Traders Price In Two Fed Rate Cuts This Year Following US CPI Data

Highlights

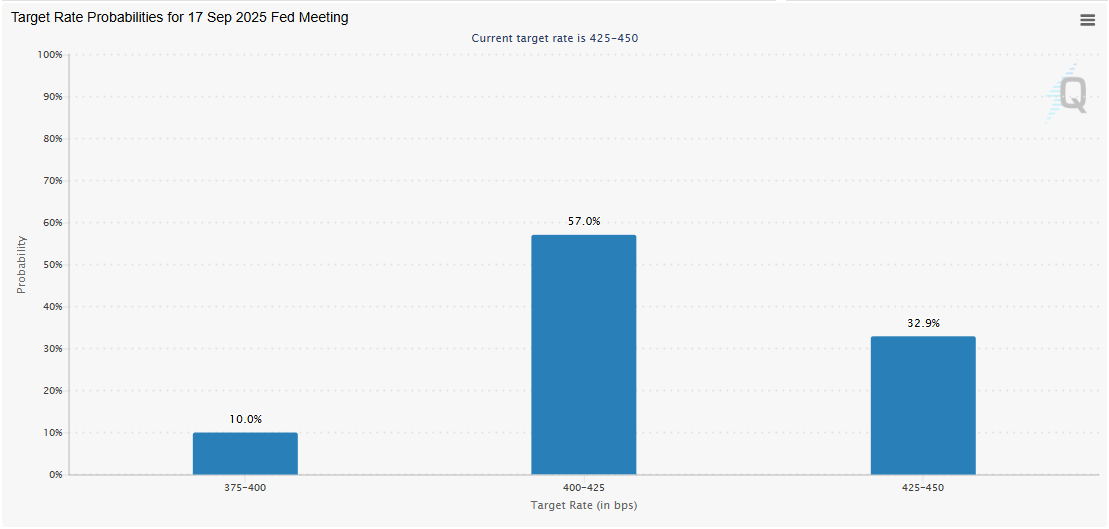

- CME FedWatch data shows that traders expect a Fed rate cut in September and December.

- There is a 57% chance that the Fed will lower rates by a quarter point in September.

- This comes following the release of the CPI data which came in lower than expectations.

- President Trump and VP Vance are pushing for the Fed to cut rates.

Traders have received a major boost following the latest US CPI data release, which came in lower than expectations. Now, these market participants are betting that there could be two Fed rate cuts, starting from the FOMC meeting in September.

Traders Bet On Two Fed Rate Cuts In 2025

CME FedWatch data shows that traders are betting on two Fed rate cuts this year following the US CPI data release. These traders expect the Federal Reserve to cut interest rates starting at the September FOMC meeting. There is currently a 57% chance that the FOMC will cut rates by a quarter point in September, lowering the benchmark interest rate to between 4% and 4.25%.

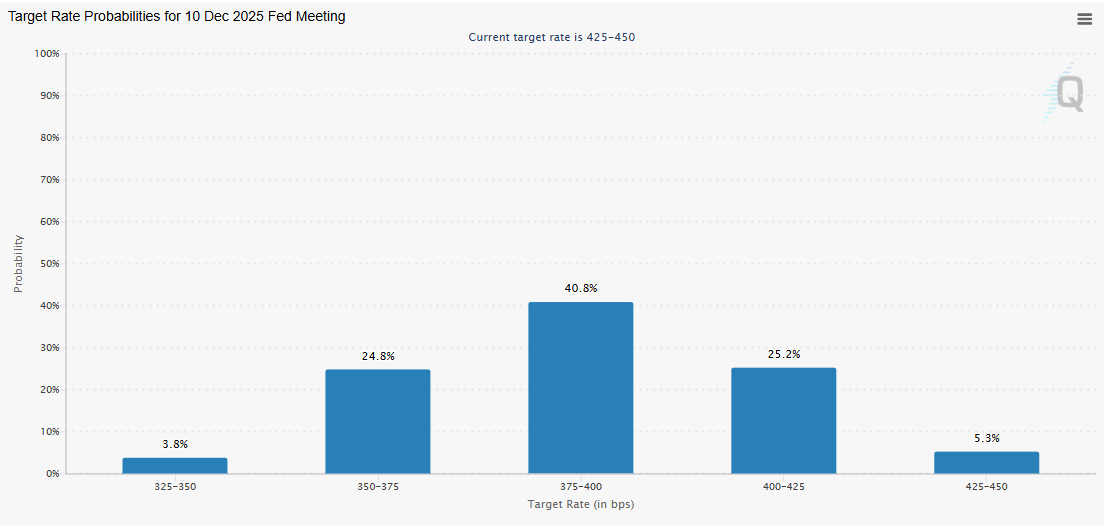

Furthermore, these traders expect the Fed to keep interest rates unchanged at the October meeting and proceed with another interest rate cut at the December FOMC meeting. There is a 44% chance that the rates will remain at 4% to 4.25% after the October FOMC meeting. Meanwhile, there is a 40.8% chance that these rates will come down by another quarter point to between 3.75% and 4% after the December meeting.

This development follows the release of May US CPI data. As CoinGape reported, the May CPI came in at 2.4% year-on-year, lower than expectations. It also rose by 0.1% month-on-month, lower than expectations of 0.2%. The Core CPI also came in lower than expectations.

This is a positive for the crypto market, as it further strengthens the case for Fed rate cuts, since inflation in the US is cooling off. However, traders are expecting the Fed to keep rates unchanged at the June FOMC meeting next week.

CoinGape reported that there is a 0.1% chance that Powell and the FOMC will cut rates. Meanwhile, there is an 81% chance that interest rates will remain unchanged at the July FOMC meeting.

US Government Urges The Federal Reserve To Act

Amid Powell’s reluctance to cut rates, US President Donald Trump continues to push for a Fed rate cut. Trump recently urged the Fed to cut interest rates by 100 Bps. Vice President JD Vance is also pushing for the Fed to lower rates. Vance stated that the Fed’s refusal to cut rates is “monetary malpractice.”

In a Truth Social post, Trump commented on the latest US CPI data. He remarked that the figures were great and again pushed for a 100 Bps Fed rate cut. He noted that this would allow them to pay much less interest on the debt that is coming due.

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter