$200M Worth of Token Unlocks Hit Market This Week- Buy The Dip Or Wait? Aster, ZRO, MERL

Highlights

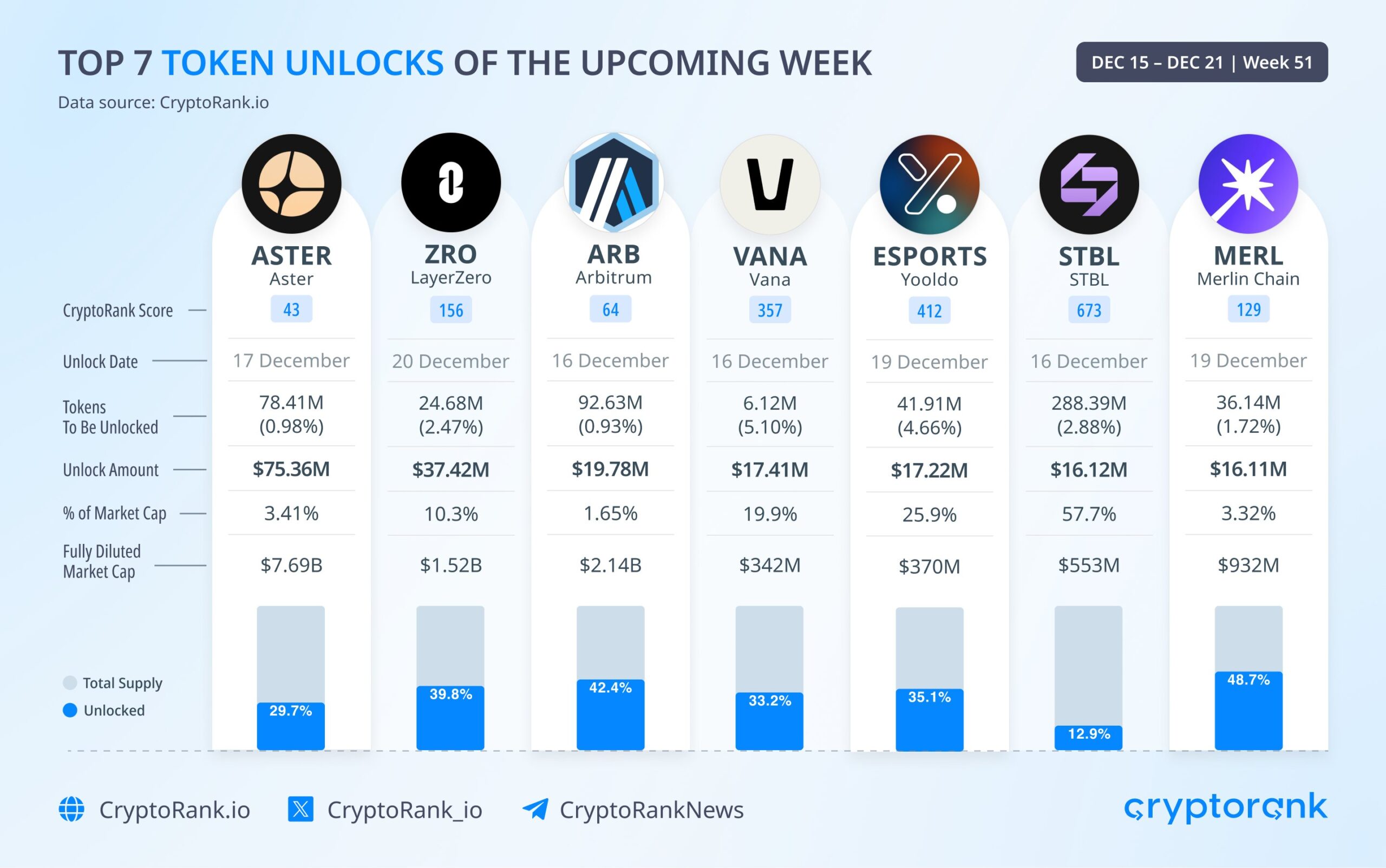

- Aster leads token unlocks with $75M scheduled this week.

- STBL’s 57.7% unlock poses extreme dilution risk now.

- ZRO unlock may trigger short-term volatility due to size.

As the week of December 15 to 21 unfolds, the cryptocurrency market continues to show mixed performance amid increasing macro uncertainty.

Bitcoin has dropped below $90,000, trading at $89,719 with a slight daily decline of 0.5%.

