Tether & TRON Crack Down On Crypto Crime, Will It Boost USDT Adoption?

Highlights

- Tether, TRON, and TRM Labs launch the T3 Financial Crime Unit to combat crypto crime.

- This new unit freezes over $12 million in USDT linked to scams and frauds.

- The collaboration aims to enhance USDT security and credibility, boosting adoption.

The leading stablecoin issuer Tether has teamed up with TRON blockchain and TRM Labs to curb crypto scams. The new collaboration primarily focuses on establishing a new financial crime unit that aims to fight illicit activities involving USDT. This move reflects the growing focus of the leading blockchain players towards crypto security, which in turn could enhance USDT’s security and appeal.

Tether, TRON, And TRM Labs Join Hand To Fight Crypto Crimes

Tether, in a recent report, said that it has joined hands with TRON and TRM Labs to launch the T3 Financial Crime Unit (T3 FCU). This is one of the first major private-sector initiatives that focuses on tackling crypto and other related financial crimes.

According to the announcement, this collaboration combines the leading stablecoin issuer’s robust investigative capabilities, TRON’s expertise on blockchain, and TRM Labs’ intelligence tool. It is expected to help create a secure environment for digital assets and their transactions.

In the initial phase, T3 FCU claimed to have already frozen more than $12 million in USDT linked to scams and frauds. According to TRM Labs, the unit actively identifies and disrupts suspicious transactions, supporting law enforcement efforts worldwide.

Meanwhile, Tron founder Justin Sun lauded the development, showing his commitment to ensuring that blockchain technology is used for positive purposes. Besides, he said that it would reinforce a zero-tolerance approach to illicit activities.

Simultaneously, Tether CEO Paolo Ardoino said that safeguarding blockchain integrity is a priority. He stressed the importance of collaboration with industry leaders to combat fraudulent activities, ensuring a safe ecosystem for users.

Meanwhile, TRM Labs underscored the critical need for industry players to evolve their capabilities in addressing the rising threats within the blockchain industry.

Potential Impact On USDT Adoption And Market Sentiment

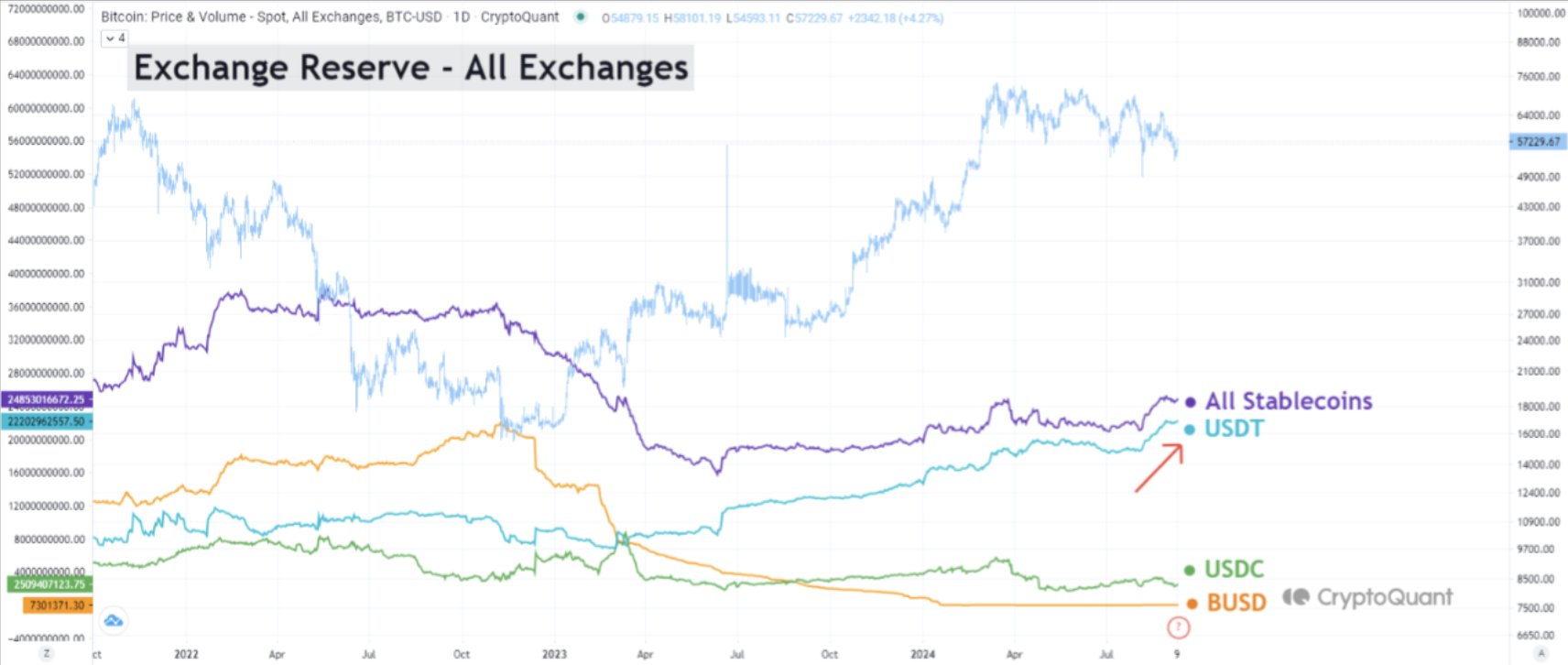

The T3 FCU’s crackdown on crypto crime comes as USDT holdings on exchanges are on the rise, suggesting an increase in buying pressure. According to a recent CryptoQuant analysis, USDT inflows to exchanges have surged since August, indicating that funds may be poised to re-enter the market.

Notably, market experts often interpret this trend as a bullish signal, hinting at potential price gains in the broader crypto market. However, it’s worth noting that some have argued that while increased stablecoin holdings can be a positive sign, it does not guarantee price surges. The funds on standby might remain inactive if market conditions or economic uncertainties persist, reflecting cautious investor sentiment.

Nevertheless, the collaboration between Tether, TRON, and TRM Labs is seen as a significant step in enhancing the credibility and appeal of USDT. By actively combating illicit activities, T3 FCU not only protects users but also sets a new standard for security in the crypto space. The move is expected to bolster USDT’s appeal as a reliable and secure asset, potentially driving wider adoption among investors.

In addition, this development also caught the investors’ eyes amid mounting concerns over crypto fraud. In a recent update, the US FBI reported a 45% surge in crypto-related fraud in 2023, resulting in $5.6 billion in losses. Having said that, many anticipate these initiatives like T3 FCU could play a crucial role in safeguarding the digital asset ecosystem.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs