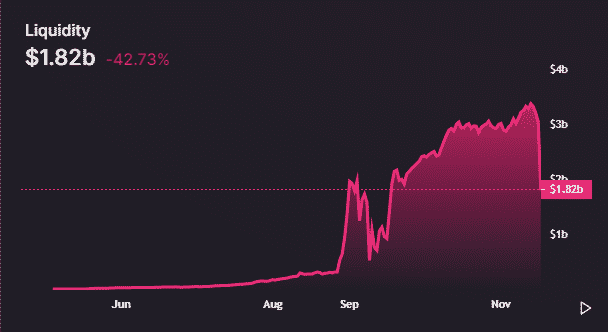

Uniswap Liquidity Plunges by 45% After UNI Liquidity Rewards Program Ends

Uniswap, the number one DEX platform saw a massive dip in its on-chain liquidity as the popular UNI liquidity mining rewards program came to an end on September 17. The liquidity movement out of the exchange was expected as the rewards for the liquidity providers would dry up. The plunge in liquidity comes just days after Uniswap posted an all-time-high record of $3.07 billion in total value locked on-chain, the current volume at the time of writing was $1.82 billion.

Uniswap’s loss turned out to be a big win for SushiSwap as majority of the liquidity that moved out of Uniswap went to SushiSwap. The TVL almost doubled for the DEX from $260 million to $500 million in a week’s time.

Many analysts had predicted that liquidity on Uniswap would dry up post the conclusion of UNI reward program as the liquidity providers would move to other yield farms to earn profits.

Uniswap Community Proproses New Governance Process to Reinstate UNI Rewards

UNI token holders have proposed a new governance model to reinstate UNI reward program for the liquidity providers. Cooper Turley, Statergy Lead at Audius proposed to cut the UNI rewards by half from the recently concluded mining reward program. If this proposal is accepted by the community, liquidity providers for WTBC/ETH, USDC/ETH, USDT/ETH, and DAI/ETH pools would be granted 1.25 million UNI per month for two months time.

In order for this proposal to come to force it would require to go through a number of governance polls which would begin with the snapshot poll. The proposal must get 25,000 votes within three days to move onto the secondary polls in the form of consensus check, this would require 50,000 votes over 5 days period. If the proposal passes the secondary governance poll it would become a governance proposal which must attract 40 million votes to get implemented.

The plunge in liquidity also had negative impact on UNI token’s price which plumbed by over 7% on the day.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple’s Valuation Tops $50B As Firm Begins $750M Share Buyback

- FDIC Proposes No Insurance for Stablecoins Under GENIUS Act Amid Banks’ ‘Deposit Flight’ Fears

- Ripple Joins Mastercard Crypto Partner Program to Advance On-Chain Payments

- Breaking: Crypto Prices Jump As IEA Members Agree To Release Record 400M Barrels Of Oil

- Breaking: U.S. CPI Holds Steady at 2.4% as Iran War Raises Inflation Concerns

- Bitcoin Price At Risk of Losing $65k as Iran Warns of “Continuous Strikes” That May Push Oil to $200

- XRP Price Prediction as Goldman Sachs Becomes Biggest Holder of Ripple ETFs

- Circle (CRCL) Stock Price Prediction Ahead of CPI Data Release-Is 120 Next?

- Bitcoin Price Today: President Trump Signals Iran Conflict May End Soon As BTC Eyes $72k

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?