Breaking: U.S. PPI Cools To 2.6%, BTC Price Rises

Highlights

- U.S. PPI fell to 2.6 YoY, below the expected 3.3%.

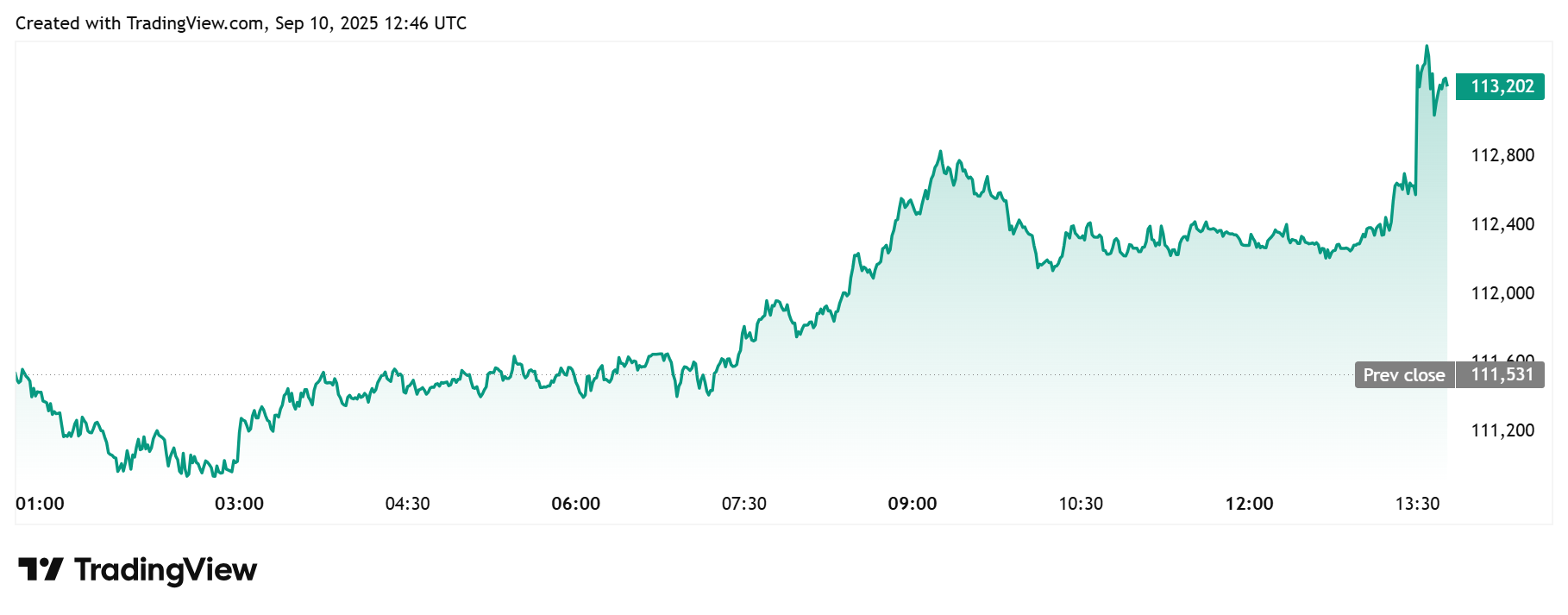

- Bitcoin sharply broke above $113,000 on the back of the data release.

- BTC is up from an intraday low of $110,770.

The U.S. PPI data has come in way lower than expectations, providing a bullish outlook for the BTC price, which sharply surged on the back of the data release. Traders are further pricing in a 50 Bps Fed rate cut, with inflation looking to be cooling in the U.S.

U.S. PPI Falls To 2.6% YoY, BTC Price Spikes

Bureau of Labor Statistics data shows that PPI fell to 2.6% in August, year-on-year (YoY), way below expectations of 3.3% and the previous reading of 3.3%. The monthly data came in at -0.1%, also below expectations of 0.3%.

Meanwhile, the core U.S. PPI came in at 2.8%, below expectations of 3.5% and also the previous reading of 3.7%. The core PPI fell to -0.1, below expectations of 0.3%. This provides relief for market participants, considering the higher-than-expected PPI figures last month.

The BTC price sharply surged on the back of the inflation data release, breaking above the $113,000 psychological level. TradingView data shows that the flagship crypto is currently trading at around $113,200.

