Synthetix Technical Analysis: SNX Flips Resistance Into Support, aiming for $5

- Synthetix price bounces off support at $3.40 in readiness for a breakout to $5.00.

- SNX/USD is drawing closer to the resistance at the 50EMA, likely to delay the bullish scenario.

Synthetix Network Token price fell in tandem with other decentralized finance (DeFi) tokens. The lending, borrowing, and liquidity ecosystem has been dealt a heavy blow amid the downtrend in the market. Synthetix cut short the recovery staged following the dip in the first week of September. A step above $6.00 was key for the bull run towards $10.00 but it found the bulls exhausted and the bears ready for revenge.

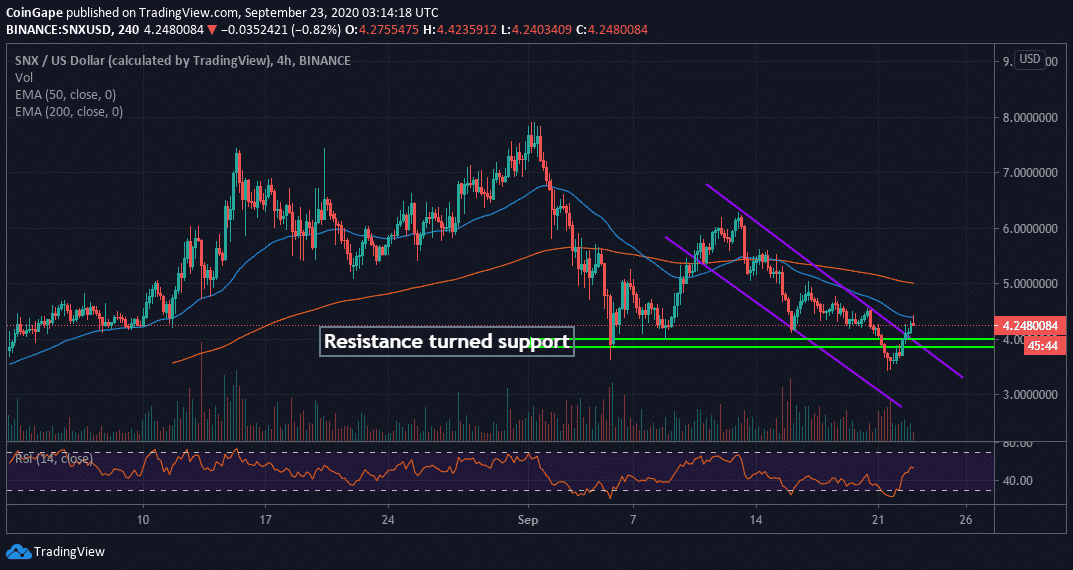

The declines followed the confines of a parallel descending channel. Support at $3.40 came in hardy, preventing the bearish leg from extending to $3.00. A reversal is currently underway. SNX has already stepped above $4.00, support confirmed earlier in September. Moreover, the DeFi token trading above the parallel channel, after a bullish flag confirmation.

SNX/USD 4-hour chart

The uptrend is highlighted by the Relative Strength Index (RSI), after a sustained recovery from the oversold region. If the RSI maintains the positive gradient into the overbought zone, SNX is likely to continue with the uptrend aiming for levels above $5.00.

The resistance at the 50 Exponential Moving Average (EMA) must, however, come down for the expected gains to materialize. More hurdles are envisaged at the 100EMA in the 4-hour range. On the flip side, short term support at $4.00 must be guarded at all costs. Otherwise, SNX could resume the downtrend, eyeing $3.00.

Synthetix Intraday Levels

Spot rate: $4.25

Relative change: -0.025

Percentage change: -0.8%

Trend: Bullish

Volatility: High

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter