Terra Classic Staking Nears ATH As Dev Reveals Update, LUNC OI Rises

Highlights

- Terra Classic developer releases v3.1.0 update for bringing 10% to Oracle pool rewards to boost LUNC staking.

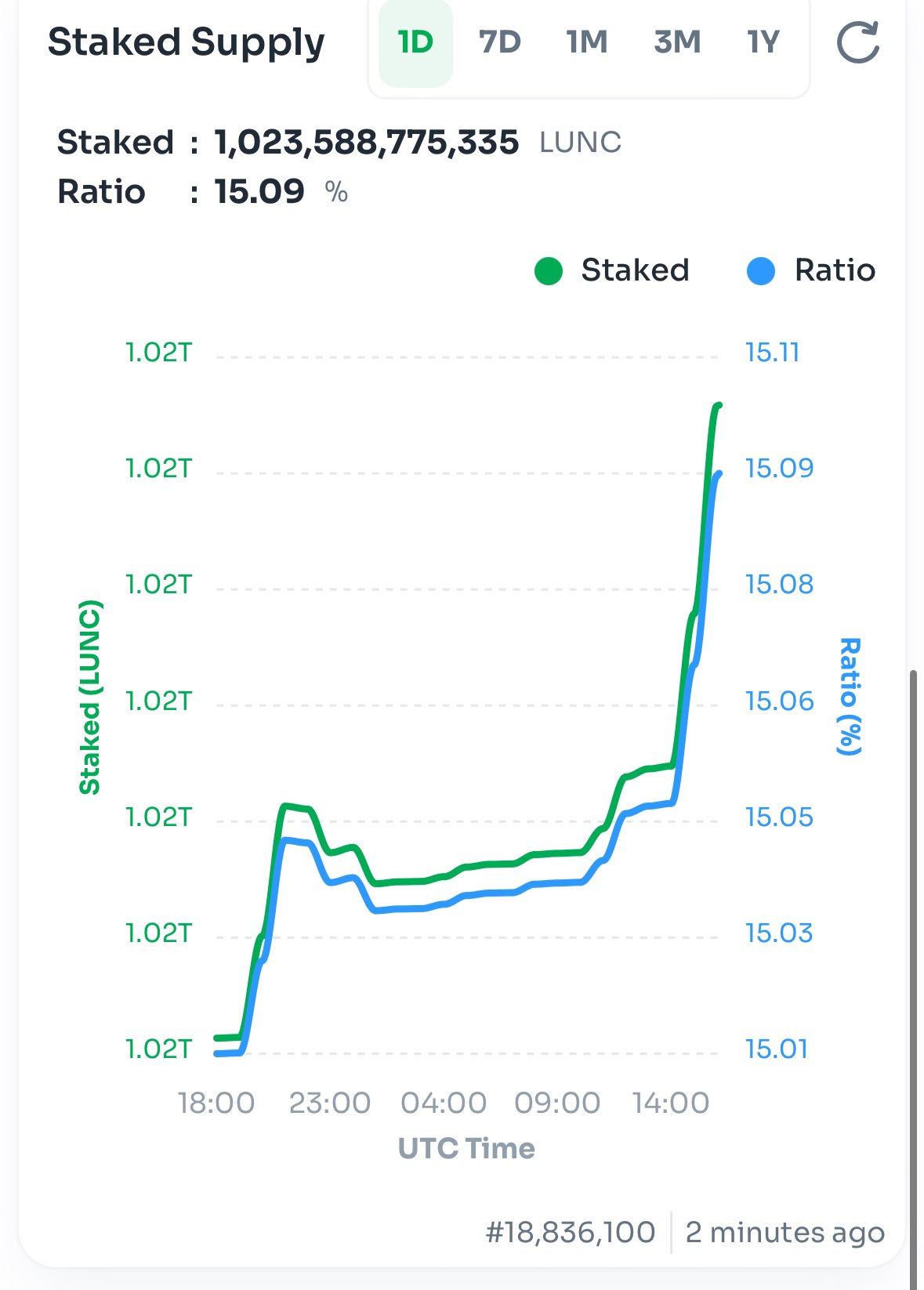

- LUNC staking ratio nears all-time high as LUNC staked rose above 1 trillion.

- LUNC futures open interest jumps 20% sparking buying sentiment.

Terra Luna Classic developer completes development of Oracle Split logic that will divert community pool rewards from tax burn to the Oracle Pool (OP) boosting long-term staking rewards. The developer has also announced a proposal to update the terrad client with a new release. Work on testnet to complete before the expected update on July 26.

Terra Luna Classic Tax Burn Distribution Update

Release v3.1.0 was announced by Terra Classic popular developer Till Z, known as Fragwuerdig, as per proposals 12098 and 12114 passed by the community. A proposal will be submitted to get validator and community approval to update terrad client to v3.1.0. The chain will halt at block height 19060800, anticipated on July 26 at 6:30 am UTC.

Validators need to update with v3.1.0 release after the chain halt and infrastructure providers with mantlemint accelerated LCDs need to install the updated mantlemint version. The rehearsal upgrade is planned on rebel-2 testnet for July 11.

Terra Luna Classic currently has a burn tax set to 0.5%. Out of this, 80% is for burn and 20% is distributed as — 10% to Community Pool and 10% to rewards. After the update, the 20% will be distributed as 10% to Community Pool and 10% to Oracle pool.

Experts said it will impact immediate block rewards for LUNC users but will help focus on long-term staking rewards (Oracle) to improve LUNC staking. In addition, it will help validators, but decrease the APR by about ~0.5% depending upon on-chain volumes.

Terra Classic staking ratio has jumped to 15.09%, near ATH of 15.16%. The community expects staking ratio to rise to 20%.

Also Read: Fiduciary Alliance Grabs Major Holdings In BlackRock Bitcoin ETF, GBTC, Crypto Shares

LUNC Futures Open Interest Soars 20%

According to Coinglass data, total LUNC futures open interest soared 20% in the last 24 hours, with a slight drop in the past few hours. Major buying is witnessed on crypto exchanges Bitget with a 45.96% rise in Terra Classic futures open interest. Meanwhile, 1000LUNC futures open interest dropped 1% over the last day.

LUNC price grew 1% in the last 24 hours, with the price currently trading at $0.00007099. The 24-hour low and high are $0.00006956 and $0.0000724, respectively. Moreover, trading volume increased by 40% in the last 24 hours, indicating a rise in interest among investors.

Meanwhile, USTC price also dropped 5%, with the price now trading at $0.0184. The 24-hour trading volume saw a mere 2% decline in the last 24 hours as traders bought the dip.

Also Read: Goldman Sachs Shifts Attention To Tokenization Projects: Report

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs