Tether (USDT) Depegs After Curve-Aave Loan Saga; Spooks Crypto Market

Tether (USDT), the leading stablecoin having $83 billion market cap, slightly depegged from the typical 1:1 ratio with the US dollar on Thursday. The move comes as DeFi lending and borrowing protocol AAVE moves to freeze Curve (CRV) use as collateral for loans on Aave.

As a result, whales and investors are taking arbitrage opportunities to swap Tether (USDT) for USDC and DAI stablecoins on exchanges Curve, Uniswap, and 1inch.

Tether CTO: Ready For Redemptions Amid USDT Depeg FUD

Tether CTO Paolo Ardoino took to Twitter to calm rising FUD surrounding USDT amid negative sentiment in the crypto market. He claims Tether is ready for any amount of redemptions. Tether reserve backing has been a key concern for the community, with critics alleging that Tether does not have money and may default.

Markets are edgy in these days, so it's easy for attackers to capitalize on this general sentiment.

But at Tether we're ready as always. Let them come.

We're ready to redeem any amount.— Paolo Ardoino 🍐 (@paoloardoino) June 15, 2023

According to the latest Tether reserves data, 84.7% are in cash & cash equivalents, 4.14% in precious metals, and 1.83% in Bitcoin. It holds cash & cash equivalents mostly in U.S. Treasury bills.

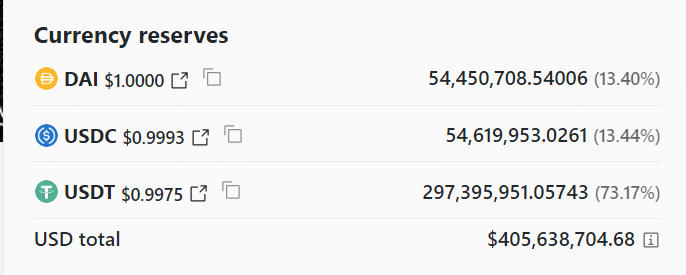

Curve 3Pool that should have 33.33% each of USDT, USDC, and DAI stablecoins has imbalanced, with USDT balance surging over 72%. DeFi traders and whales are selling millions of USDT for USDC and DAI, causing the leading stablecoin Tether depegging to $0.996.

A notable Ethereum address czsamsun.eth borrowed 31.5 million USDT from Aave V2 by using 17k ETH and 14k stETH as collateral, swapping all borrowed USDT into USDC. The borrower deposited 10 million USDC and 21 million USDC to V2 and V3, respectively. Moreover, the borrower borrowed 12 million USDT from V3 and deposited it into V2.

Also Read: USDT Depegs Again As Whales Dump Largest Stablecoin

How It All Started

Earlier this week, Curve Finance founder Michael Egorov deposited $24 million worth of Curve DAO (CRV) tokens to Aave to mitigate the liquidation risk of a $65 million stablecoin loan.

According to Debank, the wallet linked to Michael Egorov provided $188 million in total collateral on Aave v2, with $64.2 million in USDT borrowed. The health rate is 1.55, the collateral will liquidate automatically if it drops below 1.00.

Gauntlet, which managed risks on Aave, recommends the Aave community freeze CRV collateral and set Curve LTV to 0. It will prevent Michael Egorov from continuing to add CRV and increasing concentration risk, as CRV liquidity has decreased in over the past few months.

Curve DAO Token (CRV) price fell 12% in the last 24 hours and 25 in a week. The price currently trades at $0.57. Meanwhile, AAVE price is trading at $49.56, down 11% in the last 24 hours and 16% in a week.

Also Read: Crypto Community Alleges Prometheum’s US SEC And FINRA Approval Is Controversial

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Crypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran’s Strait of Hormuz Closure

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

Buy $GGs

Buy $GGs