These On-Chain Metrics Explain the Underlying Weakness in BTC Rally

The brief rally in Bitcoin and the broader cryptocurrency market has come to a halt as all selling pressure mounts. Bitcoin’s (BTC) price has corrected more than 12% over the last week currently trading around $21,000.

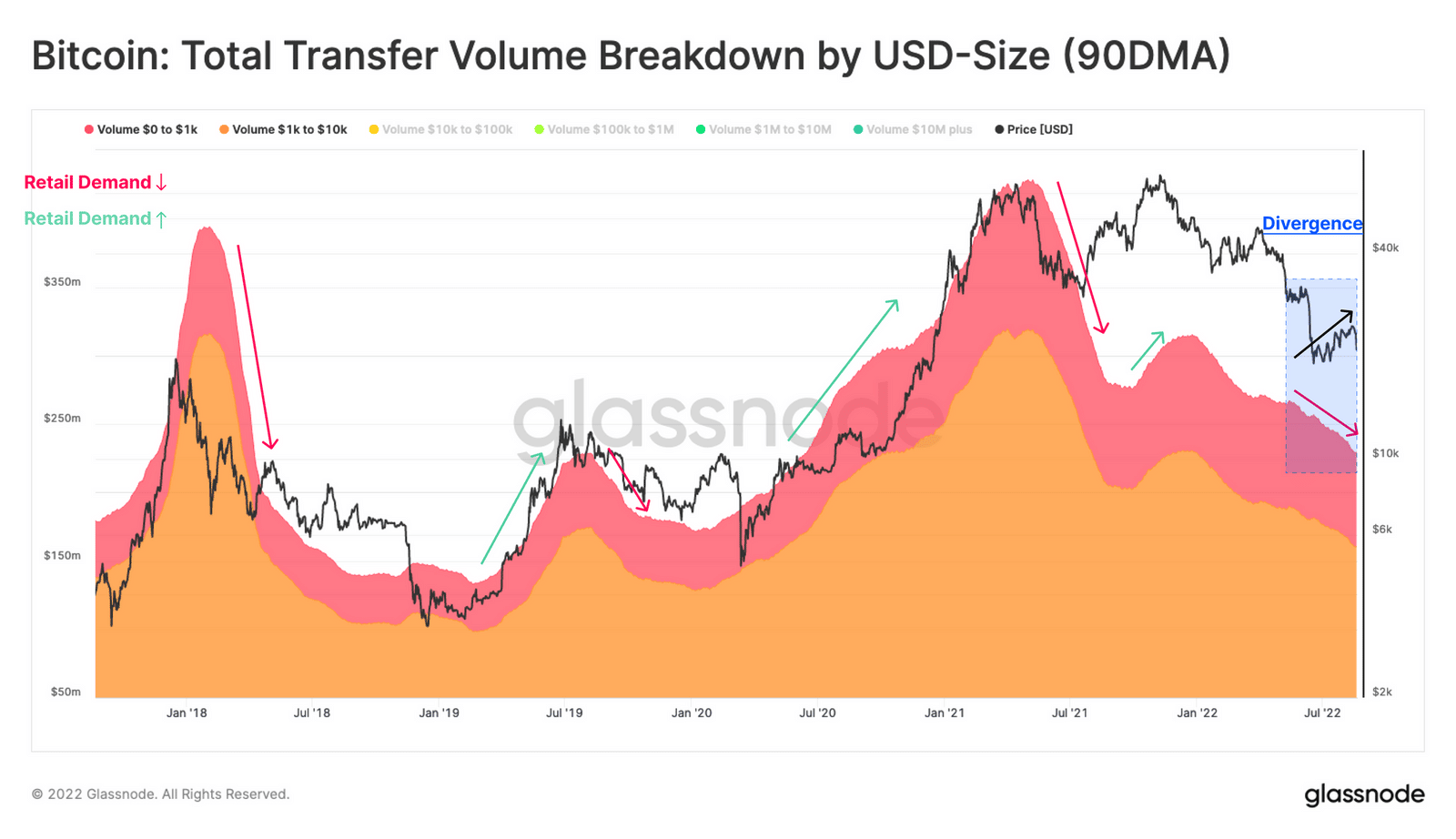

On-chain data provider has shared a detailed analysis explaining the underlying weakness during the relief rally. Glassnode points out that the participation of retail players was lacking during this relief rally citing the total number of small transactions with value less than $10,000.

