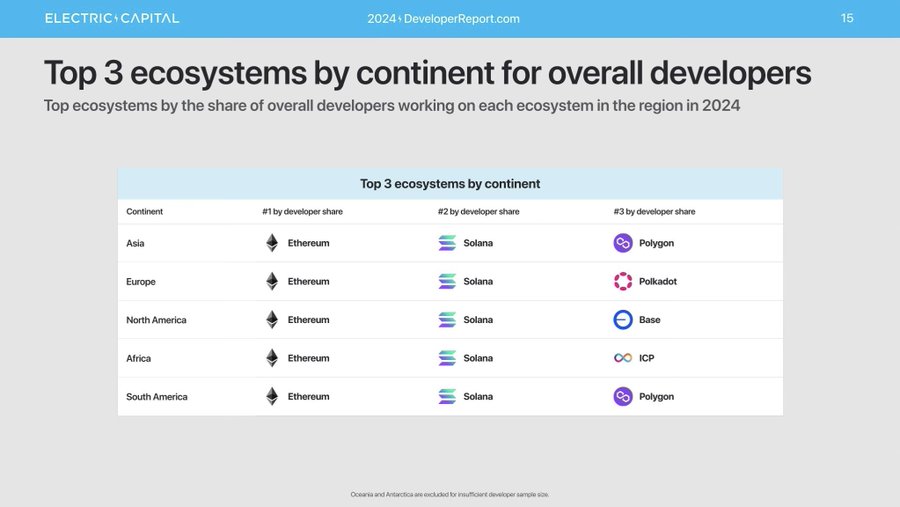

Solana’s growth took off in July 2024, when it surpassed Ethereum to become the number-one ecosystem for new developers. The network led the way in Asia and was the top ecosystem for developers in India. It was second in the US, UK, and Canada and the second-largest ecosystem overall across every continent.

Thanks to this growth, the SOL ecosystem led in low-fee use cases, with 81% of all decentralized exchange (DEX) transactions and 64% of all NFT mint transactions across all chains. 1.7 million unique wallets reportedly transacted on Solana in 2024, seven times more than the next biggest chain.

DeFi activity evidently exploded on Solana, as the network surpassed Ethereum in on-chain settlement volume, settling just over $574 billion across DEXes in 2024. The network was also the largest growing ecosystem by Total Value Locked (TVL) outside of Ethereum, surging from 3% to 25% of on-chain capital.

This developer provides a bullish outlook for the network. Asset manager Bitwise also suggested that Solana’s growth would continue in 2025. The asset manager predicted that “serious” projects would move into the SOL ecosystem to complement the network’s dominance in meme coins.

Leading The Way In DEX Volume

Thanks to Solana’s thriving DeFi ecosystem, it led Ethereum in DEX volume at different times. This volume is believed to have come mainly from its thriving meme coin ecosystem as traders flocked to invest in the meme coins on the network.

DeFiLlama data shows that Solana is still leading the way at the moment both in the last 24 hours and in the last seven days. In the last 24 hours, it has recorded a DEX volume of $4.13 billion while Ethereum has recorded a DEX volume of $3.17 billion. Meanwhile, in the last seven days, Solana has recorded a DEX volume of $30.70 billion compared to Ethereum’s $25.97 billion.

- South Korea’s Bithumb Probed by Lawmakers as CEO Blames Glitch for $40B Bitcoin Error

- Robinhood Launches Public Testnet for Ethereum Layer 2 ‘Robinhood Chain’

- Binance Founder CZ Joins Scaramucci, Saylor to Confirm Crypto & Bitcoin Buying, “Not Selling”

- Crypto Market Bill Nears Resolution as Ripple CLO Signals Compromise After Key Meeting

- $3.5T Banking Giant Goldman Sachs Discloses $2.3B Bitcoin, Ethereum, XRP, and Solana Exposure

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks