Strategy’s mNAV Slips to Lowest Ever as MSTR Stock Falls 8%, Will Michael Saylor Sell Bitcoin?

Highlights

- Largest corporate Bitcoin treasury Strategy’s mNAV slips to the lowest-ever at 1.10.

- This comes MSTR stock fell 8.14% at $162.08 despite massive $980 million Bitcoin buy.

- MicroStrategy CEO Phong Le defends MSTR stock and Bitcoin accumulation strategy.

The largest corporate Bitcoin treasury Strategy’s (previously MicroStrategy) key metric mNAV has slipped to its lowest ever. It follows a more than 8% drop in MSTR stock price despite announcing a massive 10,645 BTC purchase worth $950 million.

Strategy’s mNAV Slips to 1.10 as Bitcoin Tanks to $85K

MicroStrategy’s mNAV, a ratio of enterprise value to the market value of its Bitcoin holdings, has dropped to an all-time low of 1.10, sparking concerns among investors.

As per the Bitcoin treasury’s dashboard, Strategy’s enterprise value is $64.28 billion. However, the current enterprise value is $60.53 billion, as per Yahoo Finance and others.

As CoinGape reported, Strategy acquired Bitcoin worth $980.3 million at an average price of $92,098 per coin. The value of total holdings stands at $57.91 billion at the time of writing.

The mNAV slumped 5.9% over the last 24 hours as Bitcoin failed to hold $90K and tumbled 5% to a low of $85,304. The price has slightly bounced above $86,100. However, experts believe BTC price could tumble further in the coming days, with investors panicking ahead of the week’s potential BoJ rate hike, which could take MicroStrategy’s mNAV metric towards 1.

MSTR Stock Falls 8% on Market Jitters

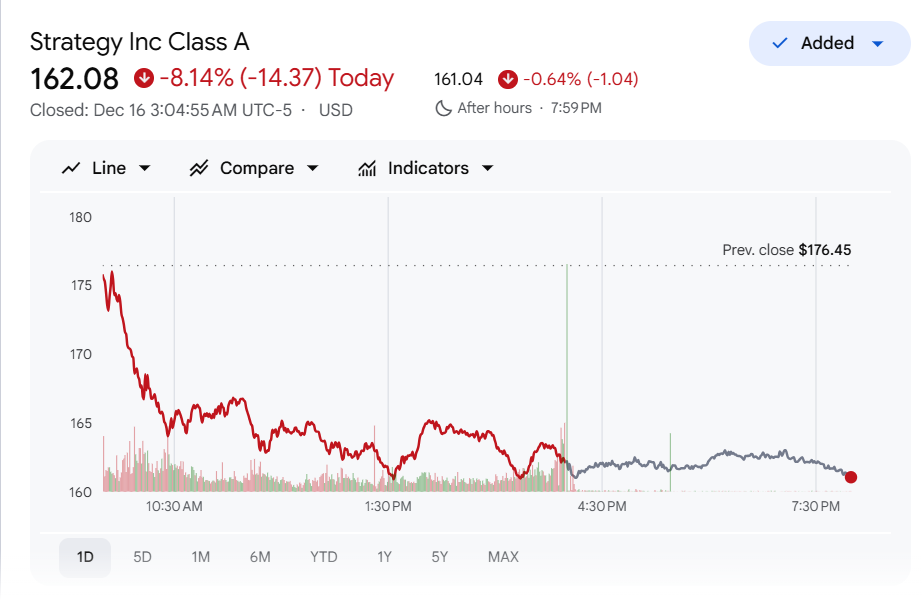

MSTR stock closed 8.14% at $162.08 on Monday, underperforming both the broader tech sector and Bitcoin. The sharp drop indicates growing investor uncertainty about the sustainability of MicroStrategy’s Bitcoin-heavy strategy, especially amid concerns of potential delisting by MSCI.

The 24-hour low and high were $160.54 and $176.50, respectively. The correction happened with a massive 24 million in trading volume, significantly higher than average volume.

MSTR stock has dropped almost 45% year-to-date, with the decline continuing since July. This comes amid $888 million dilution of its common shares, with some seeing a potential drop in stock price to $130-$150 by this year-end.

CEO Phong Le Defends MSTR Stock and Strategy Performance

Despite the challenging market backdrop, Strategy CEO Phong Le remains bullish. He described Bitcoin as a “generational, macro, and capital-markets breakthrough,” reiterating that MicroStrategy is designed to outperform Bitcoin in the long run.

He added that BTC price has almost 45% return since the company adopted Bitcoin strategy, while MSTR stock is up 62% over the same period. Phong Le points to this return as evidence of the firm’s robust positioning.

On @FoxBusiness, Phong Le called bitcoin a generational, macro, and capital-markets breakthrough and explained why $MSTR is built to outperform $BTC long term. Since adopting bitcoin: $BTC +45% return vs. $MSTR +62% return. pic.twitter.com/A8jewDar4I

— Strategy (@Strategy) December 15, 2025

Along with Michael Saylor, Phong Le remains bullish on MSTR. He claimed MicroStrategy only needs Bitcoin to grow about 1.4% annually to cover interest and preferred dividends. Notably, Strategy established cash reserves worth $1.44 billion to cover its debt and dividend obligations for two years without selling Bitcoin.

However, with mNAV falling and MSTR stock facing selling pressure, will Michael Saylor consider trimming the company’s Bitcoin holdings? Recently, Phong Le confirmed selling Bitcoin holdings if mNAV fall below 1.

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?