Synthetix Network Token DeFi Dominance Tanks Amid Looming Breakdown

- Synthetix declines on hiatus amid low volatility and volume.

- Recovery is likely to hit a snag at the 21-day SMA, which could send SNX back to the drawing board.

The decentralized finance (DeFi) craze appears to have hit pause. It seems this the time tokens in the sector have to prove their worth to investors. While the DeFi bubble is far from bursting, sustainability is of greater importance not only to the projects themselves but also to the investors in the ecosystem.

Synthetix Network Token (SNX) is currently the seventh-largest DeFi token in the industry. It has a total value locked of roughly $615 million. Over the last 24 hours, the project has lost more than seven percent of these funds, suggesting that SNX’s dominance in DeFi is dropping. At the moment, UniSwap sits at the helm of the sector with approximately $2.8 billion. Maker comes second with about $2 billion while trailed by WBTC with $1.2 billion locked in its network.

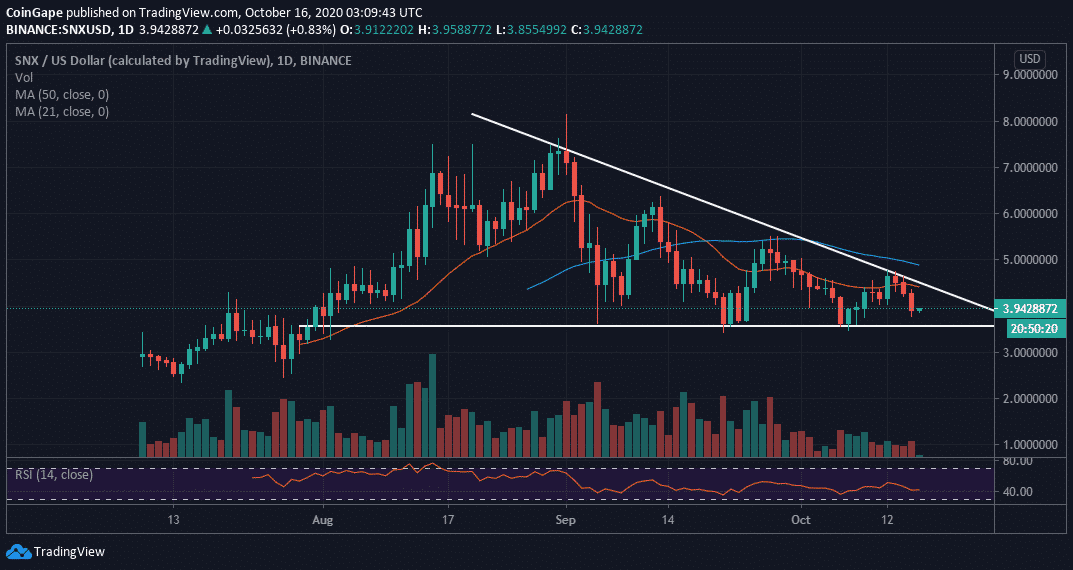

Descending triangle spells doom for Synthetix

Synthetix is trading at $3.9 at the time of writing. Recently, the token hit a barrier at $4.8 following a substantial recovery from support established at $3.6. Also limiting the upward movement was the descending triangle resistance. In addition, the 50 Simple Moving Average holds ground marginally below $5, intensifying the pressure on SNX.

The Relative Strength Index (RSI) suggests that the DeFi token is taking a hiatus but could resume the uptrend. Sideways trading will take precedence in the coming sessions as the RSI levels above 70.

SNX/USD daily chart

The probability of SNX resuming the uptrend is still high, especially now that it is not oversold and trading within the confines of a symmetrical triangle pattern. SNX could step about the $4 hurdle but may be rejected at the 21 SMA, in turn, resuming the uptrend and validating the triangle breakdown. Support at $3 is most likely to hold while gains above the triangle resistance could sabotage the bearish outlook altogether.

Synthetix Intraday Levels

Spot rate: $3.9

Relative change: 0.035

Percentage change: 0.9%

Trend: Bullish bias

Volatility: Low

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter