This Hedge Fund Loses Majority of Funds Due To FTX Bankruptcy

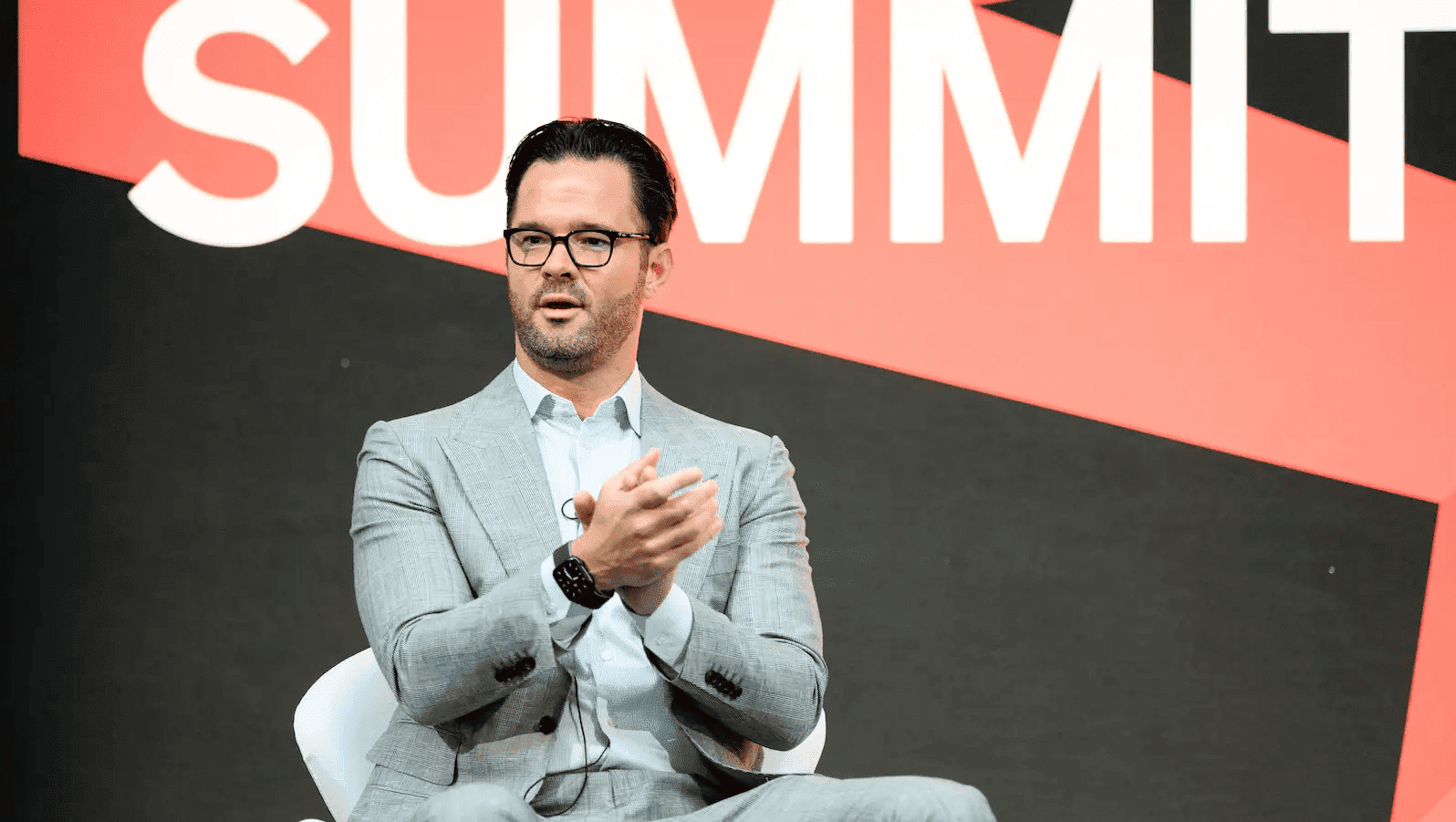

Travis Kling, the company’s founder and chief investment officer, said that the California-based hedge fund Ikigai Asset Management had a “vast majority” of its assets on the now-defunct cryptocurrency exchange FTX.

On Monday, Kling stated through Twitter that Ikigai got affected by the FTX crash last week. The majority of the assets of the hedge fund were on the FTX exchange and they received very little amount by the time they tried to withdraw on Monday morning. They are currently stranded like everyone else due to the FTX collapse.

Ikigai’s Current Roadmap

According to Kling’s Twitter thread, the company will continue trading its non-FTX-stuck assets and will soon decide what to do with its venture fund which was not affected by the FTX meltdown.

He stated that there is a great deal of ambiguity surrounding the timeline and likelihood of recovery for FTX consumers. “But at some point, we’ll be able to make a better call on whether Ikigai is going to keep going or just move into wind-down mode.” he added.

Read More: SBF Resigns, John Ray III Joins As New FTX CEO

Kling claimed that he had been in frequent contact with Ikigai’s investors since Monday and accepted full responsibility for the possible loss of funds. According to him, he has sincerely apologized to his investors for losing the money they trusted him with and further said:

“I have publicly endorsed FTX many times and I am truly sorry for that. I was wrong.”

About Ikigai

Ikigai was established in 2018 and in May, it launched a new venture fund with $30 million in funding from its current investors. Ikigai had more than 275 investors worldwide, according to a press release given during the investment round.

Kling further stated that,

“It’s obvious now that the space has not done enough to identify and expel bad actors. We’re letting way too many sociopaths get way too powerful and then we all pay the price. If Ikigai continues on, we pledge to fight harder in this regard. It’s a fight worth fighting.”

Recent Posts

- Crypto News

Will Crypto Market Crash as Over $27B in Bitcoin, ETH, XRP, SOL Options Expire Today?

The crypto market has recovered slightly to $3 trillion amid sentiment towards a potential Santa…

- Altcoin News

Trust Wallet Hack Update: CZ Speaks Out on $7M Loss, Promises Support

In the wake of the $7 million Trust Wallet hack, Binance founder Changpeng Zhao has…

- Crypto News

Trust Wallet Hack: Users Hit as Hacker Drains BTC, ETH, BNB

The Chrome extension updated to version 2.68.0, and reports of a Trust Wallet hack soon…

- Crypto News

Binance Founder CZ Reacts as BNB Chain Dominates Ethereum, Solana In This Metric

BNB Chain has the largest average of active wallets per day in the year 2025.…

- Crypto News

Mike Novogratz Credits XRP Army for Token’s Relevance as ETFs Maintain Inflow Streak

XRP has remained visible in the crypto market because of its committed community, according to…

- Crypto News

Aave DAO Saga Update: Majority Votes Against Token Alignment Proposal as Voting Nears End

The AAVE token alignment proposal looks unlikely to pass, as the majority of DAO members…