Why Arthur Hayes Is Doubling Down on ENA $1M Surge

Highlights

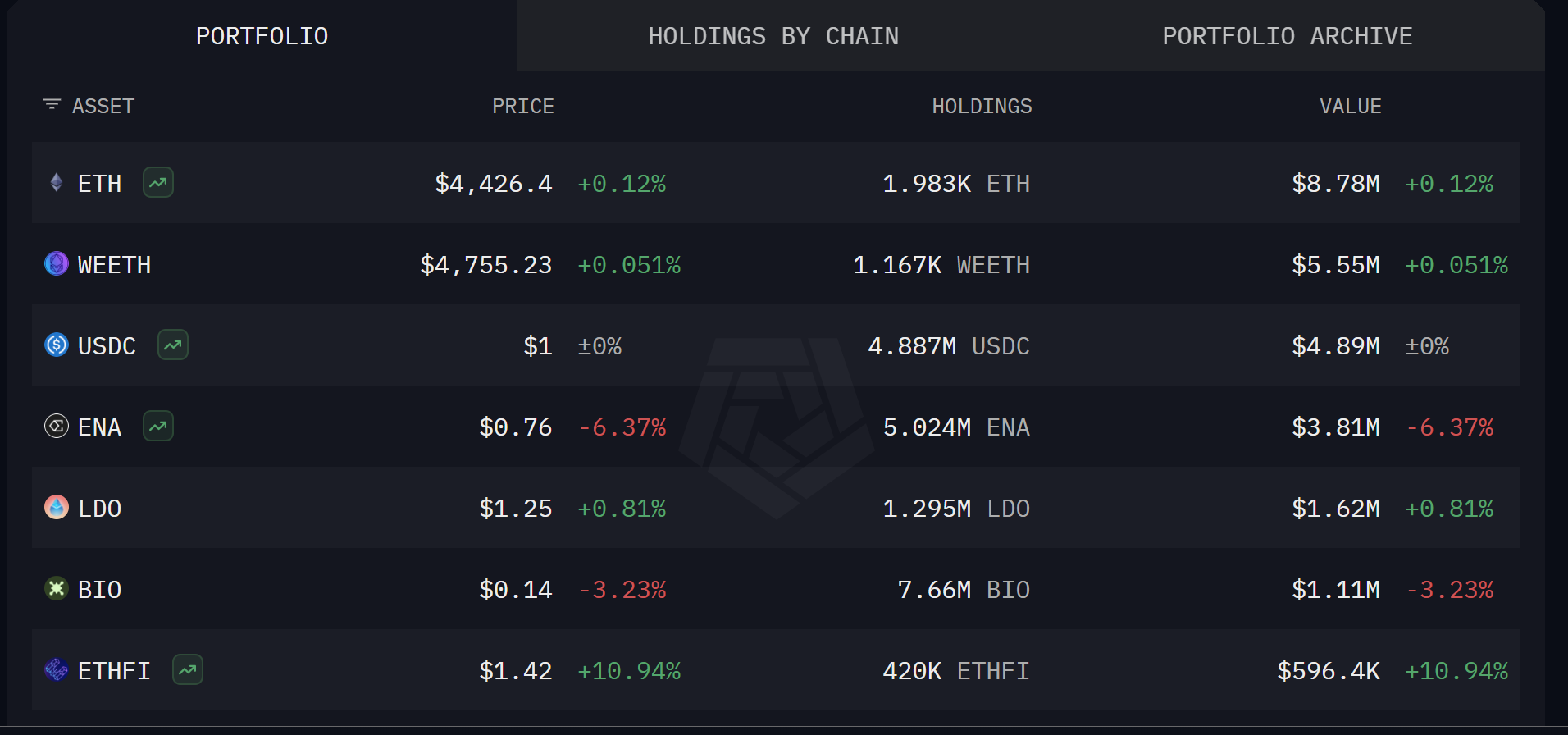

- Arthur Hayes invests nearly $1M in Ethena’s ENA, boosting his holdings past 5 million tokens.

- The buy comes just before Hyperliquid’s September 14 USDH stablecoin vote.

- Ethena’s USDe stablecoin has $13B locked and rising influence in DeFi markets.

Arthur Hayes, co-founder of the BitMEX exchange, is making headlines again. In just 48 hours, he scooped Ethena (ENA), worth nearly $1 million. According to on-chain data from Arkham Intelligence, Hayes bought around 579,000 tokens, worth $473,000 on Binance. He has been stacking ENA for months, despite selling off some during August’s market dip. So, why is Hayes doubling down now?

Arthur Hayes Timing: Hyperliquid’s USDH Vote

Currently, Arthur Hayes holds over 5 million ENA in his wallet, with a value of $3.91 million. The timing points to a very important event. On September 14, Hyperliquid will hold a vote to decide who gets the USDH stablecoin ticker. The prize is one of the most fiercely contested in DeFi. Athena receives backing from industry giants like BlackRock to compete against Paxos and Native Markets, among others.

- Arthur Hayes holds over 5 million ENA in his wallet (Source: Arkham)

In case the winning vote lands on Ethena, it could funnel 95% of USDH revenue to Hyperliquid and cover migration costs. Both platforms would win big.

Ethena’s Growing Role

Athena has grown to become one of the strongest DeFi protocols, having been founded in 2023. Its USDe stablecoin has attracted a Total Value Locked (TVL) of over $13 billion. The platform records a lifetime revenue of about $480 million, generating about $54 million in August alone. The recent Binance listing of USDe is expected to trigger Ethen’s “fee switch”. Hayes has suggested that this mechanism could lead to as much as $500 million in buybacks. This could result in a higher value for ENA, even nearing $1.50.

How is Ethena (ENA) Performing Today?

Ena token has dropped in value by around 7% over the past day, although it experienced weekly gains of 9%, to trade at $0.75 today. The price is down 50% from its all-time high it achieved in 2024. However, the Ethena project could benefit from the 50bps rate cut the Federal Reserve is eyeing, should DeFi experience a new capital flood.

Final Thoughts: What Does Arthur Hayes’ Move Mean for Traders

While Hayes’ moves don’t guarantee price action, they often set the stage in crypto circles. Many traders view him as a thought leader whose investments highlight upcoming trends. ENA has already been volatile, but his buy could add momentum as retail investors and other whales take note.

He may not just be doubling on ENA but positioning himself with size. Adding $1 million more to his portfolio could signal confidence in both the token, and the wider role Ethena may play in the DeFi. Whether this development translates to a rally ahead or just a short-term hype, the market will be paying attention.

Frequently Asked Questions (FAQs)

1. Who is Arthur Hayes?

2. What is ENA?

3. Why is Hyperliquid’s USDH vote important?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- XRP Ledger Validator Spotlights Upcoming Privacy Upgrade as Binance’s CZ Pushes for Crypto Privacy

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?