Trump-Backed WLFI Token Signals Rebound As Team Announces Buyback Plan

Highlights

- WLFI rebounds 3% in 24 hours after hitting an all-time low of $0.17.

- World Liberty Financial launches proposal to use liquidity fees for a buyback and burn program.

- Community have voted 99% so far in favor of the initiative.

The Trump-backed WLFI token is signaling a price rebound as it looks to regain momentum after recent volatility. This comes as World Liberty Financial launched a proposal to use 100% of its treasury liquidity fees for a buyback and burn program.

WLFI Rebounds After Steep Decline

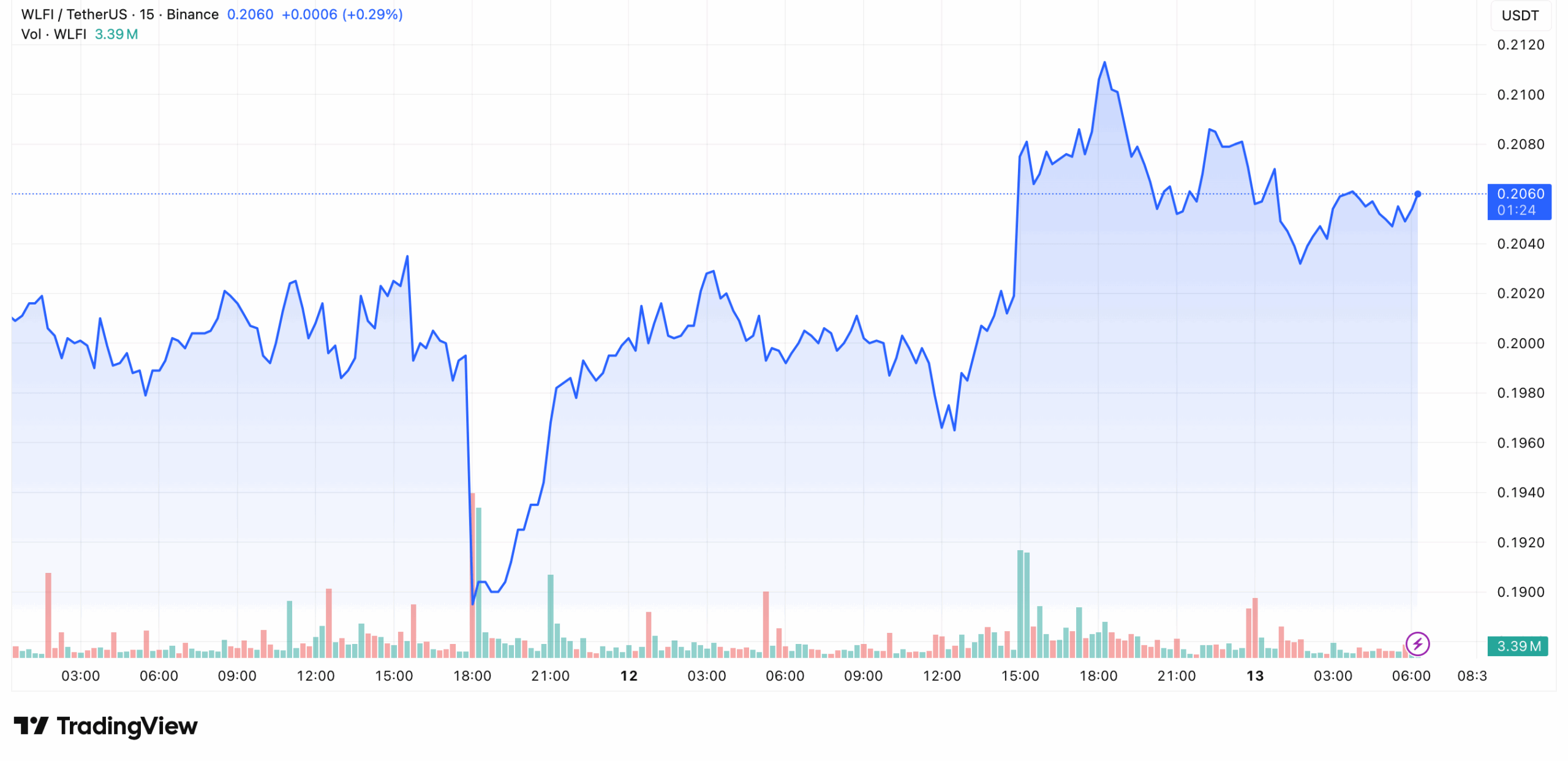

TradingView data shows that the WLFI climbed 3% in the past 24 hours. The coin has bounced back from a 10% monthly drop and a 40% post-launch crash.

This comes after WLFI hit an all-time low of $0.1614. The token is currently trading near $0.2 but remains almost 50% below its early September peak of $0.46.

The price decline was mostly attributed to reports of investors breaking the token’s no-sale policy. For example, the team froze Justin Sun’s wallet after he reportedly sold $9 million worth of tokens. Over $3 billion worth of unlocked and locked holdings were affected by the freeze.

The action provided short-term respite for the token’s market price and stopped immediate selling pressure. Sun responded by pledging to buy tokens valued at $20 million. This sparked more conjecture regarding his continued involvement in the project.

Part of the rebound is also being attributed to token management strategies rolled out by the project’s leadership. Since its launch on September 1, the token has carried the weight of high expectations due to its association with Trump and early hype.

World Liberty Proposes Buyback & Burn Program

The World Liberty Financial team launched a new proposal in a bid to resurrect the token’s stagnant price movements. The initiative involves using fees earned from the project’s liquidity to purchase tokens on the open market and send them to a burn address.

The plan would result in a continuous reduction in supply if fully implemented. In essence, the total number of tokens in circulation would be reduced by each trade that generates fees.

Governance votes also show overwhelming community support for the measure. More than 99% are currently in favor of the proposal. Advocates argue the strategy would bring the token holders long-term growth and strengthen scarcity.

Out of its 24.6 billion WLFI tokens, the project has already burned 47 million of them in its initial burn. All burns will be documented on-chain and communicated to the community.

At its launch, the WLFI token secured listings on Binance, KuCoin, and Bitget. This boosted its liquidity and retail participation. Within days of launch, daily trading volume exceeded $580 million. The majority of investments came from Asia and the Middle East, where projects bearing the Trump name frequently garner a lot of attention.

In other developments within its ecosystem, World Liberty Financial launched its stablecoin, USD1, which went live on the Solana blockchain. This strengthened the token’s bullish narrative.

The suggested buyback-and-burn strategy has given the token a fresh boost as it attempts to reach its prior highs.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Crypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran’s Strait of Hormuz Closure

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

Buy $GGs

Buy $GGs