This is what led to the $400 Billion Wipe-Off From the Crypto Market

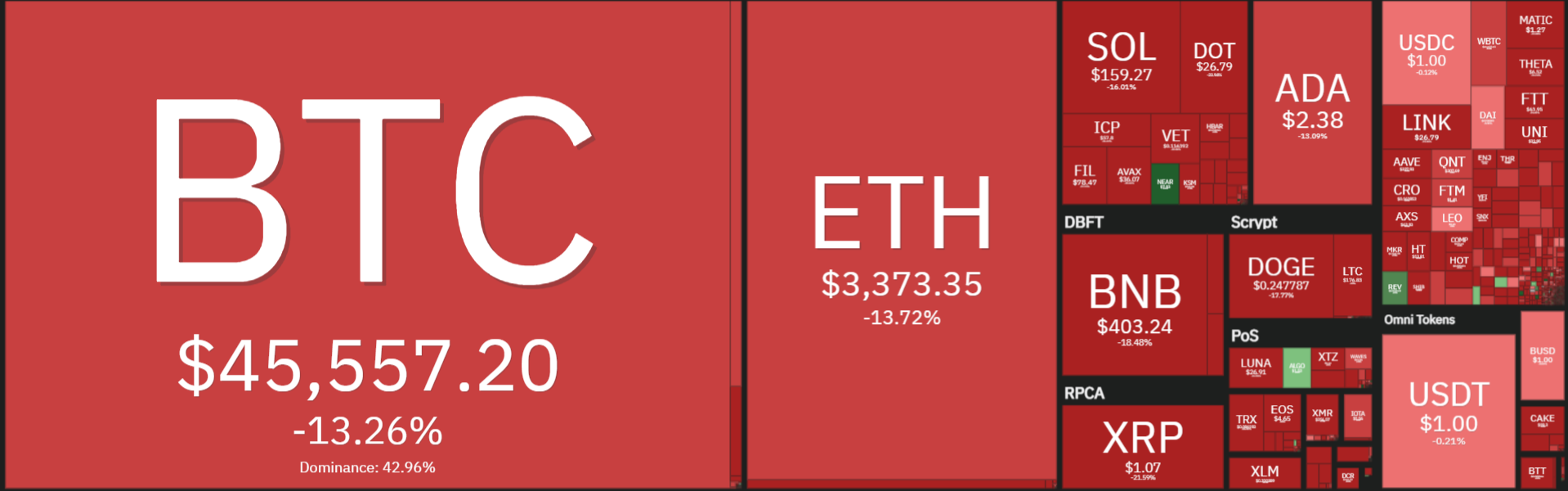

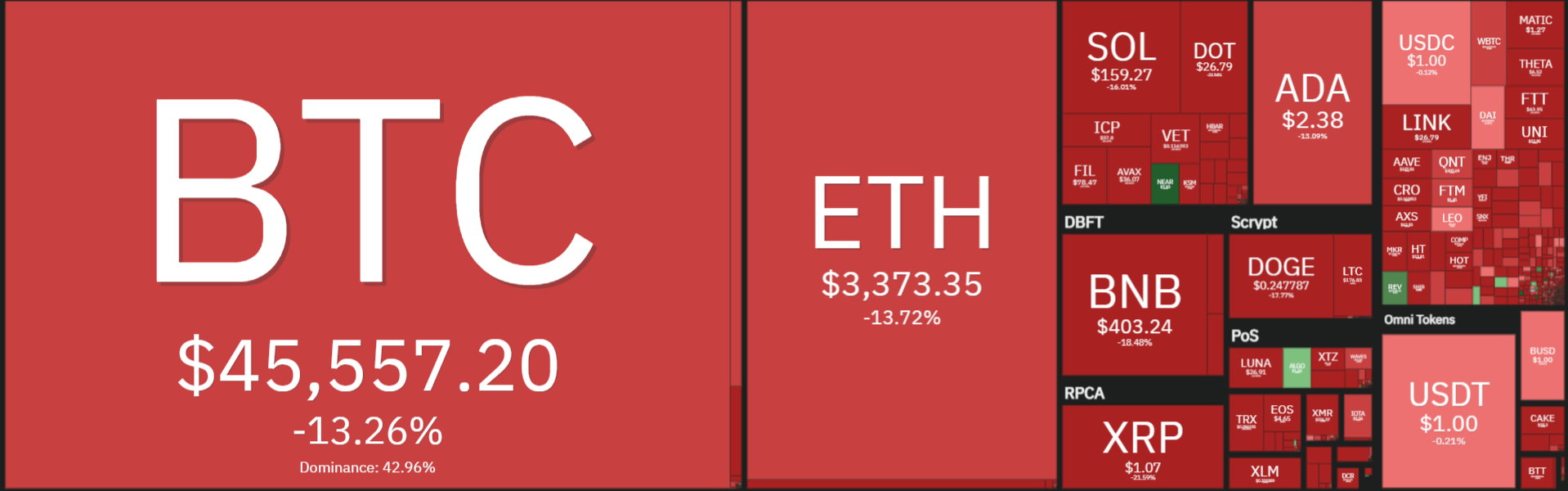

The crypto market experienced its first major pullback post-August gains on Tuesday as the majority of crypto assets lost their monthly gains in a matter of few hours. The total crypto market cap fell below $2 trillion momentarily before climbing back, but the net loss over the past 24-hours reached over $400 billion.

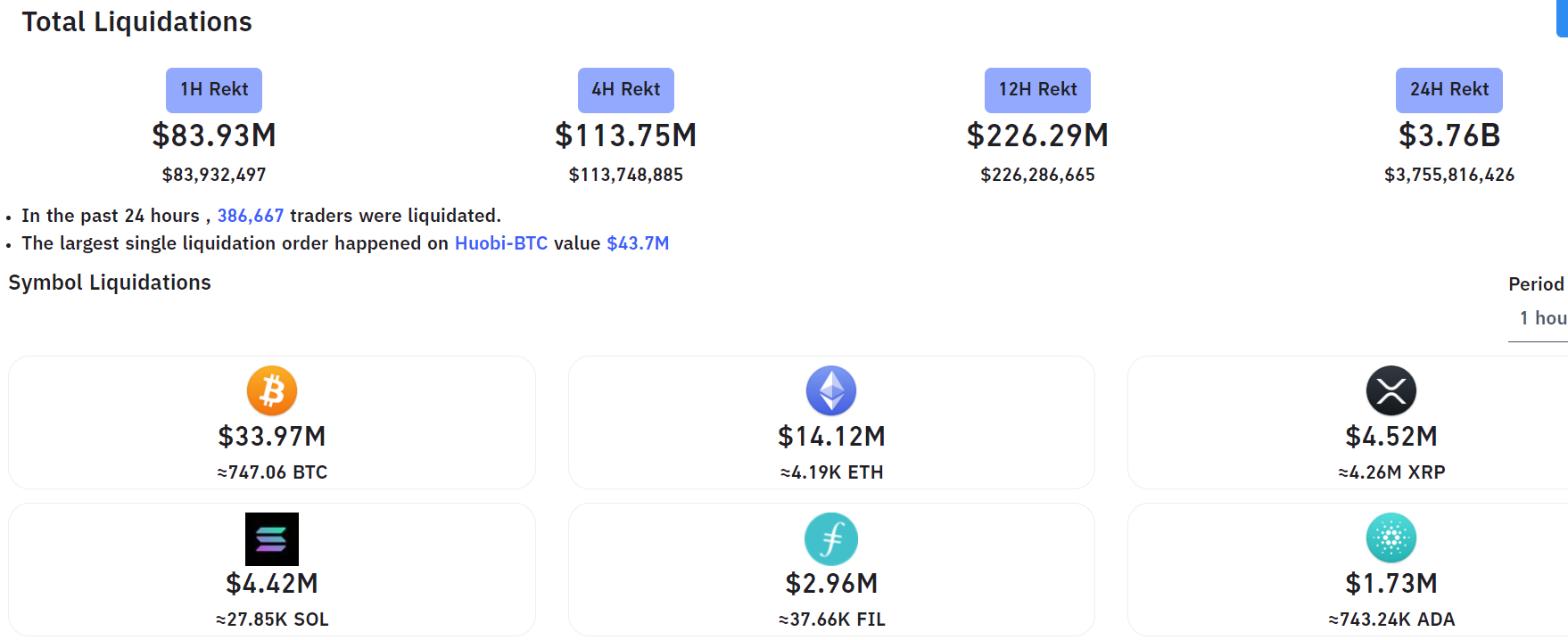

Nearly $4 billion in leveraged positions were liquidated during the crypto market flash crash. Bitcoin ($BTC) lead the liquidation with over $34 million getting liquidated on various exchanges followed by Ethereum (ETH) and XRP.

Ether’s open positions set a new record high and saw mass liquidation, the open interest of Ether reached $11.62 billion. The price of Eth is currently trading at $3,365 after dropping over 20% on Tuesday. Similarly, over $4 billion in Bitcoin open interest was cleared during the market sell-off.

What Led to the Crypto Market Flash Crash?

The crypto market was well set on its path to recovery as nearly half a dozen altcoins had already hit ATH and Bitcoin was also looking set for a move above $55K. However, the flash crash has wiped out month-long gains and increased market volatility. During the early stages of the flash crash, many believed a malfunction in El Salvador’s national wallet Chivo triggered the sell-off, which was later aggravated by the news of SEC investigating Coinbase crypto exchange.

SEC reportedly warned Coinbase of legal consequences for their upcoming staking product. Brian Armstrong, the CEO of Coinbase Inc. revealed that the exchange has received a Wells Notice from the SEC. Armstrong seemed confused about SEC claiming he doesn’t understand why the regulatory body is threatening legal action over a staking product. Many believe the SEC’s threat also played a key role in Tuesday’s market crash.

1/ Some really sketchy behavior coming out of the SEC recently.

Story time…— Brian Armstrong (@brian_armstrong) September 8, 2021

Armstrong claimed that the SEC has not yet revealed what qualifies its lending product as security despite them fully cooperating with their demands. He said,

“They refuse to tell us why they think it’s a security, and instead subpoena a bunch of records from us (we comply), demand testimony from our employees (we comply), and then tell us they will be suing us if we proceed to launch, with zero explanation as to why.”

The dilemma around which asset qualifies as security has already led to the Ripple lawsuit, and many believe they might come for Coinbase as well. The SEC threat to Coinbase and El Salvador Bitcoin glitch combined with the impending pullback led to the flash crash in the crypto market.

Coinbase said the SEC threatened to sue their lending products, and the crypto market began to fall again due to this.

— Wu Blockchain (@WuBlockchain) September 8, 2021

- Bitget’s TradFi Daily Volume Doubles to $4B as Crypto Traders Diversify Into Gold, Silver

- Breaking: Senate Committee Moves Crypto Bill Markup To January 29 as Government Shutdown Looms

- Breaking: Tom Lee’s Bitmine Acquires 40,302 ETH as Whales Double Down On Ethereum

- BlackRock Files S-1 for Bitcoin Premium Income ETF as Crypto ETPs See $1.73B in Outflows

- Breaking: Michael Saylor’s Strategy Adds 2,932 BTC as Bitcoin Erases YTD Gains

- XRP Price Prediction as Ripple Scores Big Partnership in Cash-Rich Saudi Arabia

- Bitcoin Price Prediction As Gold Breaks All-Time High

- Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73%

- PEPE vs PENGUIN: Can Pengu Price Outperform Pepe Coin in 2026?

- Binance Coin Price Outlook As Grayscale Files S-1 for BNB

- Solana Price Prediction as SOL ETF Inflows Outpace BTC and ETH Together