Will Uniswap [UNI] Survive The Ongoing Token Outflow?

The surprise launch of Uniswap’s UNI governance token created a lot of buzz in the DeFi world. Days after climbing to an all-time high of $7.07, UNI shed more than 46% of its gains in just two days when it dropped to $3.79. Despite the dip, UNI bounced back, and at the time of writing, the token was priced at $4.97.

However, according to a recent development, most users who claimed UNI either sold or transferred all of their stakes shortly thereafter. This was revealed by the crypto-analytic firm, IntoTheBlock that tweeted,

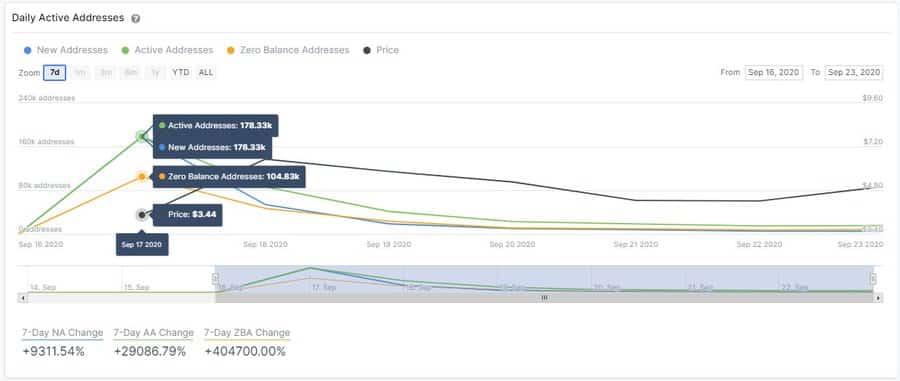

“The day the UniswapProtocol’s token $UNI was released, there were 178.330 active addresses. By analyzing the number of zero balance addresses, we can confirm that most UNI claimers either sold or transferred all of their stake immediately.”

Outflow in tandem with Price Surge

The number of active addresses reached an all-time high of 178.33K on the 17th of September, a day after its launch on Ethereum mainnet. On the same day, the number of ‘Zero balance addresses’ climbed to 104.83K. But as the price of the token increased and reached ATH, the number for active addresses saw a massive outflow of funds.

Notably, this continued even after UNI suffered a drop following the market downturn in which pulled down several DeFi tokens to lose significant value.

Currently, the token’s price appeared to be headed for a recovery route, but the same cannot be said for the figures for daily active addresses.

Despite this, many investors were bullish on Uniswap’s capabilities. Arthur Cheong, the Founder of Defiance Capital recently tweeted in favor of the protocol,

“I used to be skeptical of Uniswap’s model due to its capital inefficiency and inability to reject toxic taker flows but turn out there’s a lot more nuanced than that when it comes to scaling MM and liquidity.”

He added,

“One year ago, no professional market-maker/trader thinks the Uniswap model will work in the long-term and will be able to challenge centralized exchange in volume. Just goes to show that extrapolating tradfi knowledge to DeFi doesn’t guarantee you to be a know-it-all.”

UniSwap [UNI] Ownership Stats

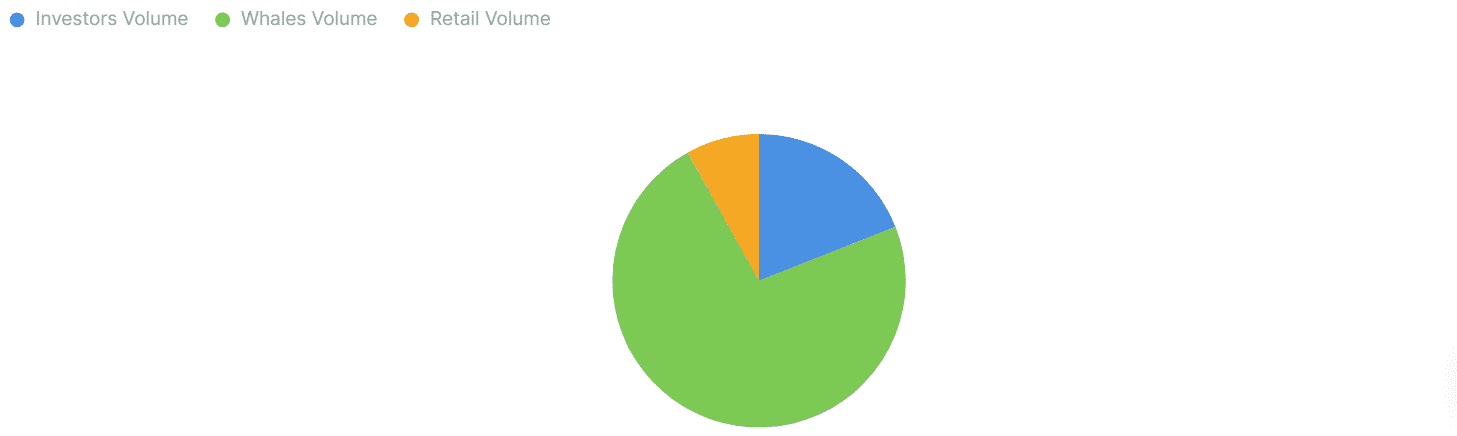

According to ITB, there are currently 14 whales that own more than 1% of the total circulating supply, out of which three addresses were highly active. The number of investors, who own 0.1%-1% of the total tokens in circulation, stood at 36. Retail volume, on the other hand, amounted to just 8.07% of the total ownership concentration.

- Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown

- Trump Tariffs: U.S. And India Reach Trade Deal, Crypto Market Recovers

- Is Kevin Warsh’s Fed Chair Nomination Bullish or Bearish for Bitcoin?

- U.S. ISM PMI Hits 4-Year High Above 52%, BTC Price Climbs

- Hyperliquid Unveils ‘HIP-4’ for Prediction Markets, HYPE Price Surges

- Top 3 Meme coin Price Prediction: Dogecoin, Shiba Inu And MemeCore Ahead of Market Recovery

- Here’s Why Pi Network Price Just Hit an All-Time Low

- Crypto Events to Watch This Week: Will the Market Recover or Crash More?

- XRP and BTC Price Prediction if Michael Saylor Dumps Bitcoin Following Crypto Market Crash

- Here’s Why MSTR Stock Price Could Explode in February 2026

- Bitcoin and XRP Price Prediction After U.S. Government Shuts Down