UniSwap Price Analysis: UNI Rallies Towards $4.5 After Launching New DeFi Token

- UniSwap Protocol launches a new governance token, receiving immense support in DeFi.

- UnitSwap price eyes symmetrical triangle breakout to $4.50.

UniSwap is on an upward roll following the fiasco with its forked asset SushiSwap. Since its listing on Binance, UNI has traded a high of $4.46. However, the saga with vampire token, SushiSwap saw UniSwap lose bearing, resulting in a breakdown to $2.40.

Recovery spears to have resumed as calm returned into the SushiSwap ecosystem. At the time of writing, UNI is trading at $3.74 amid a growing bullish momentum. The bullish scenario is supported by the Relative Strength Index (RSI) after climbing above the midline. If the RSI continues with the positive gradient towards the overbought region, there is a chance that UNI will clock $4.50 soon.

Meanwhile, the above bullish trend is attributed to the news that UniSwap has launched its own governance token, perhaps to reduce pressure from the fallout with SushiSwap. The new token will be utilized in powering on-chain governance decisions. It is also meant to give users the power to contribute to running the protocol. Already the new governance token has become the most widely distribute token in DeFi.

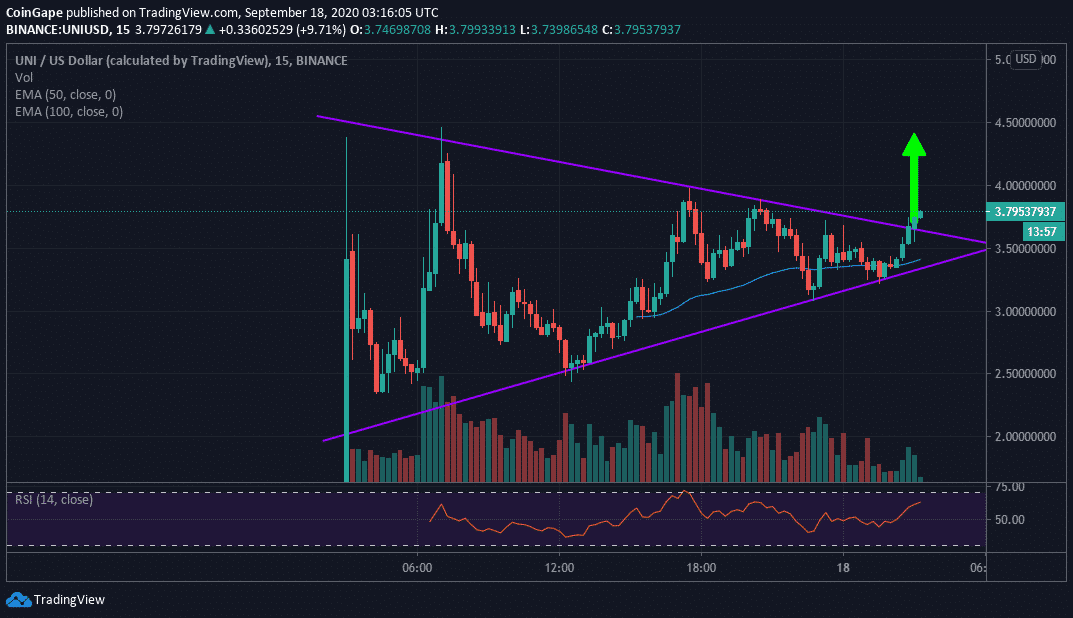

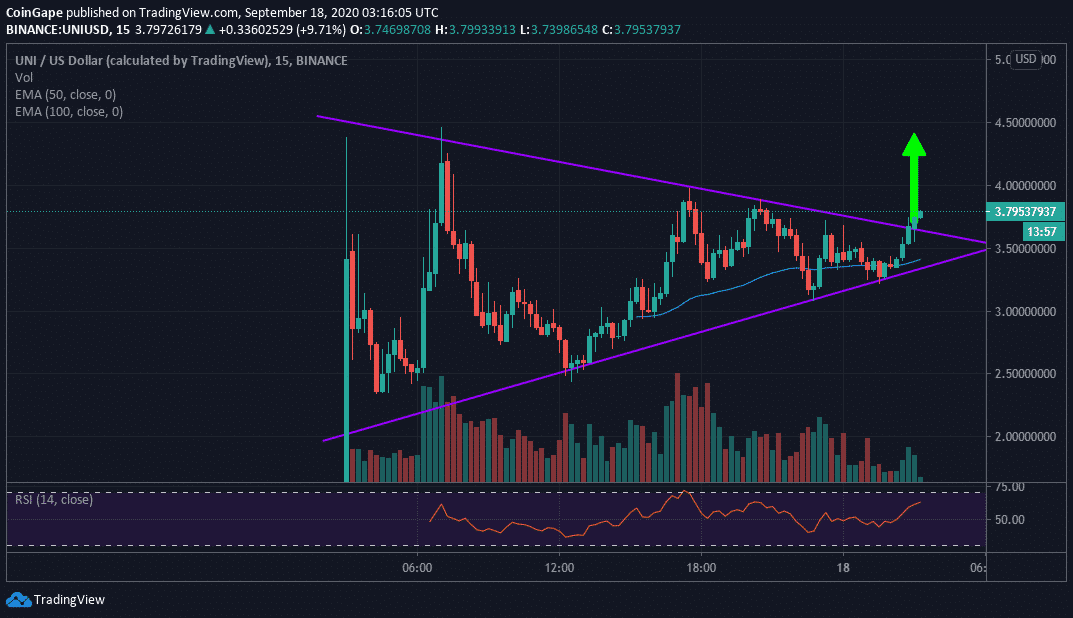

UNI/USD 15-minutes chart

Short term analysis illustrates the formation of a symmetrical triangle pattern. A breakout above this pattern could easily send UniSwap to highs above $4.50. Some resistance is, however, envisioned at $4 but due to the high volume and positive sentiments from the community, UniSwap will have the potential to continue with the breakout.

Also Read: Uniswap Announces 4 Liquidity Mining Pools For UNI Token, Starting 18th Sept.

Intraday Levels

Spot rate: $3.74

Trend: Bullish

Volatility: High

Relative change: 0.30

Percentage change: 8.48%

- Breaking: Bitcoin Bounces as U.S. House Passes Bill To End Government Shutdown

- Why Is The BTC Price Down Today?

- XRP’s DeFi Utility Expands as Flare Introduces Modular Lending for XRP

- Why Michael Saylor Still Says Buy Bitcoin and Hold?

- Crypto ETF News: BNB Gets Institutional Boost as Binance Coin Replaces Cardano In Grayscale’s GDLC Fund

- Ondo Price Prediction as MetaMask Integrates 200+ Tokenized U.S. Stocks

- XRP Price Risks Slide to $1 Amid Slumping XRPL Metrics and Burn Rate

- Gold and Silver Prices Turn Parabolic in One Day: Will Bitcoin Mirror the Move?

- Cardano Price Prediction as the Planned CME’s ADA Futures Launch Nears

- HYPE Price Outlook After Hyperliquid’s HIP-4 Rollout Sparks Prediction-Style Trading Boom

- Top 3 Meme coin Price Prediction: Dogecoin, Shiba Inu And MemeCore Ahead of Market Recovery