Meanwhile, Ethereum price remains stable at $3,128, gaining 0.5%. The fear is still negative, and Fear and Greed Index stands at 16, which reflects very high levels of fear among the investors.

Crypto performance is mixed with $BTC again falling below $90K, while $ETH is still holding strong at the $3100 support. With macro concerns, sentiment is back in extreme fear.$BTC: $89,719 -0.5%$ETH: $3,128 +0.5%

FGI: 16 → Extreme Fear

Market Cap: $3.29T

Liquidations: $294M pic.twitter.com/Aho4ayZFRN— CryptoRank.io (@CryptoRank_io) December 15, 2025

In this risk-averse atmosphere, more than $199 million in token unlocks is to be rescued this week. Such developments may add further volatility in the crypto market.

Token Unlocks Cross $199M as Key Projects Release Supply

This week, the top 7 token unlocks will inject approximately $199.42 million worth of tokens into the market, led by ASTER, ZRO, and MERL. These unlocks represent planned vesting unlocks, or liquidity supply unlocks, ecosystem reward unlocks, or team unlocks.

The biggest one is that of Aster (ASTER), which is going to open up a total of 75.36 million worth of tokens on December 17. This represents 78.41 million of its entire supply or 0.98%.

The issued tokens constitute 3.41% of the market capitalization of Aster, 29.7% of total supply is in circulation.

The next unlock is LayerZero (ZRO) with a value of 37.42 million on December 20. The 24.68 million tokens constitute 2.47% of the entire supply but 10.3% of the market cap, which is more substantive. ZRO retains 39.8% of circulation of its tokens.

Merlin Chain (MERL) will release the tokens on December 19, totaling $16.11 million. This incident consumes 36.14 million tokens or 1.72 % of the entire supply and 3.32% of its market capitalization.

Mid-Tier Projects Also Add to Weekly Token Unlocks

Other significant token unlocks this week include:

Arbitrum (ARB): Unlocking on 16 December 19.78M (92.63M or 0.93M of the supply), which was 1.65% of its market capitalization.

Vana (VANA): unlocking of 17.41M on 16 December (6.12M tokens), which represents 5.10% and 19.90% of supply and market cap, respectively.

Yooldo Esports (ESPORTS): Dec 19 unlock of $17.22M (41.91M tokens), which is 25.9 %of its valuation.

STBL: Unlocking on December 16, 16.12M and unlocking a big 288.39M tokens: 2.88% of supply and an astounding 57.7% of its market cap, the greatest percentage of dilution on the list.

The majority of unlocks are between 1% and 5% of total supply. Nonetheless, others, such as STBL and ESPORTS, have a high risk of dilution because of low market caps and high unlock ratios.

Will These Token Unlocks Trigger a Selloff or Accumulation?

These token unlocks could either create sell pressure on the existing market or create market access points to long-term buyers who are already on edge. Most susceptible to short-term fluctuation are unlocks of more than 10% of market cap, like ZRO and STBL.

Conversely, such tokens as ARB can smoothly consume unlocks because of bigger liquidity pools and a larger range of investors.

Close attention should be paid to on-chain activity and exchange flows by investors this week. A few of these unlocks can provide trading options, particularly provided that the larger market becomes stable.

Frequently Asked Questions (FAQs)

1. Why do token unlocks affect market prices?

2. Can token unlocks create buying opportunities?

- Veteran Trader James Wynn Turns Bullish, Opens BTC Long as Bitcoin Price Breaks $93K

- “Orange or Green?” Saylor’s Bitcoin Tracker Sparks New BTC Accumulation Speculation

- Bitcoin Holds Above $90K Despite Venezuela Strike As Market Shows Resistance To Geopolitical Shocks

- Maduro Arrest: Prediction Markets Face Insider Trading Scrutiny After Latest US Attack on Venezuela

- Top Gainers of the Week: MYX, PEPE, CC Lead Market Gains as as Bitcoin Rallies To $90k

- Weekly Crypto Price Prediction: Bitcoin, Ethereum and XRP

- MSTR Stock Price Prediction 2026: Wall Street Senior Analyst Targets $500

- XRP Price Reclaims $2 After 10% Breakout: How High Can It Climb in January 2026?

- Ethereum Price Prediction 2026 As Vitalik Buterin Unveils New Scaling Roadmap

- Bitcoin and XRP Price Prediction 2026 Ahead of US Crypto Reserve, CLARITY Act

- Analyst Predicts Cardano Price to Surge 103% to $0.75 as Midnight, Leios Launch Near

Claim $500

Claim $500