This One Metric Indicates Strong Bitcoin (BTC) Accumulation Ahead of 2024 Halving

On Wednesday, April 12, the US announced its CPI data for the month of March 2023 with inflation figures staying on the expected line. The world’s largest cryptocurrency Bitcoin (BTC) has shown little volatility to this macro development and has been holding above $30,000 as of press time.

Over the last week, Bitcoin (BTC) gained more than 7% to surge past $30,000 surprising the Satoshi Street, and has been gearing up for ‘explosive growth‘ as per on-chain indicators. While everyone is paying attention to the current macro setup, popular market analyst Ali Martinez pays attention to the next big event in the Bitcoin ecosystem i.e. halving in 2024.

If past halving events are an indicator, the Bitcoin price has rallied significantly before and after the event. In Bitcoin halvings, the rewards for mining Bitcoin transactions are cut in half. Halving reduces the rate of new coins created in the market, and this reduction in the supply drives the prices higher.

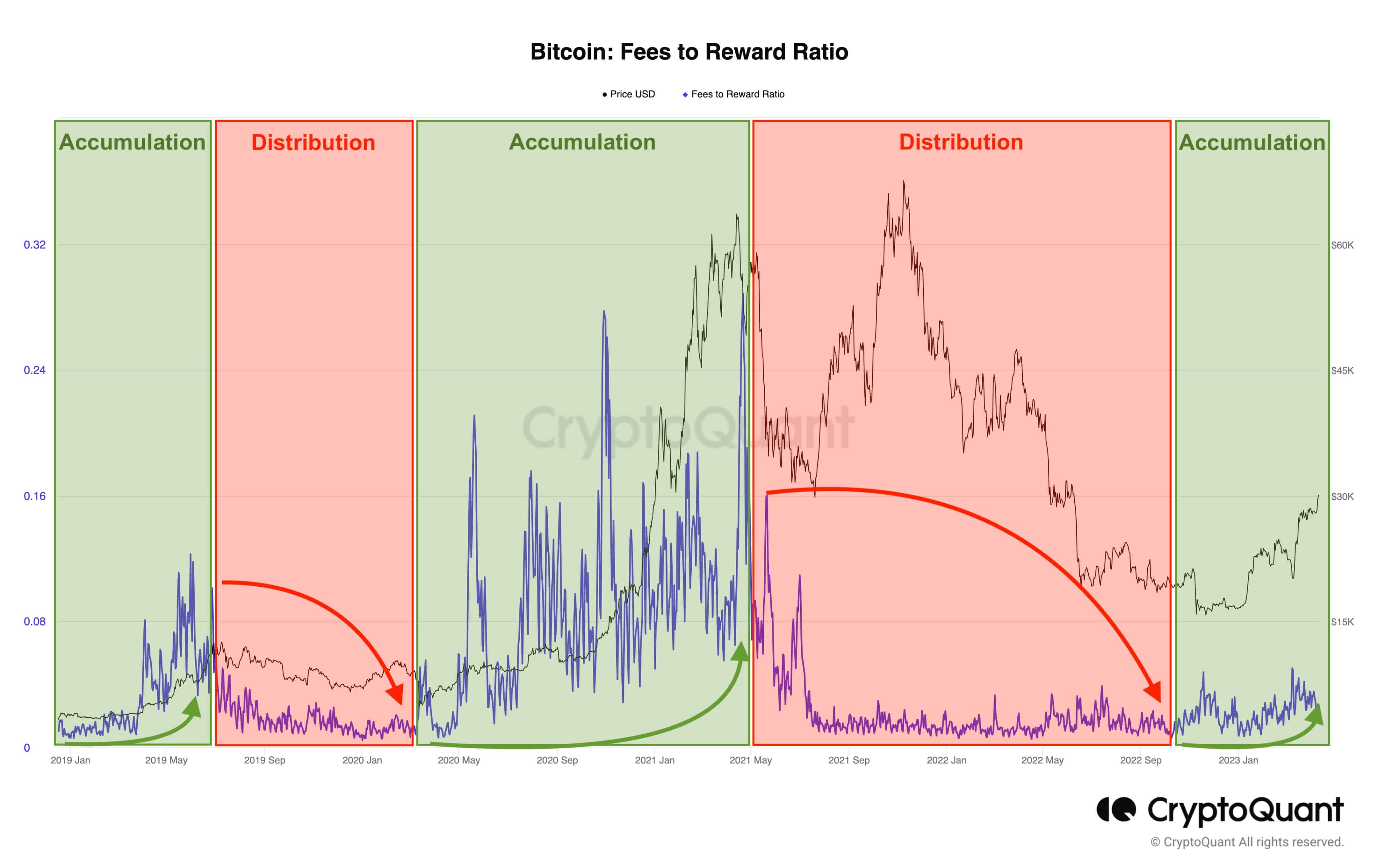

However, to gain insights into the future performance of Bitcoin, one metric that investors need to carefully watch is the fees-to-rewards ratio.

Bitcoin Fess to Rewards Ratio

Crypto analyst Ali Martinez notes that the Bitcoin fees-to-rewards ratio is a crucial indicator that shows the financial sustainability of the Bitcoin network. With block rewards decreasing after the halving event, the Bitcoin fees-to-rewards ratio becomes an extremely critical income source for miners. The crypto analyst explains:

A higher ratio signals a healthy & sustainable network, boosting investor confidence & demand, and driving the price of $BTC higher. Conversely, a lower ratio might raise concerns about long-term sustainability, affecting the price of #BTC negatively.

As we can see from the above image, the market has entered a strong accumulation cycle, similar to the one we saw in 2019 and 2020. This signals a potential Bitcoin price rally coming ahead to the run-up to 2024 halving.

Note that this doesn’t mean BTC will be absolutely free of volatility. There are several major macro events up to 2024 halving which could influence the BTC price.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- Cardano Founder Warns Over CLARITY Act, Cites Lack of Protection for DeFi, Stablecoins, Prediction Markets

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

Buy $GGs

Buy $GGs