Top Reasons Why Ethereum Price is Down Today?

Highlights

- The US Fed's apparent hawkish stance has contributed to the Ethereum price drop.

- The negative Spot Ethereum ETF flows also led to this ETH price drop.

- Ethereum whales are also selling.

The Ethereum price is down over 6% in the last 24 hours, dropping to as low as $3,120 during this period. This price drop is due to several factors, including the Fed’s hawkish stance, which paints a bearish picture, not just for ETH but also for the broader crypto market.

Top Reasons Why The Ethereum Price Is Down

The Ethereum price has dropped to as low as $3,120, with several factors contributing to this price drop. These factors include the Fed’s hawkish stance, negative ETF flows, and a massive sell-off from ETH whales.

Fed’s Hawkish Stance

The Fed’s apparent hawkish stance is the primary reason why the Ethereum price has dropped significantly today. Despite the Federal Reserve announcing a 25 bps rate cut, Fed Chair Jerome Powell’s speech hinted that the US Central Bank is currently hawkish.

Powell also hinted that the Fed is likely to adopt a quantitative tightening approach from next year. There are estimates that there will be lower rate cuts next year, as the Fed has already made three cuts this year.

Cleveland Fed President Beth Hammack has also raised inflation concerns, which could strengthen the case for tightening policies, especially if future economic data come in hot.

Negative ETF Flows

The negative flows from the Spot ETH ETFs have also contributed to the Ethereum price drop. SosoValue data shows these ETFs recorded a negative daily inflow of $60.47 million yesterday.

Grayscale’s Ethereum Trust (ETHE) was mainly responsible for these outflows, with $58.13 leaving the fund. This negative outflow was the first in the last nineteen days and could indicate a change in sentiment among investors.

Negative ETF flows are typically bearish for the crypto, as outflows lead to significant selling pressure since these ETF issuers have to offload the assets under management to make redemptions.

ETH Whales Are Selling

ETH Whales are also selling, which is another reason the Ethereum price is down today. CoinGape reported on a whale that sold 22,746 ETH ($7.7 million) and another whale sold 49,910 ETH ($170 million) in the last 24 hours.

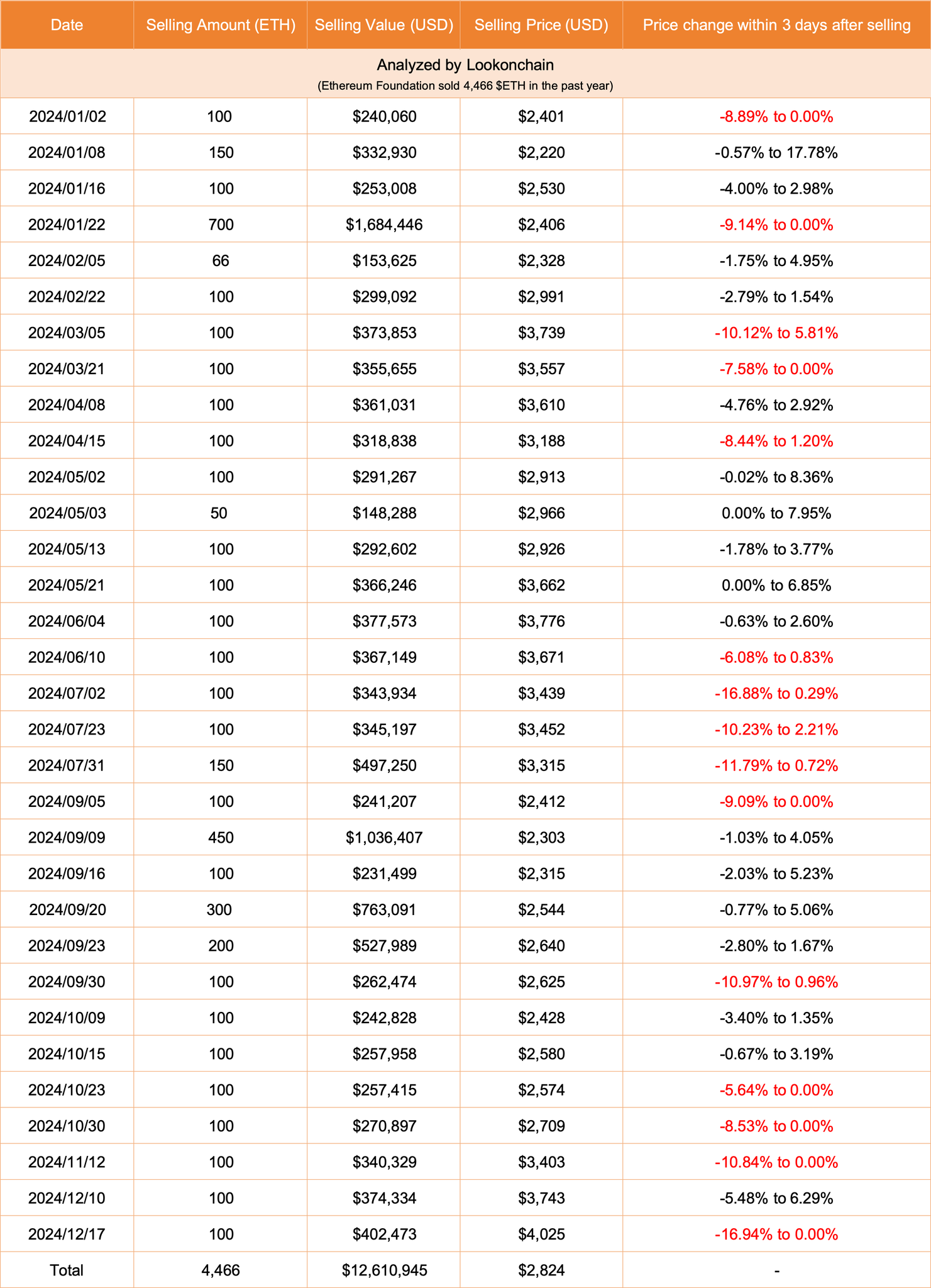

The Ethereum Foundation has also contributed to this selling pressure. On-chain intelligence platform Lookonchain noted that the Ethereum price has dropped around 17% since the Foundation sold 100 ETH on December 17.

The Ethereum Foundation has sold 4,466 ETH ($12.6) million over the past year, just around every ETH local top.

A Positive For ETH

Despite today’s drop, some other whales are still accumulating, which is positive for the Ethereum price. CoinGape reported that Donald Trump’s World Liberty Financial bought 759 ETH today, bringing its total holdings to 16,362 ETH (54.62 million).

Lookonchain also reported that Whales have started accumulating ETH as the market rebounds. The platform stated that four fresh wallets had withdrawn 8,440 ETH ($28.43 million) from Binance today.

- CFTC Launches “Future-Proof” Initiative to Modernize Crypto and Prediction Market Rules

- Bitcoin Drops Below $90K as Supreme Court Delays Ruling on Trump Tariffs

- Trump Tariffs: U.S. President Threathens 200% Tariffs on France Amid Greenland Dispute

- Breaking: Tom Lee’s BitMine Acquires 35,268 ETH as Staked Ethereum Surges to All-Time High

- Fed Chair Decision: Trump Could Decide on Powell’s Successor Next Week, Scott Bessent Says

- Chainlink Price Prediction After 24/5 Stock Data Launch: What’s Next For LINK?

- XRP Price Eyes a 25% Rebound Ahead of Brad Garlinghouse Statements at Davos Summit

- Why Silver and Gold Prices Are Rising While Crypto Falls Under Tariff Pressure?

- Solana Price Prediction As NYSE Launched Stock Tokenization Platform

- Bitcoin Price Outlook Ahead of Trump’s Davos Speech as Trade War Tensions Ease

- Top 3 Price Prediction for Ethereum, XRP and Bitcoin If Crypto Structure Gets Approved This Month