Tether (USDT) Daily Unique Addresses Hit 2022 Highs, What It Means For Crypto Markets

A key measure of trade for top stablecoin Tether (USDT) hit its highest level this year, indicating an elevated level of demand. The data could imply two potential scenarios for the crypto industry, based on USDT’s role as a trade facilitator and as a safe haven.

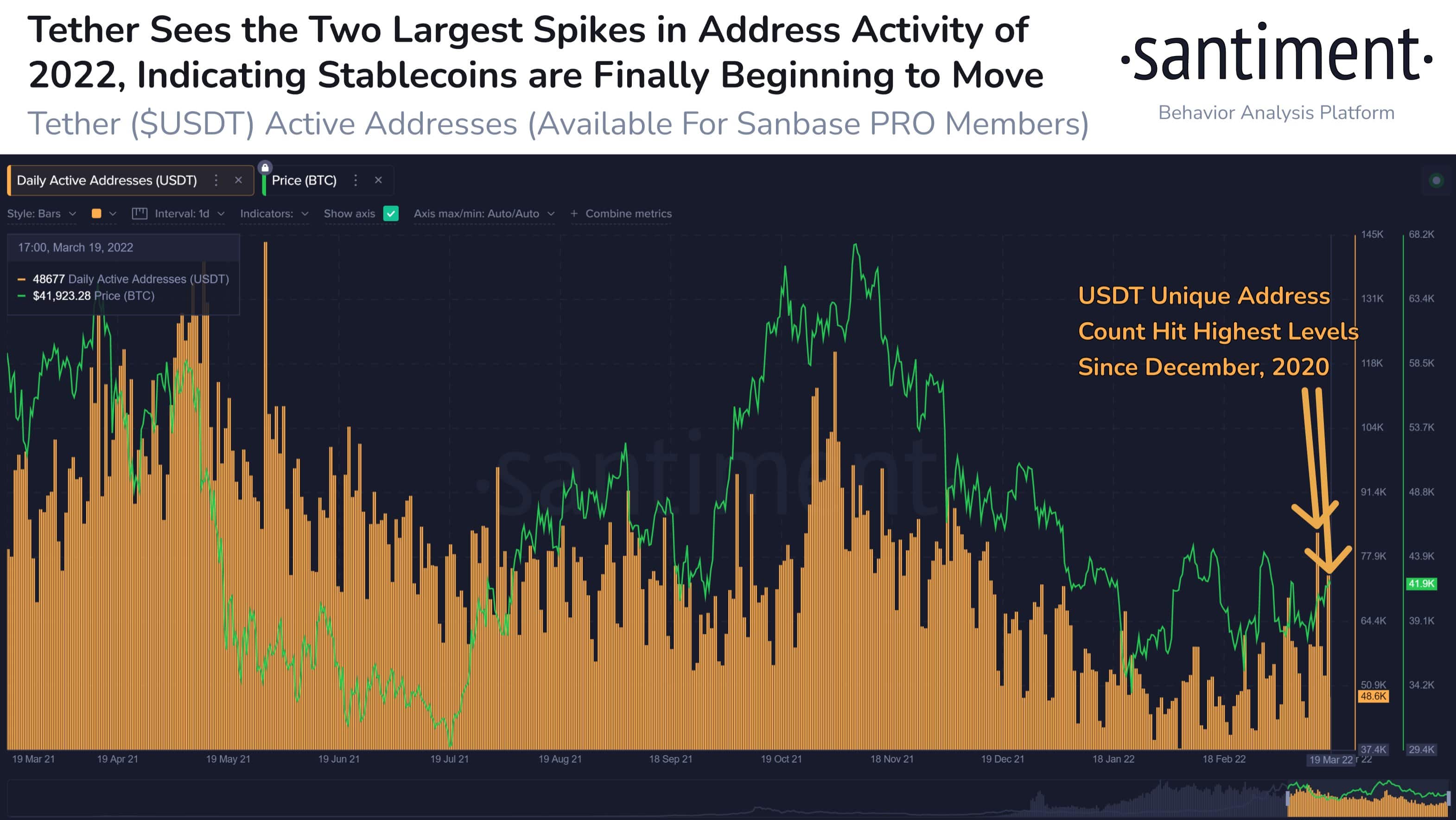

According to data from crypto research firm Santiment, daily active addresses, ie, the number of unique users that traded the token in a single day, spiked to over 83,000 on Thursday, and also hit 74,000 on Saturday, with the former being its highest level since early-December.

The data indicates that several distinct traders appeared to be accumulating the world’s largest stablecoin. Tether’s positive, albeit limited performance last week also indicates that users are buying into the token.

But increasing USDT accumulation has several implications for the crypto market. The two most likely scenarios are:

Volatility set to rise

USDT is used extensively in trading other crypto tokens, given its near 1:1 peg against the U.S. dollar. Traders usually exchange their dollars for the token, before using it to trade for other cryptos.

A high amount of accumulation could mean the market is positioning for more trading action- indicating more volatility in the near-term. A rise in USDT trading could eventually spill over into other tokens.

Santiment also believed the data pointed to more volatility.

Historically, gradually rising active addresses are #bullish. A massive cluster of spikes all at once can be a bit more of a volatility marker.

-Santiment said in a tweet.

But conversely, elevated Tether demand could also mean-

Safe haven seekers are piling into USDT

USDT’s 1:1 peg against the dollar, along with its large reserves, makes it a premier safe haven in the crypto space. The token has seen its volumes surge this year, primarily as the Russia-Ukraine conflict drove up volatility and pushed traders into safe havens.

The token’s accumulation now could also imply that traders are positioning for more headwinds in the market, and as such, piling into safer spaces.

Sentiment is already strained due to the Russia-Ukraine conflict and its economic impact. Traders also have to grapple with increasing inflation and hawkish moves from the Federal Reserve this year. The Bitcoin Fear and Greed index was at fear, and has hovered around that level since February.

All this negative sentiment could also be a driver of Tether demand.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs