Breaking: U.S. CPI Inflation Rises To 2.9% YoY, Bitcoin Reacts

Highlights

- The U.S. CPI data data came in line with expectations.

- Bitcoin sharply dropped following the CPI data release.

- It has now recovered and reclaimed the $114,000 level.

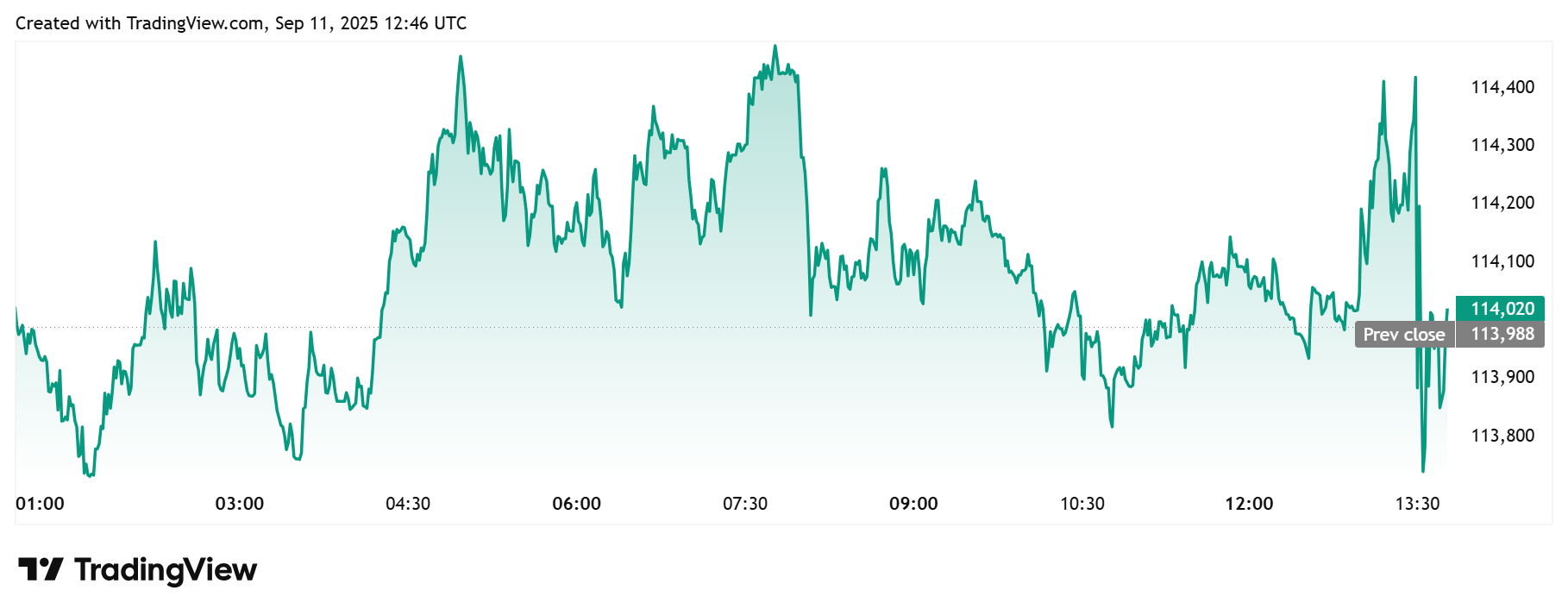

The August U.S. CPI inflation data have come in line with expectations, which further strengthens the case for a rate cut at next week’s FOMC meeting. Bitcoin had sharply dropped on the back of the data release, but is now looking to hold above the $114,000 level.

U.S. CPI Inflation Comes In Line With Expectations, Bitcoin Reacts

Bureau of Labor Statistics data show that the CPI inflation rose to 2.9% year-over-year last month, in line with expectations. The monthly CPI data came in at 0.4%, just above expectations of 0.3%

The Core CPI inflation data were also in line with expectations, rising to 3.1% Y0Y and 0.3% month-on-month. This development suggests that inflation remains steady and supports a case for a rate cut at next week’s FOMC meeting.

The Bitcoin price had sharply dropped on the back of the CPI release, falling below the psychological $114,000 level. However, TradingView data shows that the flagship crypto has now rebounded and is again looking to break above $114,000.

The CPI inflation data is a positive for Bitcoin and other crypto assets, as the Fed is likely to make a rate cut next week. A rate cut is expected to boost risk-on sentiment and inject more liquidity into the market.

Meanwhile, it is worth mentioning that the PPI inflation data, which dropped yesterday, also strengthened the case for a Fed rate cut. The data came in way below expectations, suggesting that the Fed should be more worried about the weakening labor market than inflation.

The initial jobless claims data, which dropped today alongside the CPI inflation data, also confirms that the labor market is indeed weakening. The weekly jobless claims jumped to 263,000, against expectations of 235,000. This represents the highest figure since October 23, 2021.

Market Settles On 25 BPS Rate Cut

With the CPI inflation data coming exactly in line with expectations, market participants have now settled on the Fed making a 25 bps rate cut, with a 50 bps cut looking unlikely. CME FedWatch data shows that there is a 90.9% chance the committee will lower rates by 25 bps, while there is only a 9.1% chance of a 50 bps cut.

Market expert Will Meade noted that the CPI data probably took the 50 bps rate cut off the table, having come in just in line with expectations. However, he added that the job market continues to “deteriorate and fast”, with jobless claims spiking to a 4-year high. Meade remarked that a 25 bps cut is the most likely scenario next week.

Unfortunately the CPI print probably takes the 50 basis point cut off the table but the job market continues to deteriorate and fast, with jobless claims spiking to a 4 year high. 25 bps cut next week is the most likeky scenario.

— Will Meade (@thechartdr) September 11, 2025

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin News: CitiBank to Launch BTC Services in 2026

- Deutsche Bank-Backed AllUnity Launches First MiCA-Compliant Swiss Franc Stablecoin

- Crypto Market on Edge as US-Iran Hold Talks Ahead of Trump’s War Deadline

- XRP Prepares for Phase 4 Lift-Off, $21.5 Level in Focus

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

Buy $GGs

Buy $GGs