Breaking: SWIFT Unveils Blockchain Ledger for Global Payments, Sparking Ripple Debates

Highlights

- The SWIFT announced shared blockchain-based ledger to boost global payments.

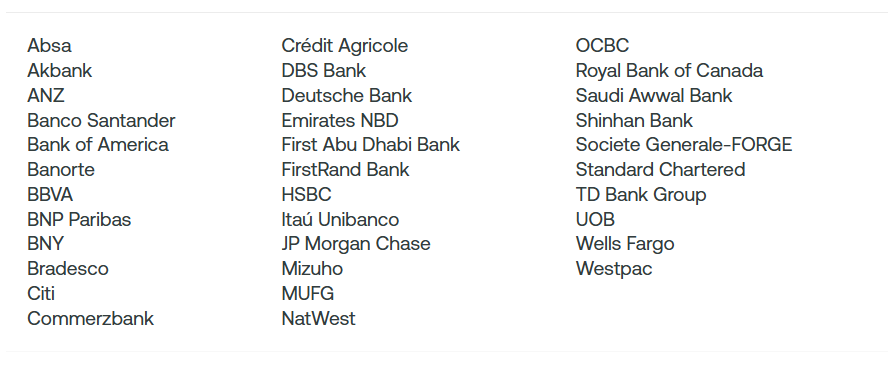

- The financial system partners with 30 financial institutions and blockchain firm Consensys to develop the ledger.

- Tokenization boost and regulatory developments bringing financial system on blockchains.

The SWIFT on Monday said it has partnered with more than 30 global financial institutions and Ethereum blockchain software company Consensys to develop a shared blockchain-based ledger. The global banking system plans to primarily focus on real-time 24/7 cross-border payments. This move from the firm has sparked debates on how it could go head-to-head with Ripple in providing on-chain payment services.

SWIFT Unveils Blockchain Ledger Plans with Consensys

During the Sibos 2025 event on September 29, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) disclosed plans to launch a new blockchain-based ledger. This marks a groundbreaking moment for the global financial system and the blockchain industry.

“Through this initial ledger concept, we are paving the way for financial institutions to take the payments experience to the next level with Swift’s proven and trusted platform at the centre of the industry’s digital transformation,” said Swift CEO Javier Perez-Tasso.

Over 30 financial institutions globally, such as JPMorgan, HSBC, and Bank of America, are assisting in developing the shared digital ledger, with real-time 24/7 cross-border payments as the initial focus. The institutions will provide feedback on the design of the ledger and implement the prototype in phase one, and define its future phases of work.

This will further expand the accessibility to regulated tokenized assets and boost blockchain use cases in the financial system. Also, the SWIFT will roll out client solutions to connect different systems, supporting both private and public networks to ensure safe and secure transactions.

Partnership with Consensys

SWIFT has partnered with Ethereum blockchain software firm Consensys to build the prototype of the shared ledger. The blockchain ledger will leverage the system’s resiliency, security, and scalability to bolster cross-border transaction facilitation. The ledger will record, sequence, and validate transactions and enforce rules through smart contracts.

The global banking system has selected ConsenSys’ L2 network Linea over Ripple’s XRPL for a pilot project aimed at transitioning interbank messaging and communications on-chain.

The ledger will expand the financial communication system’s role into blockchain, helping banks to scale the movement of regulated tokenized value across these digital ecosystems. SWIFT will only focus on the infrastructure, with the types of tokens eligible on the ledger depending on the central banks.

Notably, SWIFT has worked with Chainlink on numerous initiatives to bridge financial institutions to blockchain networks using their existing infrastructure and messaging standards.

The Ripple vs. SWIFT Debate Continues

Meanwhile, SWIFT’s move to integrate blockchain technology into its operations has again raised debates on whether Ripple could effectively steal market share from the firm with its payment solution using the XRP Ledger (XPPL).

XRPL validator remarked that “SWIFT is in desperate need [of] blockchain tech” and that it shows. Following his statement, an XRP community member asked him about the possibility of banks agreeing with the new direction and wanting to retain control through a permissioned ledger, thereby killing Ripple’s chances of providing a cross-border payments solution.

Vet replied, stating that the permissioned ledger solves a lot of problems, but that it lacks what makes blockchains so special. He added that blockchains are special because they are public, decentralized, and neutral, thereby making a case for Ripple’s payment solution.

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand