Tom Lee’s Bitmine Immersion Buys $82M in Ethereum, BMNR Stock Jumps

Highlights

- Bitmine Immersion purchases an additional 28,625 ETH worth $82.11 million.

- BMNR stock jumps 5% higher as Tom Lee-backed Ethereum treasury firm continues to buy the dip.

- ETH price needs to rebound above $2,900 for upside momentum, analyst predicts.

Bitmine Immersion Technologies, the largest Ethereum treasury, has purchased an additional 28,625 ETH. Tom Lee-backed Ethereum treasury firm continues to buy the dip, according to on-chain data on Monday. BMNR jumps almost 5% during premarket hours.

Tom Lee’s Bitmine Immersion Buys $82.11 Million in Ethereum

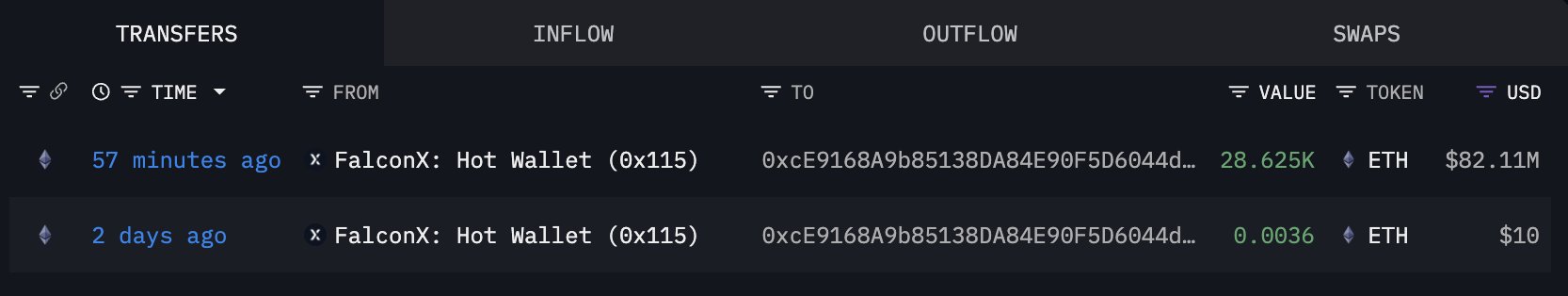

Funstrat’s Tom Lee-backed Ethereum treasury firm Bitmine Immersion Technologies added another 28,625 ETH worth $82.11 million, Lookonchain reported on November 24.

Bitmine made another massive move from FalconX in two days. On Sunday, the firm received 21,537 ETH worth almost $60 million from FalconX. The firm will release an official announcement later today to disclose its Ethereum, Bitcoin, stake in Eightco Holdings, and cash.

Last week, Bitmine announced 3.6 million ETH holdings, accounting for 2.9% of the Ethereum supply. The total crypto holdings and cash are worth almost $12 billion. Tom Lee remains bullish on ETH, as well as Bitcoin.

BMNR Stock Rebounds

BMNR stock is trading nearly 5% higher during the premarket trading hours on Monday. This comes amid massive ETH buying as Fed rate cut odds jumped following recent comments and reports that Jerome Powell supports a rate cut in December.

Bitmine shares closed at $26 on Friday, with a 24-hour low and high of $24.33 and $26.77, respectively. Also, trading volume was higher than the average volume of 44 million.

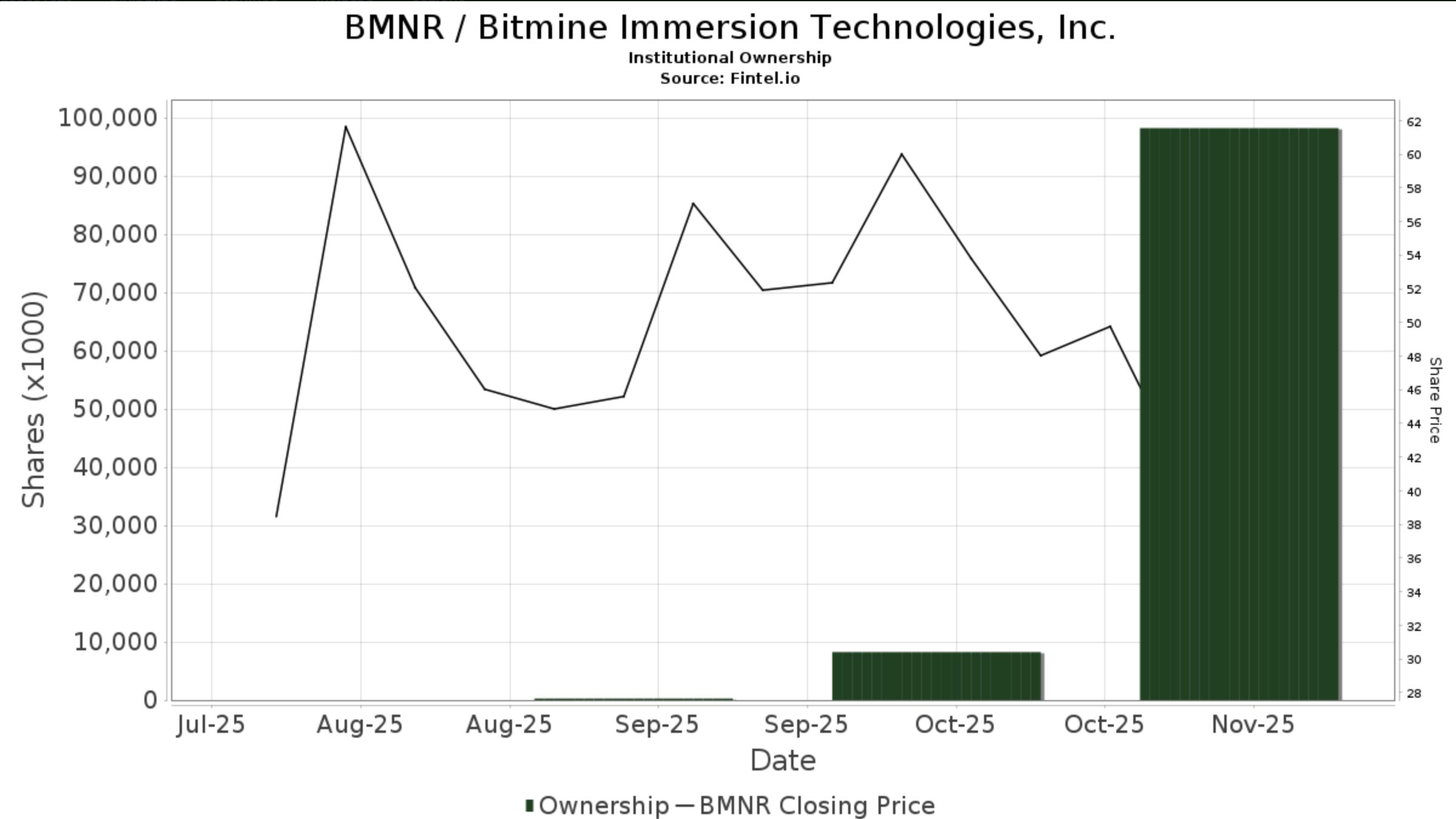

The stock has dropped almost 50% in a month amid the crypto market crash. The year-to-date (YTD) performance has reduced to 258%. As per Fintel data, institutional ownership has increased from 10 million to 100 million shares within a month.

Will ETH Price Reclaim Above $2,900?