As per the Glassnode data, when the BTC price jumped back to $24.4K, the transaction volumes for retail investors were still heading lower. This lack of retail demand marks the underlying weakness in the market.

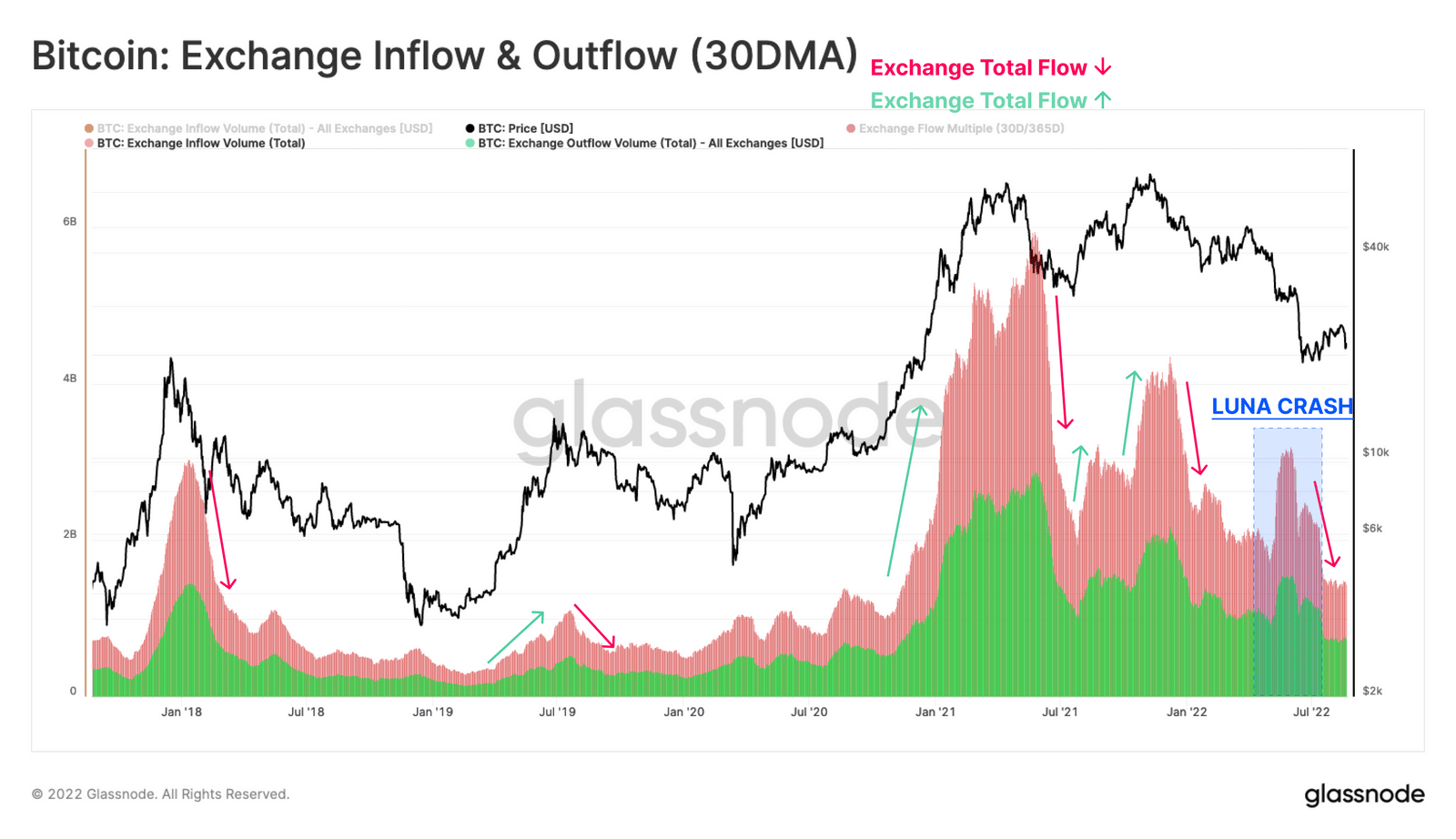

Comparing Exchange Inflows and Outflows

On-chain data provider Glassnode explains the cyclical behavior of Bitcoin prices to the USD-denominated inflows and outflows at the exchanges. The data provider states:

Exchange flows have now declined to multi-year lows, returning to late-2020 levels. Similar to the retail investor volumes, this suggests a general lack of speculative interest in the asset persists.

