UNI’s Surprise Launch, Sell-Off Triggers Volatility in Ethereum’s Price

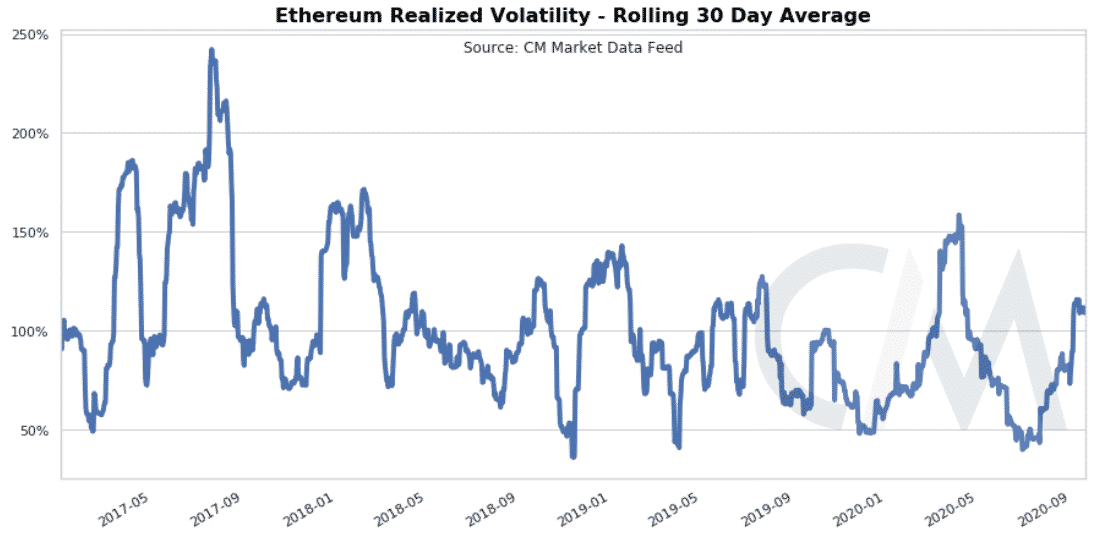

When compared to traditional markets, the cryptocurrency industry is highly volatile, and the price fluctuations are driven by many factors. After weeks of consolidation in the Ethereum market, volatility has made a comeback. This was noted in the latest report of Coin Metrics.

This was primarily driven by the recent sell-off and the surprise launch of Uniswap Protocol’s native governance token-UNI on the Ethereum network.

The report further read,

“This is significant because it follows a period of sustained levels of low volatility not seen since mid-2019. This increase in volatility precedes some significant events, namely the launch of the first phase of ETH 2.0 and, more urgently, the September 25th options expiration.”

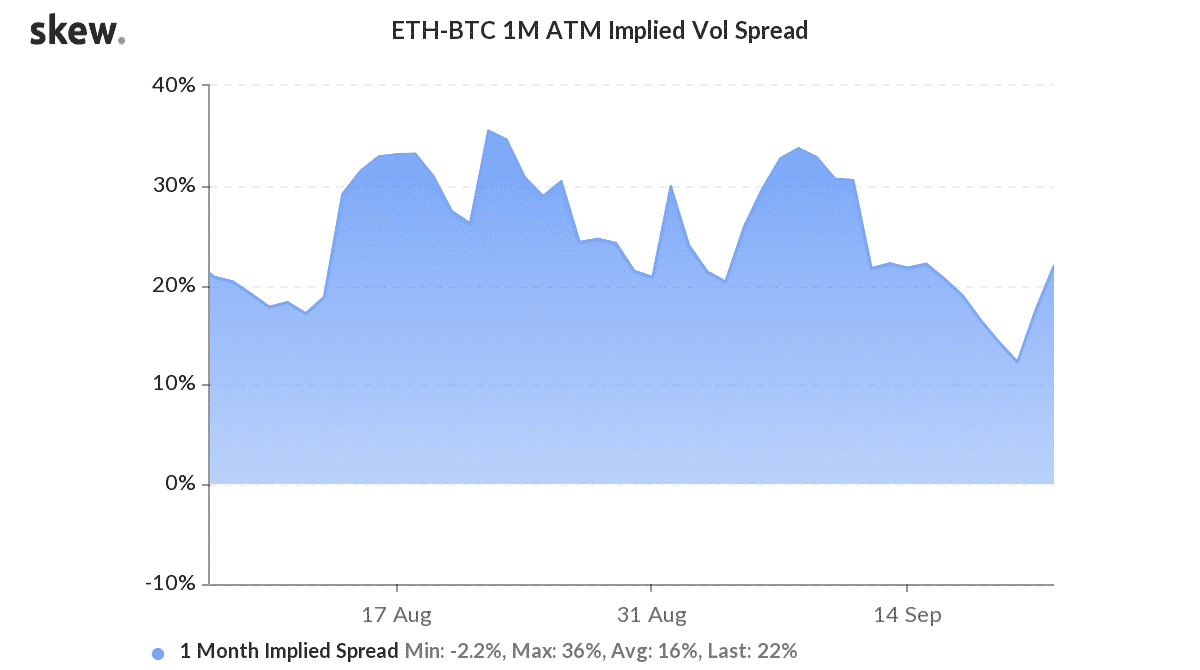

Ether-Bitcoin one-month Implied Volatility notes an uptick

Additionally, the one-month implied spread between Ether and Bitcoin has noted a spike to 22%. The latest uptick in the volatility spread suggests investors are pricing bigger percentage moves in the second-largest cryptocurrency than Bitcoin over the next one month as market participants continued to focus on the growing defi sector and careful of a potential big move in ETH. Notably, over the past couple of months, Ethereum has noted greater price volatility than Bitcoin and is known for leading altcoin rallies.

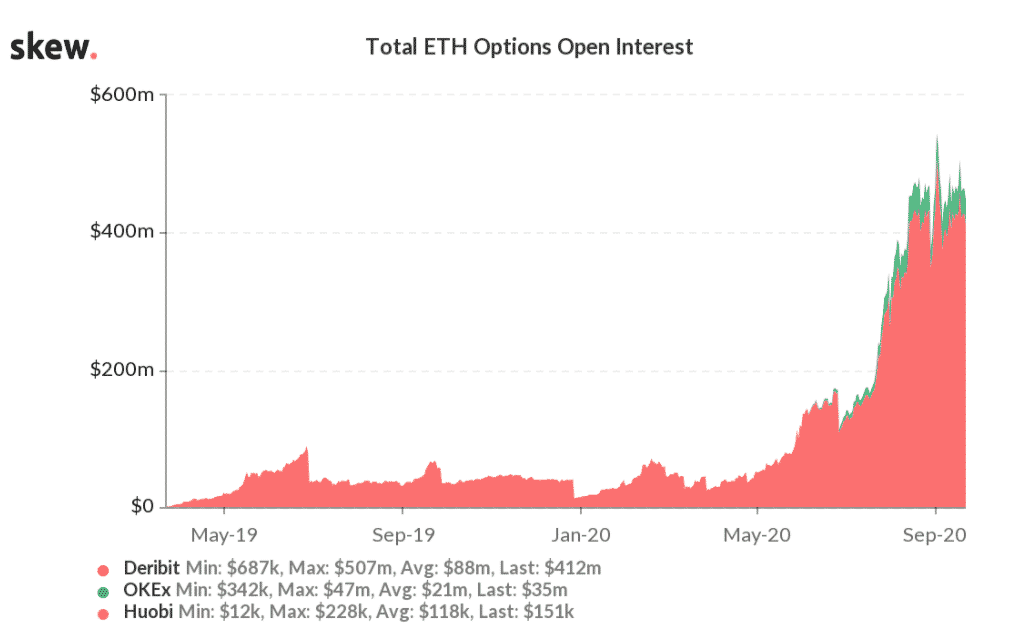

While the rise in implied volatility does not give the idea of the direction of a price breakout, what it does, however, is it shows the market’s opinion of the underlying asset’s potential moves in the near future. Having said that, volatility has a positive impact on options price as higher the volatility or uncertainty translates to the stronger hedging demand for both call and put options.

- Breaking: Bitcoin Bounces as U.S. House Passes Bill To End Government Shutdown

- Why Is The BTC Price Down Today?

- XRP’s DeFi Utility Expands as Flare Introduces Modular Lending for XRP

- Why Michael Saylor Still Says Buy Bitcoin and Hold?

- Crypto ETF News: BNB Gets Institutional Boost as Binance Coin Replaces Cardano In Grayscale’s GDLC Fund

- Ondo Price Prediction as MetaMask Integrates 200+ Tokenized U.S. Stocks

- XRP Price Risks Slide to $1 Amid Slumping XRPL Metrics and Burn Rate

- Gold and Silver Prices Turn Parabolic in One Day: Will Bitcoin Mirror the Move?

- Cardano Price Prediction as the Planned CME’s ADA Futures Launch Nears

- HYPE Price Outlook After Hyperliquid’s HIP-4 Rollout Sparks Prediction-Style Trading Boom

- Top 3 Meme coin Price Prediction: Dogecoin, Shiba Inu And MemeCore Ahead of Market Recovery