Solana Treasury Company SOL Strategies Gets Approval To List On Nasdaq

Highlights

- SOL Strategies receives Nasdaq approval for listing.

- This move will boost validator development and investment from institutions.

- CEO Leah Wald celebrates Nasdaq debut, calling it Solana’s biggest stage milestone.

SOL Strategies Inc. has received approval to be listed on the Nasdaq Global Select Market. As a Solana-based treasury and infrastructure company, these will provide shareholders with greater liquidity and allow institutions to invest in the company.

Nasdaq Listing to Boost Validator Growth and Institutional Access for Solana

According to the official statement, the approval represents a major step for SOL Strategies, which invests in and builds infrastructure for the Solana blockchain. Trading will begin on September 9, 2025, under the ticker symbol STKE. This marks a milestone for both the firm and the wider Solana ecosystem.

The company will continue trading on the Canadian Securities Exchange under the symbol HODL. However, its shares will no longer be listed on the OTCQB Venture Market under CYFRF once Nasdaq trading begins. OTC holders do not need to act, as shares will convert automatically.

Chief Executive Officer Leah Wald said joining Nasdaq aligns the company with the world’s most innovative technology firms. She described the move as validation not just for SOL Strategies, but for the entire Solana ecosystem. Wald added that the listing strengthens the ability of the firm to scale validator operations and access institutional capital markets. This echoes broader network upgrades such as the recently approved Solana Alpenglow proposal to boost network speed.

In a social media statement, Wald commented on how it had taken the company more than one year to reach this milestone, citing over a year of hard work, perseverance, and dedication to the company vision. She pointed out that SOL Strategies is yet to enter the full swing in its expansion and the new listing could help in this regard.

The company expects the Nasdaq debut to accelerate validator partnerships and expand staking operations as demand for Solana rises. The listing remains subject to regulatory clearance from the U.S. Securities and Exchange Commission. This includes the effectiveness of its Form 40-F registration statement.

SOL Price Holds Above $204 following Nasdaq Listing Update

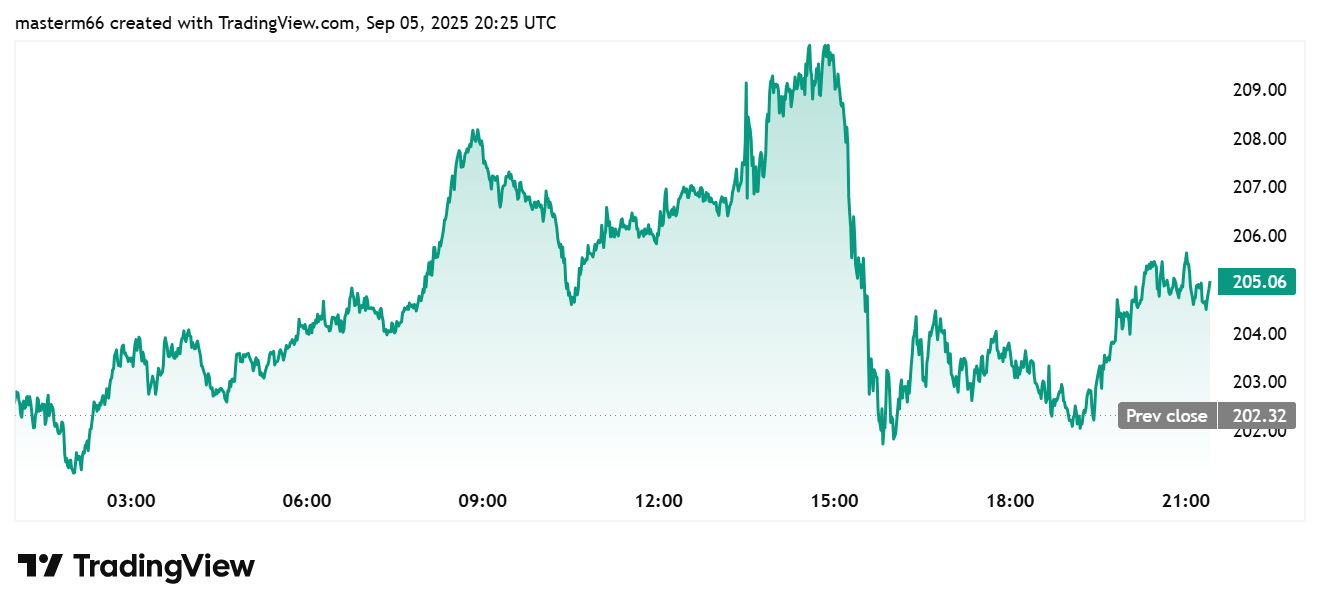

Solana price reflected positive sentiment from the Nasdaq listing announcement. SOL traded at $204.82, up 1.24% in the past 24 hours, according to TradingView. The token climbed from $202.32 and held firm after intraday swings.

Despite a weekly decline of 4.66%, Solana remains up 24.61% over the past month and 49.26% in six months. SOL has risen by 8.27% since the start of 2025, whereas the token has registered an increase of 53.01% over the past year.

Traders noted the Nasdaq approval for SOL Strategies will add confidence to the market outlook for the network. The listing gives big investors a safe way to invest in Solana’s infrastructure, along with holding the token.

- India’s Crypto Taxation Unchanged as the Existing 30% Tax Retains

- Crypto News: Strategy Bitcoin Underwater After 30% BTC Crash

- Expert Predicts Ethereum Crash Below $2K as Tom Lee’s BitMine ETH Unrealized Loss Hits $6B

- Bitcoin Falls Below $80K as Crypto Market Sees $2.5 Billion In Liquidations

- Top Reasons Why XRP Price Is Dropping Today

- Here’s Why MSTR Stock Price Could Explode in February 2026

- Bitcoin and XRP Price Prediction After U.S. Government Shuts Down

- Ethereum Price Prediction As Vitalik Withdraws ETH Worth $44M- Is a Crash to $2k ahead?

- Bitcoin Price Prediction as Trump Names Kevin Warsh as new Fed Reserve Chair

- XRP Price Outlook Ahead of Possible Government Shutdown

- Ethereum and XRP Price Prediction as Odds of Trump Attack on Iran Rise