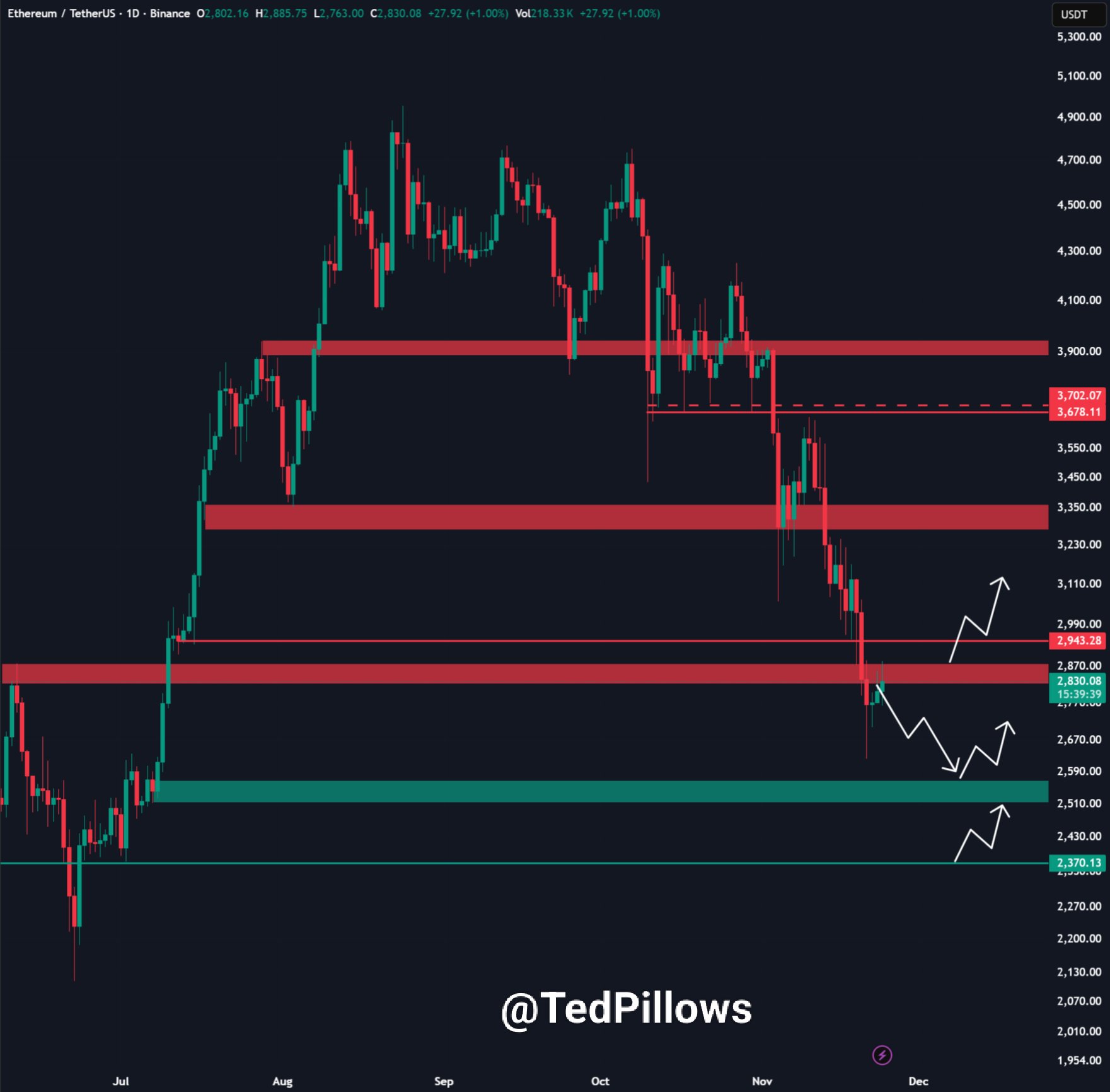

ETH price has pared all gains over the past 24 hours, with the price currently trading at $2,793. The 24-hour low and high are $2,763 and $2,883, respectively. Furthermore, trading volume has increased by 33% in the last 24 hours.

Derivatives data showed selling in the last few hours, with total ETH futures open interest dropping 2% in the last 4 hours. The 24-hour ETH futures open interest has reduced to 0.56% to $33.83 billion, at the time of writing.

Analyst Ted Pillows pointed out that Ethereum attempted to reclaim the $2,850-$2,900 level, but failed. If it doesn’t reclaim above the level, ETH price could risk dropping to $2,500.

Also Read: 8 Proven Ways to Earn Passive Income with Crypto in 2025

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k