Tom Lee’s BitMine Announces 2026 ETH Staking Plans Amid $4B Treasury Loss

Highlights

- BitMine shared its Ethereum staking plans for 2026.

- The product is scheduled to launch in very early next year.

- BitMine is under pressure with almost $4 billion in unrealized losses.

BitMine plans to start a network of Ethereum validators built in the U.S. This comes even as the company’s treasury is facing billions in unrealized losses due to the market crash.

BitMine Pushes Ahead With 2026 ETH Staking Plans

In a recent press release, the treasury firm announced that it is launching the Made in America Validator Network (MAVAN). This will help the firm stake its ETH treasury. The company also stated that it has selected three pilot partners to test the program with a small amount of its ETH.

We plan to partner with one or more of these pilot partners plus world-class infrastructure providers to scale our own “Made in America Validator Network” (MAVAN) over the coming quarter,” he said.

These early-stage tests are designed to test node performance and service quality before deployment.

Tom Lee said the company plans to scale MAVAN via partnerships with top-tier infrastructure providers.

“BitMine continues to execute at the highest level. The company is well positioned in 2026 and we look forward to commencing ETH staking with our MAVAN, or Made in America Validator Network, in early calendar 2026,” he said.

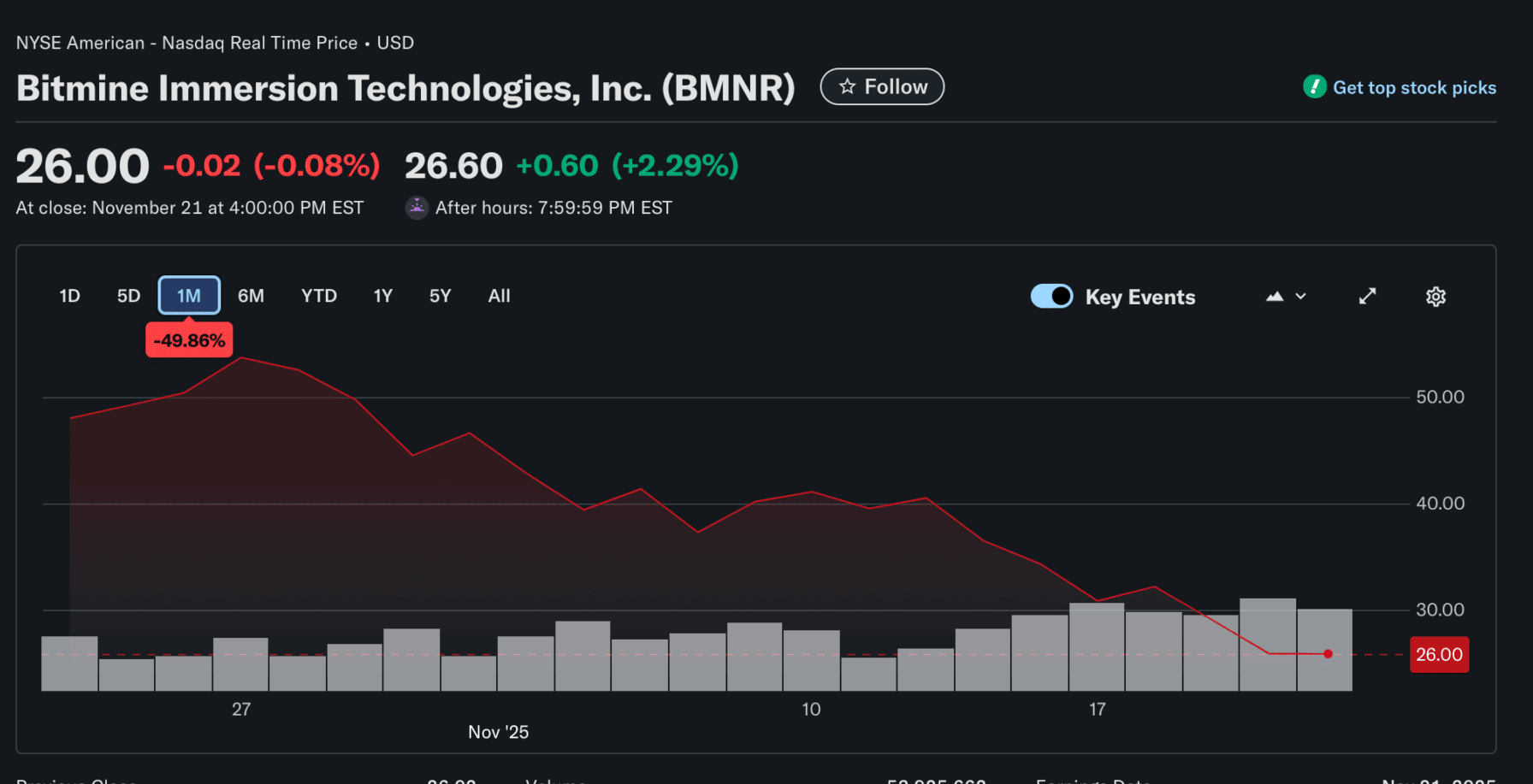

This staking plan has arrived at a particularly difficult moment for the firm. It has about $4 billion in unrealized losses left from the crypto crash. The shares of BMNR have also fallen 84% from their high back in July. It has erased the premium that was once attached to its net asset value.

Despite the crash, the company has continued adding to its ETH treasury. Tom Lee has repeatedly called the dip a “golden opportunity.” He argued that accumulating assets during periods of decline is what will make the strategy profitable for the company.

Tom Lee Says ETH Weakness Mirrors Earlier Liquidity Shocks

Lee said that Ethereum’s slide resulted from a temporary fall in crypto liquidity similar to the post-FTX environment seen in 2022. He pointed out that the October 10 liquidation event marked the largest single-day wipeout.

According to Lee, past cycles indicate that the long periods of downturn usually bring in recoveries once liquidity returns.

Despite these losses, the finances of BitMine still showed some growth. It has an earned income of $328.1 million. The company also said it made earnings of $13.39 per share.

Meanwhile, some treasuries are taking profits. FG Nexus sold some of the tokens in its treasury. This company was buying tokens but started selling tokens when the market started to get worse.

- Shark Tank Kevin O’Leary Warns Bitcoin Crash as Quantum Computing Threats Turns Institutions Cautious

- Japan’s SBI Clears XRP Rumors, Says $4B Stake Is in Ripple Labs Not Tokens

- 63% of Tokenized U.S. Treasuries Now Issued on XRP Ledger: Report

- Will Bitcoin & Gold Fall Today as Trump Issues Warning to Iran Before Key Nuclear Talks?

- Crypto Ties Revealed in Epstein Files: 2018 Emails Point to Gary Gensler Discussions

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?