Notably, the Bitcoin price had climbed from an intraday low of $110,700 ahead of the PPI data release. The figures provide a bullish outlook for BTC and the broader crypto market as the Fed is further likely to cut rates and could even make a 50 basis points (bps) rate cut, as opposed to a 25 bps cut.

Attention will now turn to the CPI data, which comes out tomorrow and is the last major economic data before the Fed decides on monetary policy next week. At the moment, macroeconomic data points to the labor market weakening while inflation remains steady.

Fed Chair Jerome Powell had already signaled that they might have to lower interest rates, with the downside risk to the labor market rising. The PPI data further confirms that the FOMC should be more focused on its employment mandate than the inflation mandate.

Rate Cut Bets Increase Following Soft Inflation Data

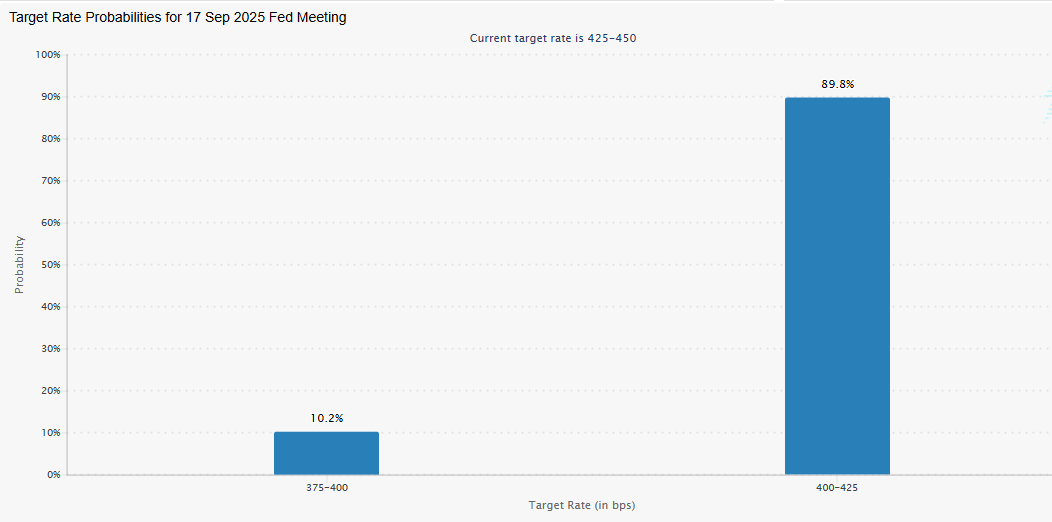

Traders are increasing their bets on a monetary easing cycle ahead. CME FedWatch data shows that the odds of a 50 bps rate cut have again climbed above 10% following the PPI data release.

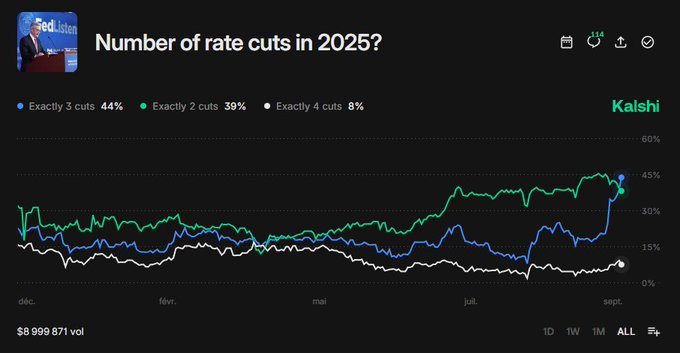

Furthermore, Kalshi data shows that traders are now increasing their bets on three Fed rate cuts this year, as against two. There is currently a 44% chance of three cuts and a 39% chance of two cuts.

Meanwhile, following the PPI data release, U.S. President Donald Trump declared that there is no inflation and demanded that Powell lower rates now. “Too Late (Powell) must lower the RATE, BIG, right now,” he said.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- ZachXBT Names Axiom Exchange in Alleged Employee Crypto Insider Trading Investigation

- Bitcoin Falls as U.S. Jobless Claims Signal Labor Market Rebound

- Bitcoin News: CitiBank to Launch BTC Services in 2026

- Deutsche Bank-Backed AllUnity Launches First MiCA-Compliant Swiss Franc Stablecoin

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs