Did Uniswap Rush UNI Token Launch In Response To Sushiswap?

Uniswap has been creating a lot of buzz in the decentralized finance [DeFi] space. The popular lending protocol has recaptured the imagination of traders with its native token UNI which was recently launched on the Ethereum mainnet.

Since it went live on the second-largest blockchain network, UNI’s prices climbed a high of $5.81 before retracing its steps back down to the current price level of $5.16 after putting on an impressive rally of over 50% in the last 24-hours. Additionally, UNI was the third largest among other DeFi tokens on the CoinMarketCap leaderboard, at the time of writing.

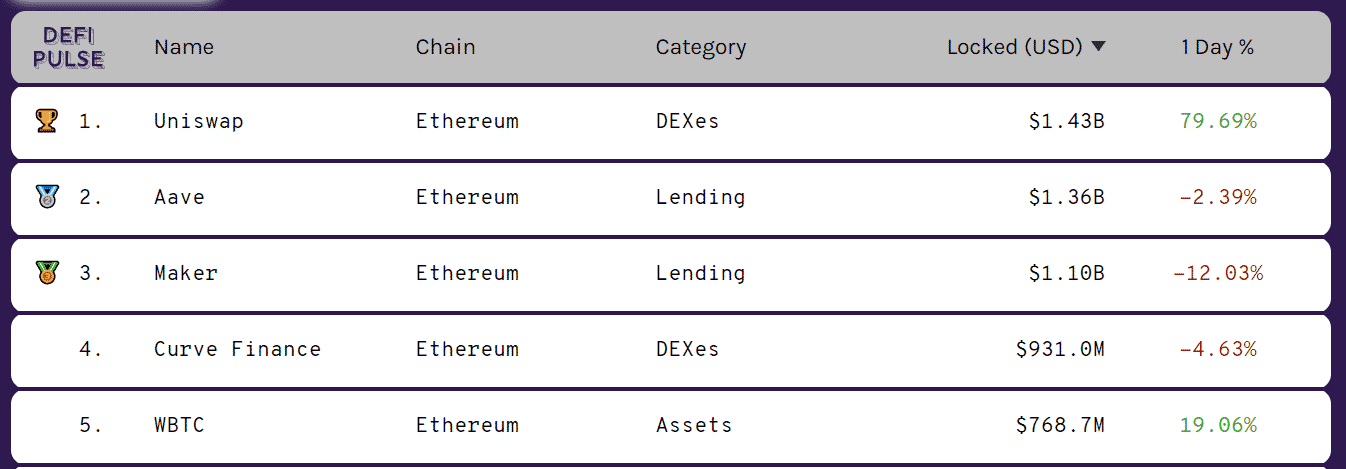

In terms of the total value locked in USD, the protocol dominated the first position as it jumped all the way to $1.40 billion. In addition to that, with respect to Ether and Bitcoin locked in, Uniswap was ranked at second and fifth position with 1.861 million ETH and 12.874K BTC respectively. Besides, DAI locked in Uniswap also surged to a fresh all-time high of 110.266 million.

The listing of the UNI token on high-profile cryptocurrency exchanges such as Coinbase Pro and Binance further catapulted the protocol’s popularity. But was this “unexpected” move, a response to the forked SushiSwap controversy?

Andre Cronje, who happens to be a longtime developer and the Founder of another important DeFi protocol called Yearn. Finance echoed a similar sentiment on Twitter. Cronje tweeted,

“Kinda meh about the UNI launch. The launch itself is perfect, surprise launch, and retrospective. Exactly how it should be done nowadays. But I can’t help but feel that the launch was simply in response to SUSHI. Never let other people set the pace for you, move at your own pace”

He further went on to point out,

“Traditionally, I have found the Uniswap team to have a much longer play. They just recently closed their funding. I wasn’t expecting a token until after the v3 launch. Why hype up v3 but launch a token with v2? My data showed UNI would come with/after v3.”

In a similar tone, Mark Jeffrey, co-founder, and CEO of Guardian Circle weighed in and stated that Uniswap “had no option but to react” and that a response to Sushi was required.

Several market commentators also speculated the unexpected launch could essentially be an outcome of the surmounting pressure on the protocol by its investors due to the popularity of its vampire protocol- Sushiswap, which, although was a fork of Uniswap, it did proffer a better trading fee distribution model.

- Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown

- Trump Tariffs: U.S. And India Reach Trade Deal, Crypto Market Recovers

- Is Kevin Warsh’s Fed Chair Nomination Bullish or Bearish for Bitcoin?

- U.S. ISM PMI Hits 4-Year High Above 52%, BTC Price Climbs

- Hyperliquid Unveils ‘HIP-4’ for Prediction Markets, HYPE Price Surges

- Top 3 Meme coin Price Prediction: Dogecoin, Shiba Inu And MemeCore Ahead of Market Recovery

- Here’s Why Pi Network Price Just Hit an All-Time Low

- Crypto Events to Watch This Week: Will the Market Recover or Crash More?

- XRP and BTC Price Prediction if Michael Saylor Dumps Bitcoin Following Crypto Market Crash

- Here’s Why MSTR Stock Price Could Explode in February 2026

- Bitcoin and XRP Price Prediction After U.S. Government Shuts Down