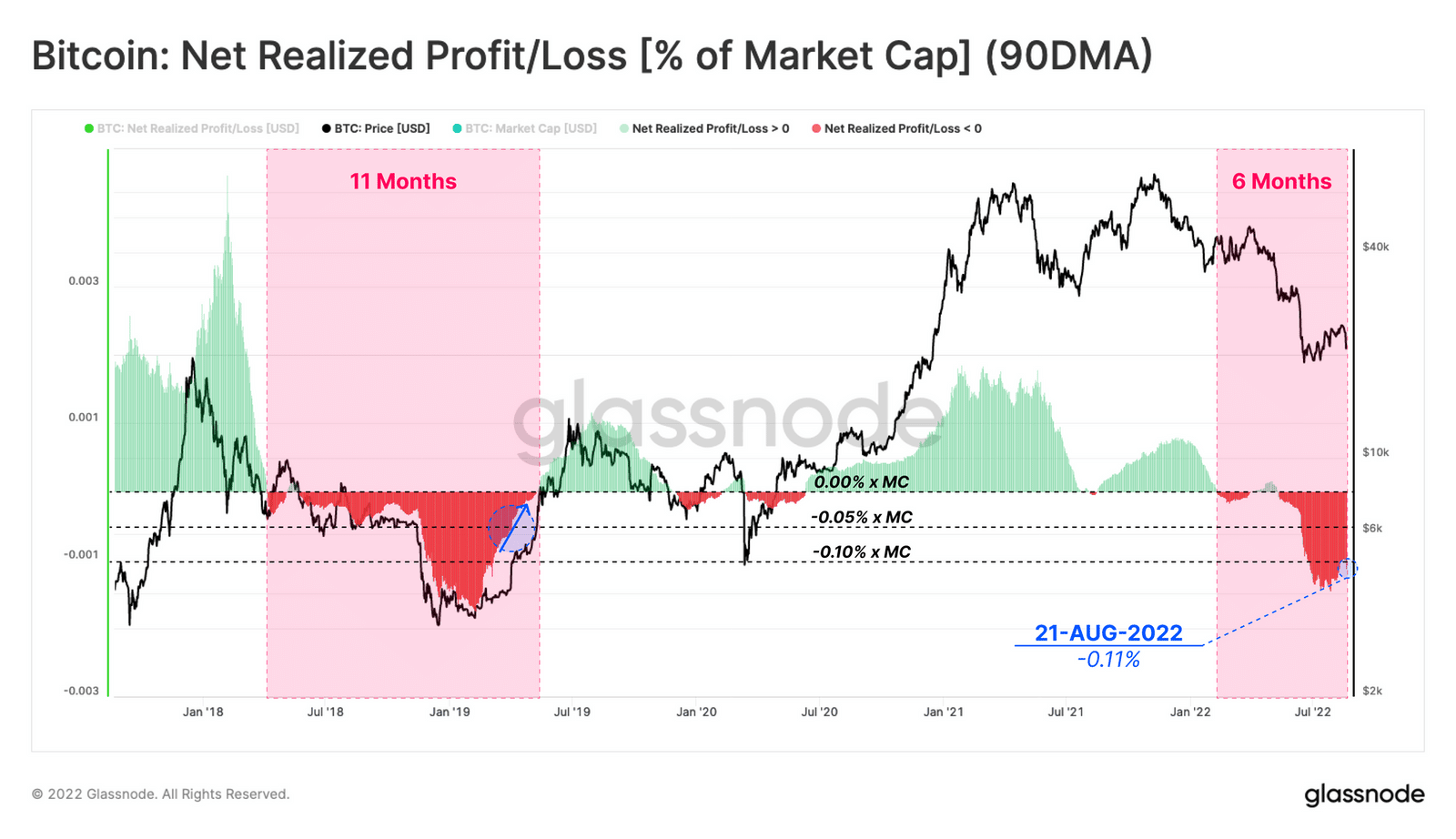

One thing is clear, with the lack of retail participation, the network demand and activity on the Bitcoin blockchain were lacking severely. Furthermore, Glassnode points out at the Net Realized Profit/Loss (90DMA) explaining that sellers are yet not exhausted in the recent bear market.

Looking at the last bear cycles of 2018-2019, the Net Realized Profit/Loss (90DMA) should return to neutral to suggest any price recovery.

