Uniswap, Polkadot price Analysis: August 5, 2021

- Altcoin’s led by Uniswap, Polkadot, and Solana, break away from Bitcoin to post remarkable double-digit gains.

- Ethereum prepares for the London hard fork that could trigger an altcoins’ rally.

Crypto assets across the board are flexing their muscles following the correction from last week’s highs and the sluggish price action toward mid-week. Bitcoin retested support at $38,000 before regaining the momentum to lift to $40,000.

Ethereum is up 8.9%, several hours ahead of the much-awaited London hard fork. The upgrade is expected to lower gas fees for users transacting on the blockchain. In addition to that, smart contracts will benefit from the upgrade, especially with lower deployment costs.

Uniswap:-

According to live price data by CoinGecko, Uniswap is trading 11% higher over the last 24 hours. The decentralized finance (DeFi) token has attracted a $578 million trading volume across exchanges and boasts $12 billion as market capitalization.

The 12-hour chart shows UNI trading at $23 while bulls battle a short-term hurdle at $24. The price action has been impressive and consistent since the selloff in July, where Uniswap traded at $14.

Most technical indicators favor the uptrend after flipping bullish in July. The Moving Average Convergence Divergence (MACD) indicator shows that buyers have the upper hand. As long as the buy signal holds, UNI’s path with the slightest resistance would be upward toward $30.

Perhaps a break above $24 will trigger more buy orders as investors speculate the ultimate rally above $24. However, the RSI in the oversold areas, hinting at a possible correction before the uptrend resumes. Therefore, there is the need to proceed with caution.

UNI/USD 12-hour chart

Polkadot:

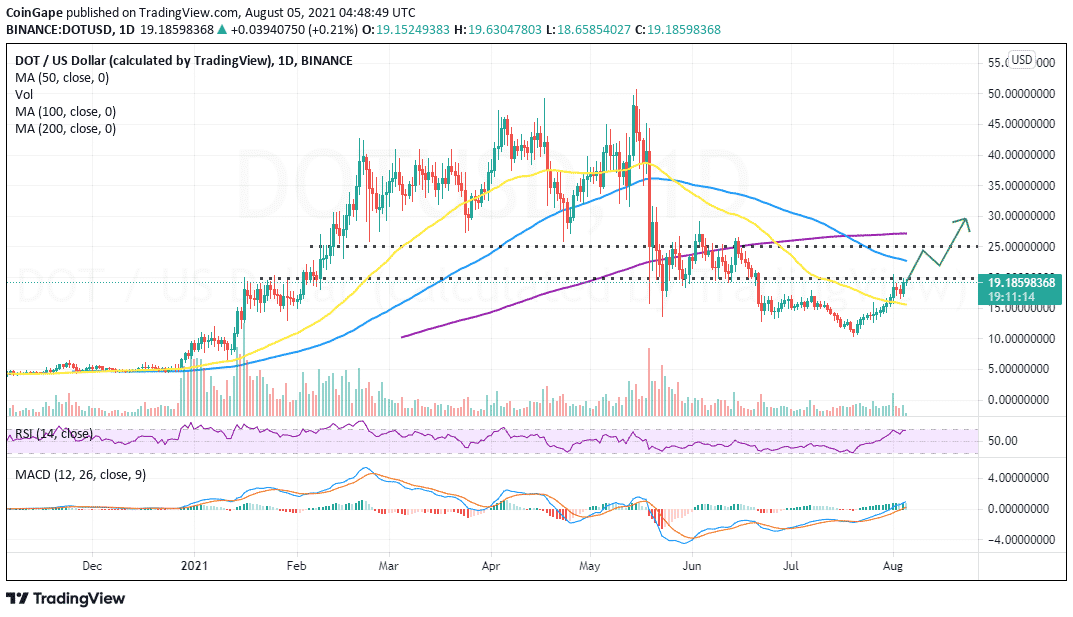

Polkadot bulls seem to have changed the narrative, launching another successful meeting to $20. Earlier in the week, the smart contract token corrected to $16.5, where support at the 50-day Simple Moving Average (SMA) brought back market stability.

As altcoins rallied on Thursday during the Asian session, Polkadot was not left behind. A recovery occurred, pulling the price to $20.

At the time of writing, DOT is trading at $19.2 while bulls throw heavy jabs at the $20 barrier. Trading past this hurdle would stir more bullish action as investors shift the target to $25 and later to $30.

DOT/USD daily chart

The MACD has sustained a bullish outlook since June, apart from some minor setbacks. With the trend momentum indicator above the mean line, the uptrend could remain intact longer. Therefore, buyers must concentrate on lifting above $20 to ensure that correction to the 50-day SMA is averted.

- 21Shares Spot DOGE ETF Secures DTCC Listing as Expert Predicts Dogecoin Rally

- Just-In: WisdomTree Registers Top 20 Crypto Index Fund with XRP, Solana, Cardano

- Ripple Eyes Tokenization and Stablecoins in XRP Ledger Institutional DeFi Roadmap

- UK and US Announce Joint Task force to Boost Collaboration on Crypto Regulation

- Deutsche Bank Predicts Central Banks Could Adopt Bitcoin Alongside Gold by 2030

- Solana Price Prediction: $836M Whale Transfer Spark Fear of $200 Retest Before 62% Rebound

- Bitcoin Price Prediction: $150K in Q4 as Gold’s ATH Momentum Sets the Tone

- PUMP Price Forecast: Whale Buys 1B Tokens as Bullish Pennant Signals 65% Breakout

- Bitcoin Price Prediction: Analyst Highlights Breakout Patterns as Coinbase CEO Backs Crypto Structure Bill

- Dogecoin Price Prediction: Grayscale ETF Move Aligns With Cycle Breakout

- Chainlink Price Prediction: Whales Scoop 2M LINK as Analysts Eye 184% Breakout Rally