Standard Chartered Sees Bitcoin Soaring to $200,000 by Year-End on ETF Boom

Highlights

- According to Standard Chartered, Bitcoin might be valued at $200,000 by the end of the year due to increasing demand for its spot ETFs.

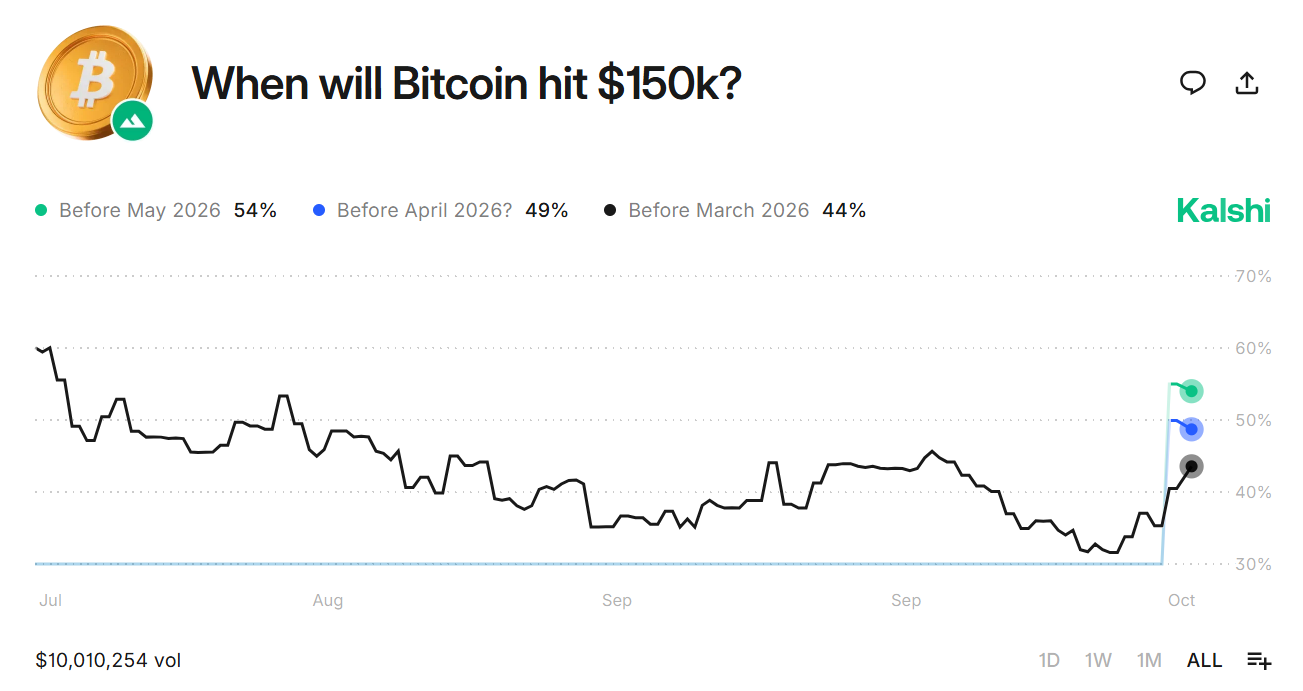

- Kalshi traders believe that Bitcoin will rise to $150, 000 and only in the middle of 2026.

- Bitcoin ETFs have attracted $58 billion, and it indicates rising interest among institutions.

Standard Chartered believes Bitcoin (BTC) could reach a record high by the end of 2025. The bank’s head of digital assets research, Geoff Kendrick, said the token’s outlook has strengthened. According to him, this is fueled by investor demand and growing momentum from exchange-traded funds.

Standard Chartered’s $200,000 Bitcoin Target Meets Market’s $150,000 Outlook

In a note shared with Walter Bloomberg, a respected journalist, Kendrick stated that BTC price trajectory is tied to broader macroeconomic conditions. If the U.S. government shutdown drags on, he expects the asset to benefit from its correlation with Treasury term premiums. Investors are increasingly viewing Bitcoin as a hedge during times of fiscal and political uncertainty.

Currently trading around $120,456, the leading cryptocurrency is holding just below its August peak of $124,480. Standard Chartered forecasts the cryptocurrency will soon break through $135,000, before accelerating to $200,000 by year-end. Citigroup predicts Bitcoin could climb to $231,000 within the next 12 months, setting a more aggressive target than Standard Chartered.

According to Kendrick, Bitcoin’s strong correlation with Treasury dynamics is another driving factor. Rising term premiums often highlight investor concern over government finances, which tends to push demand toward alternative assets like Bitcoin.

At the same time, prediction markets give a less optimistic estimate of the rise in Bitcoin price. On the Kalshi platform, traders are betting on when Bitcoin will first cross $150,000. The market shows a 44% chance it happens before March 2026, rising to 49% before April 2026, and 54% before May 2026.

ETF Inflows Fuel Standard Chartered’s $200,000 Bitcoin Projection

In an exclusive with Decrypt, Kendrick, said inflows into BTC ETFs are reshaping the market. According to him, this is also setting the stage for the leading digital asset to reach a new all-time high. Kendrick argued that institutional adoption is creating conditions for a powerful rally despite the short-term price swings.

So far, Bitcoin ETFs have attracted $58 billion in inflows, with $23 billion arriving this year alone. This week spot Bitcoin ETFs drew in $2.2 billion as BTC price surged past $120,000.

Kendrick projected at least $20 billion more could flow into ETFs by December, a level he said would support his $200,000 forecast. Also, JPMorgan has argued that Bitcoin remains undervalued, forecasting a rally toward $165,000.

The bank’s analysis also noted that BTC has broken away from historic post-halving patterns. In past cycles, the cryptocurrency often weakened 18 months after halving events. Following the April 2024 halving, however, Bitcoin has remained strong and continued rising into October.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs