S&P Welcomes WhiteBIT’s Native Coin Across Five Key Crypto Indices

Highlights

- WhiteBIT joins major S&P digital asset indices.

- WBT integration expands institutional market reach.

- Token hits a new all-time high milestone.

WhiteBIT’s native coin (WBT) has now officially been added to the S&P Cryptocurrency Broad Digital Market (BDM) Index.

The S&P BDM Index is curated by S&P Dow Jones Indices and tracks the performance of leading digital assets.

The requirements to get on the list are strict, as users must meet institutional eligibility criteria, including liquidity, market capitalization, governance, transparency, and risk controls.

In addition to being added to the Broad Digital Market Index, WhiteBIT’s coin (WBT) has also been added to four additional S&P Dow Jones digital-asset indices.

With this, WBT now appears within the following key indices:

- S&P Cryptocurrency Broad Digital Asset (BDA) Index

- S&P Cryptocurrency Financials Index

- S&P Cryptocurrency LargeCap Ex-MegaCap Index

- S&P Cryptocurrency LargeCap Index

To achieve these classifications, WhiteBIT showed a multi-quarter record of stable liquidity, transparent price formation, and consistent market-cap behavior.

Thanks to WhiteBIT coin’s inclusion in the BDM index, the crypto is now well-positioned to be integrated into the applications of the world’s leading institutional-grade digital-asset providers.

Getting Recognized Shows WhiteBIT Has Gone Global – CEO

Speaking about the inclusion of WhiteBIT’s native crypto in S&P’s BDM index, Volodymyr Nosov, CEO of WhiteBIT, said it signals that the region’s crypto infrastructure now meets the standards expected by global institutions.

Calling it a “turning point,” the CEO added that the inclusion signals WhiteBIT’s evolution as a compliant crypto services provider worldwide.

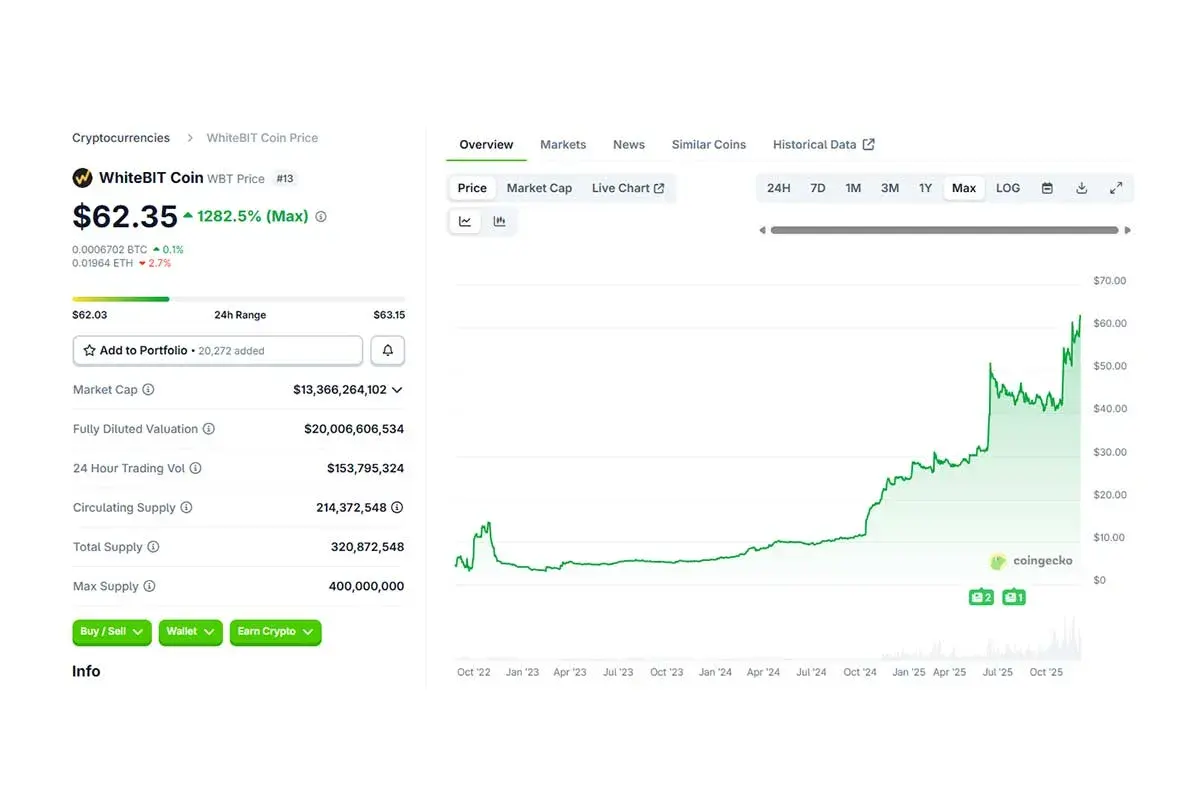

WBT’s Utility Expansion and Price Action

With the recent expansion, WBT can now be integrated into global benchmark structures used by investment firms, ETF/ETN designers, and quantitative research platforms.

Furthermore, WBT can now be incorporated into the analytical frameworks designed for long-term allocation strategies, diversified exposure construction, and risk-adjusted portfolio modeling.

The WBT price has been impacted directly by the token’s inclusion in the index. Following an accumulation period, the token achieved a new all-time high of $62.96 on November 18, 2025.

Final Words

WhiteBIT’s inclusion in the S&P BDM index is a benchmark for the project. The way is now clear for the token and WhiteBIT’s platform to gain global adoption, thanks to the asset’s use in future financial products and long-term investment strategies.

- U.S. Weekly Jobless Claims Fall to 3-Year Low Ahead of FOMC Meeting

- Hyperliquid Rival Aster DEX Targets Early 2026 For Layer 1 Launch

- CZ vs. Peter Schiff: Binance Founder Argues Bitcoin Beats Gold on Verifiability, Utility and Scarcity

- Solana Mobile Set to Launch SKR Token in January 2026

- Tom Lee’s BitMine Keeps Buying ETH, Adds $150M Despite DAT Purchases Crashing 81%

- XRP Price Prediction as ETF Buyers Add $50.27M to Holdings

- Ethereum Price Reclaims $3,200 as Shark Wallets Accelerate Accumulation

- Dogecoin Price Holds $0.15: Bullish Reversal or Just a Temporary Bounce?

- Sui Price Surges 10% As Vanguard Group Adds SUI to Bitwise 10 Crypto Index

- Bitcoin Price Prediction: Will Next Bull Run Push BTC to $100,000?

- Pepe Coin Price Risks 80% Crash as Alarming Pattern Forms and 6.5T Inflows