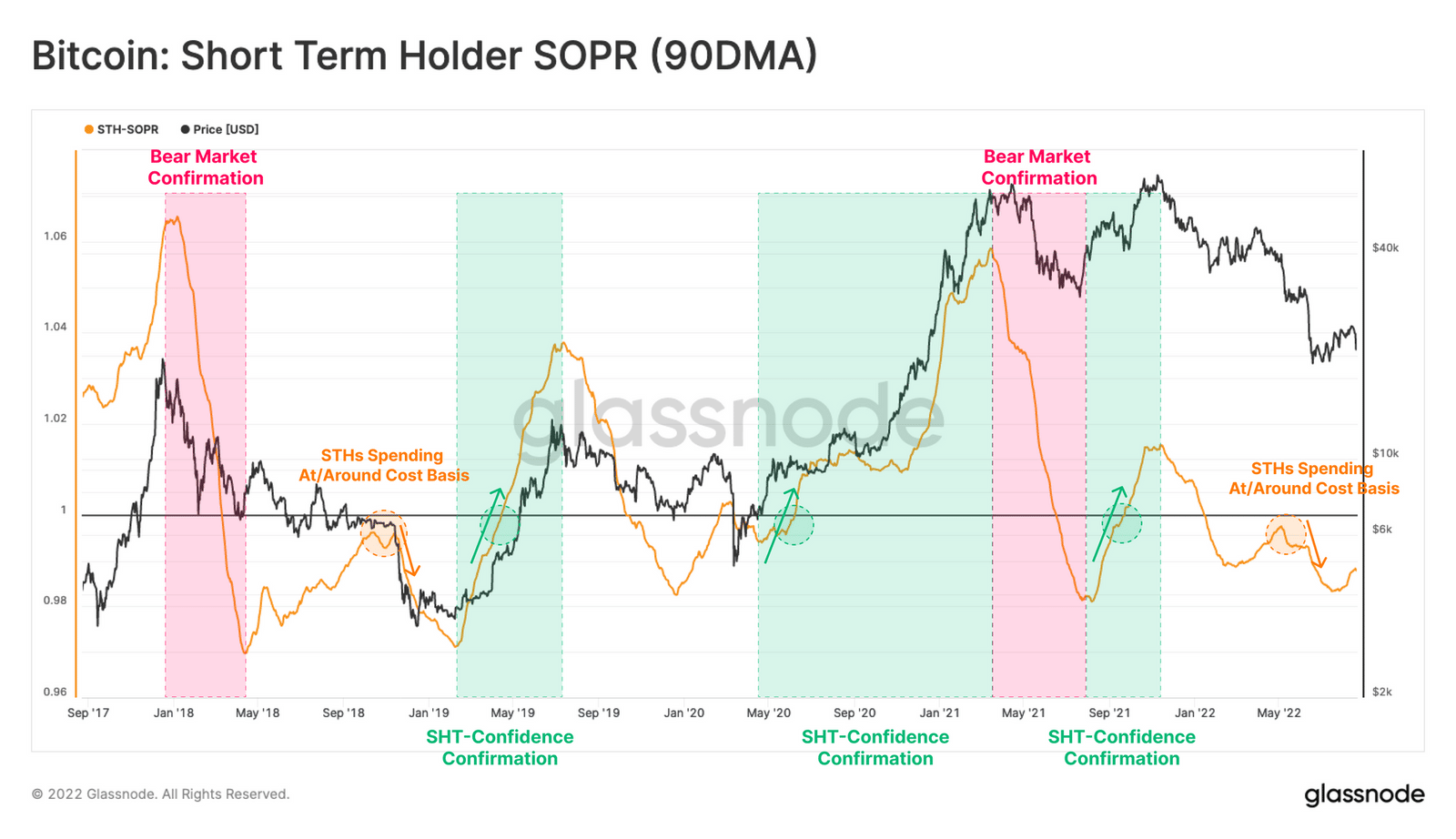

Finally, Glassnode speaks of the Short-term holders’ SOPR (90DMA) which explains the ratio of investors’ selling prices relative to their buying prices. The important threshold here remains the cross-over of 1. Any break above it would indicate a return to profitable spending. As Glassnode explains:

Following the capitulation from the November ATH, short-term holders (top buyers) realized heavy losses, causing a sharp drop in Short-Term Holders SOPR (90DMA) below 1. This phase is usually followed by a period of low conviction, where the break-even value of 1 acts as overhead resistance.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Crypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran’s Strait of Hormuz Closure

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

Buy $GGs

Buy $GGs