What’s Behind Crypto Market Red Zone?

Highlights

- Crypto market faces downturn due to macroeconomic uncertainty and resistance.

- Federal Reserve rate cut uncertainty dampens risk appetite for cryptocurrencies.

- Taiwan explores Bitcoin reserves; geopolitical shifts challenge US dollar dominance.

The crypto market has seen a 1.5% decline in the last 24 hours, extending a 10.85% drop over the past month. Despite institutional buying pressure, the market faces mixed macroeconomic factors and technical resistance.

The market has been in a sideways trend in the past week as both the bulls and the bears fight each other in control. The major cryptocurrencies, such as BTC, hover at around $103K following a drop to below $105K. Ethereum (ETH) has also slowed down to about $3,500 after the recent decline of the market, as XRP, DOGE, and ADA eye recovery.

Here’s Why Crypto Market Is Facing a Major Downturn

The crypto market is experiencing a significant downward trend today, and the overall market capitalization is decreasing. This is a downward turn because the US government shutdown ended and investors are on alert, reconsidering their short-term plans. The doubt about the shutdown, which is the longest in US history, has lowered the appetite of investors to riskier assets such as cryptocurrencies.

As risk sentiment shifts towards safer assets, major crypto tokens are facing fresh selling pressure. This shift is contributing to weaker market momentum and slowing any recovery efforts that were previously anticipated.

Federal Reserve Uncertainty Dampens Crypto Market Sentiment

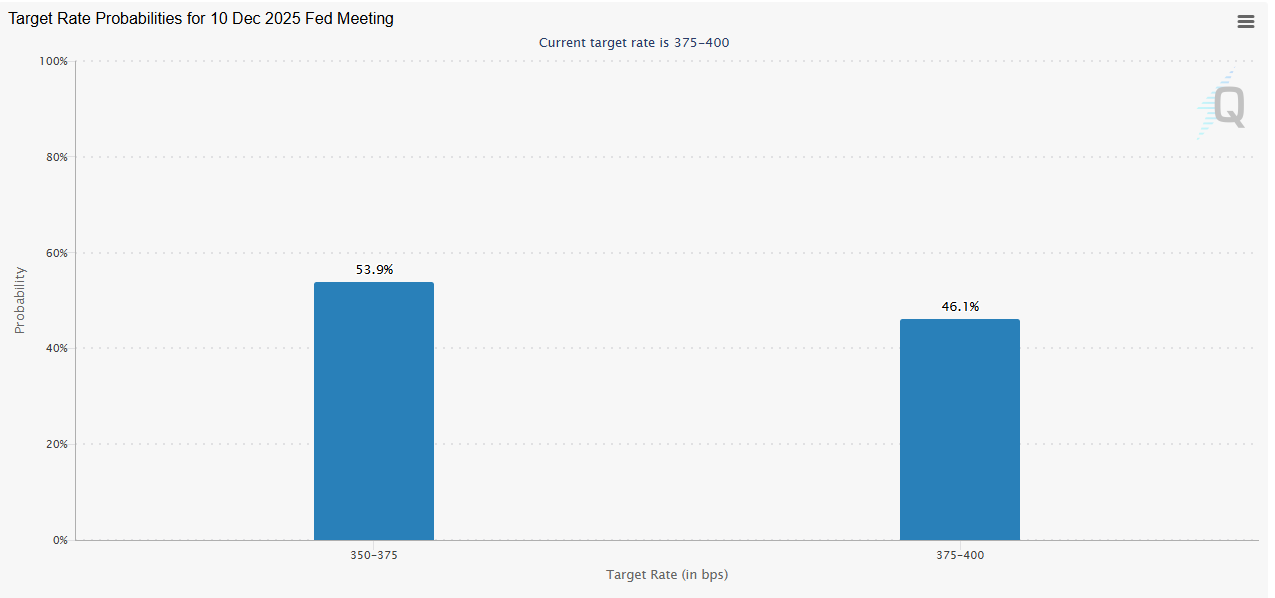

To complicate the situation further, the possibility of a Federal Reserve rate cut in December has been thrown into doubt. Now, traders are reducing their hopes of a 25 basis point (bps) cut, and this created further pressure on risk-based assets such as cryptocurrencies. This indecisiveness has led to a more or less sideways trading trend in the crypto market, with investors unsure of what Fed can do next.

The risk assets pressure has risen significantly, with the probability of a rate cut at end of December reduced to 53%. This has established a difficult situation in cryptocurrencies, which have failed to experience any significant positive trend.

In other projects, Kyrgyzstan is making moves to roll out a USD-pegged stablecoin, supported by the national stockpile of gold. This project is a major change in the strategy of the country towards digital currency and can threaten the US dollar supremacy. Analysts opine that this may act as a geopolitical experiment to other countries that may want to circumvent US sanctions and reduce use of dollar.

Taiwan Explores Bitcoin Integration into National Reserves

In the meantime, Taiwan is alleged to be progressing towards implementations of incorporating Bitcoin (BTC) into the national reserve strategy. The Executive Yuan, as well as the Central Bank of Taiwan, is also considering the possibility of making use of Bitcoin as a strategic asset. Taiwan is also considering the option of implementing a pilot program with the use of confiscated BTC.

Also, the legislature has requested an audit on the Bitcoin reserves in the country, and the final report will be available by year-end. The actions of Taiwan are an indication of the increased interest in the prospects of the diversification of the traditional fiat currencies, as countries of the world start considering the prospect of Bitcoin as a possible reserve asset.

🇹🇼 TAIWAN STARTING ITS OWN BITCOIN NATIONAL RESERVE

Taiwan’s Central Bank and Executive Yuan have launched a formal study on adding Bitcoin to national reserves.

Legislator Dr. Ju-chun Ko says Bitcoin could diversify reserves and reduce reliance on the US dollar, complementing,… https://t.co/Yba7ZGCWlV pic.twitter.com/RecuEznpjh

— CryptosRus (@CryptosR_Us) November 13, 2025

Although these are encouraging developments, the crypto market is still under the pressure of large transactions with a significant turn by whale investor Owen Gunden, transferring 2,401 BTC worth 244 million into Kraken. This action has contributed to the negative mood of the market.

The Fear and Greed Index has fallen to 25, the lowest since March 2025, signifying that investors are very fearful and cautious. As the world economy is uncertain about the future, as well as the market of cryptocurrencies, the way to recover is uncertain.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Why is the crypto market experiencing a downturn?

2. What impact did the US government shutdown have on the crypto market?

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs