Gold vs Bitcoin: Can BTC Outperform Gold Ahead in 2026?

Highlights

- Gold vs Bitcoin: Bitcoin's volatility offers higher growth potential than gold.

- Federal Reserve rate cuts could make Bitcoin more appealing in 2026.

- Institutional support and Bitcoin ETFs drive investor confidence and adoption.

The rivalry between Bitcoin and gold is intensifying, especially as recent global events shake the market. Following U.S. President Donald Trump’s tariff announcement against several European nations, the two assets displayed contrasting movements.

Gold soared to a record high of $4,690, while Bitcoin price crashed below $94,000.

This divergence highlights a continued shift toward traditional safe havens as uncertainty grips global markets. Investors rushed to gold, seeking stability amid the rising tensions caused by the tariffs.

As the landscape evolves, the question remains whether Bitcoin can challenge gold’s long-standing role as the ultimate store of value by 2026.

Will Bitcoin Outshine Gold in 2026? Here’s Why It Could

Bitcoin’s potential to outperform gold is becoming a topic of increasing interest. Several key factors are emerging, which suggest Bitcoin could be poised for significant growth.

Federal Reserve Rate Cuts

The expected interest rate cuts by the Federal Reserve in 2026 could significantly impact Bitcoin’s performance. The Fed is expected to reduce rates, and it would make riskier investment options such as Bitcoin more attractive to investors.

The initial Federal Reserve meeting in 2026 will be held on January 27-28. When interest rates drop, a greater amount of investment in riskier and potentially higher-paying assets like Bitcoin is commonly seen.

Support from the Trump Administration

The Trump administration has been a strong advocate for cryptocurrency. This assistance has been used to establish a more crypto-friendly environment in the U.S. As the sitting government approves executive orders to increase the crypto industry, the number of investors in Bitcoin is growing steadily.

These prospects of additional Trump endorsement might spell out more institutional support towards Bitcoin and this would further propel its adoption.

U.S. Strategic Bitcoin Reserve

Speculation about the U.S. developing a strategic Bitcoin reserve has been growing. If this plan moves forward, it could positively affect Bitcoin’s value.

The introduction of a Bitcoin reserve by the U.S would legalize the digital asset and boost the value of Bitcoin in a significant manner. Doing so would likely prompt other countries to consider such solutions, which would further promote the position of Bitcoin in the sphere of finance.

Legislative Moves: Clarity Act

The Digital Asset Market Clarity Act is a critical piece of legislation currently facing delays in the U.S. Senate. Should it pass, it will give the crypto market, including Bitcoin, clearer regulations.

This would eliminate uncertainty and bring a more stable to institutional investors. Bitcoin would gain better institutional appeal with clearer guidelines and see an increase in its market value.

Bitcoin’s Volatility and Growth Potential

Bitcoin’s volatility, while often seen as risky, also contributes to its potential for massive price increases. Bitcoin, where the gold is less predictable is capable of enormous growth at least when it gets to the bull markets.

Bitcoin can expand at a higher rate compared to other conventional resources like gold as it is increasingly being utilized by institutions. The institutional attraction that is currently rising indicates that in the nearest future, the Bitcoin can become more apparent.

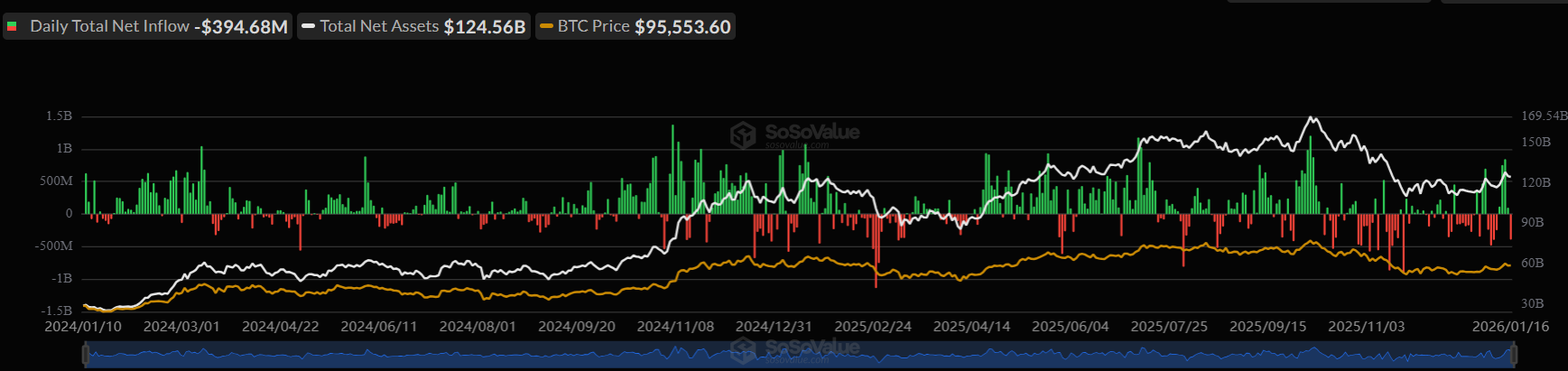

Institutional Support and Crypto ETFs

Institutional support for Bitcoin continues to grow, with more investors looking to add crypto to their portfolios. The ETFs, the popularity of which has been growing, offer institutional investors an opportunity to invest in the cryptocurrency market.

As of late, inflows on Bitcoin ETFs have been most recently at a record high of $1.42 billion, the best week since October. This indicates increased institutional attraction and may result in the further rise of Bitcoin price, surpassing such traditional assets as gold.

Keeping these factors in mind, it appears more probable that by 2026, Bitcoin might become better than gold. With the increase in institutional support and changing market conditions, Bitcoin can further appeal to investors. In case of BTC price recovery, the bullish trend will be able to rebound to $100k in the near future.

Frequently Asked Questions (FAQs)

1. What makes Bitcoin more volatile than gold?

2. Can Bitcoin outperform gold in 2026?

- Bitcoin Drops Below $90K as Supreme Court Delays Ruling on Trump Tariffs

- Trump Tariffs: U.S. President Threathens 200% Tariffs on France Amid Greenland Dispute

- Breaking: Tom Lee’s BitMine Acquires 35,268 ETH as Staked Ethereum Surges to All-Time High

- Fed Chair Decision: Trump Could Decide on Powell’s Successor Next Week, Scott Bessent Says

- Breaking: Michael Saylor’s Strategy Hits 700k Bitcoin Milestone Ahead of Trump Tariffs Decision

- Why Silver and Gold Prices Are Rising While Crypto Falls Under Tariff Pressure?

- Solana Price Prediction As NYSE Launched Stock Tokenization Platform

- Bitcoin Price Outlook Ahead of Trump’s Davos Speech as Trade War Tensions Ease

- Top 3 Price Prediction for Ethereum, XRP and Bitcoin If Crypto Structure Gets Approved This Month

- Dogecoin Price Eyes a 20% Rebound Ahead of SCOTUS Ruling on Trump’s Tariffs

- Bitcoin Price Prediction Amid US-EU Tariff Tension