‘Trump Insider Whale’ Increases Bitcoin Short As U.S. Counters China in New Australia Deal

Highlights

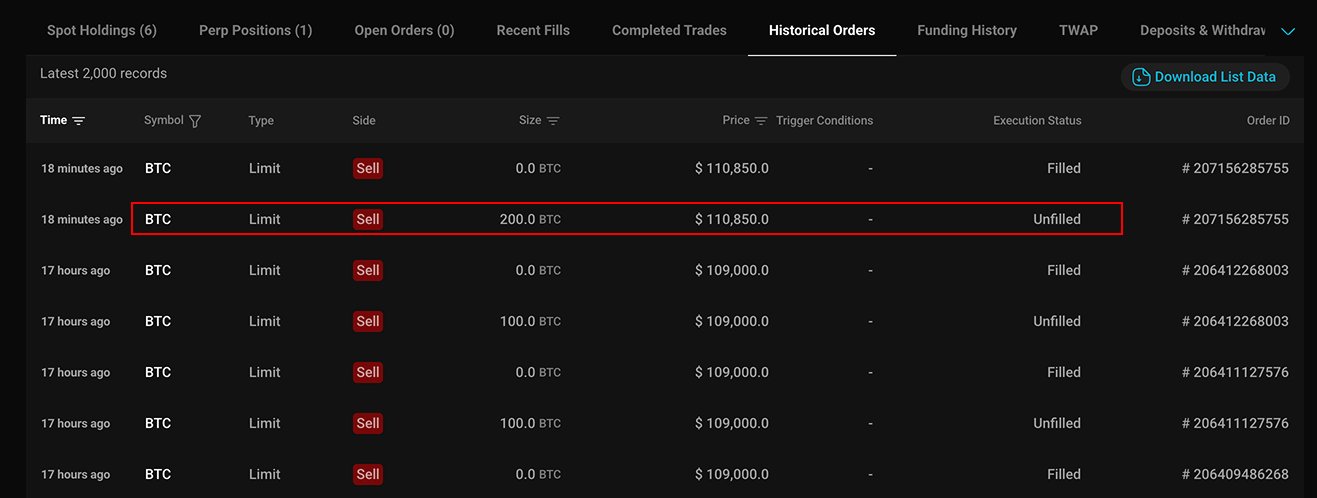

- The “Trump insider whale” has expanded its Bitcoin short position by 200 BTC.

- The move coincides with President Trump’s $2 billion trade agreement with Australia to reduce dependence on China.

- The U.S.-Australia partnership aims to strengthen Western supply chains amid escalating tariff threats.

The “Trump insider whale” has once again increased its bearish bets on BTC. This comes as the U.S. and Australia sign a new agreement to counter China as trade war tension grows.

Trump Insider Whale Deepens BTC Short Ahead of Geopolitical Developments

Data shows that the so-called Trump insider whale has added another 200 BTC (valued at about $22.1 million) to their short position. This brought their total to 900 BTC, worth roughly $99.6 million. The trader’s entry price stands at $109,521, with a liquidation threshold near $141,072 and a floating loss of just over $1.1 million.

The Trump insider whale’s move comes after last week’s $76 million short and a cumulative exposure exceeding 3,400 BTC. The individual, believed to have earned more than $160 million from market moves linked to Trump’s previous tariff declarations, appears to be positioning for another macro-driven downturn.

Interestingly, while the Trump insider whale continues to double down on bearish bets, other major investors appear to be taking the opposite side. Reports suggest that another whale recently opened $255 million in long positions across BTC and Ethereum.

This came shortly after Trump confirmed plans to meet China’s President Xi Jinping at the APEC summit on October 31.

Trump Tightens Economic Front Against China, Signs $2B Deal With Australia

According to Reuters, on Monday, President Trump met with Australian Prime Minister Anthony Albanese at the White House. The leaders signed a critical minerals agreement aimed at reducing reliance on China.

Under the agreement, Australia and the United States will each contribute $1 billion over six months to mining and processing projects. The agreement establishes a minimum price floor for vital minerals needed for semiconductor production, electric vehicles, and defense.

The agreement is viewed as a strategic counterweight to China’s dominance in the global rare earth supply chain. It also follows Trump’s earlier backing of a nuclear submarine partnership with Australia to strengthen Indo-Pacific security.

“In about a year from now, we’ll have so much critical mineral and rare earths that you won’t know what to do with them,” Trump said during the joint press briefing. He also highlighted his administration’s commitment to securing Western supply lines.

The U.S.-China trade standoff has deepened in recent days. China announced new “special charges” on U.S.-built or operated vessels. This exempted its domestic fleets, while Washington retaliated with tariffs on imported timber, furniture, and kitchen goods, many sourced from Chinese manufacturers.

Beijing’s Ministry of Commerce warned it would “fight to the end” if pushed into a full-scale trade war.

Notably, during the bilateral luncheon with Australia’s Prime Minister, Trump cautioned that China could face tariffs of up to 155% if no agreement is reached by November 1. However, he expressed optimism that a deal is likely to be finalized before the deadline.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs