Unlock $16T RWA Market: BitFrac Makes Bitcoin Mining Accessible Now

Highlights

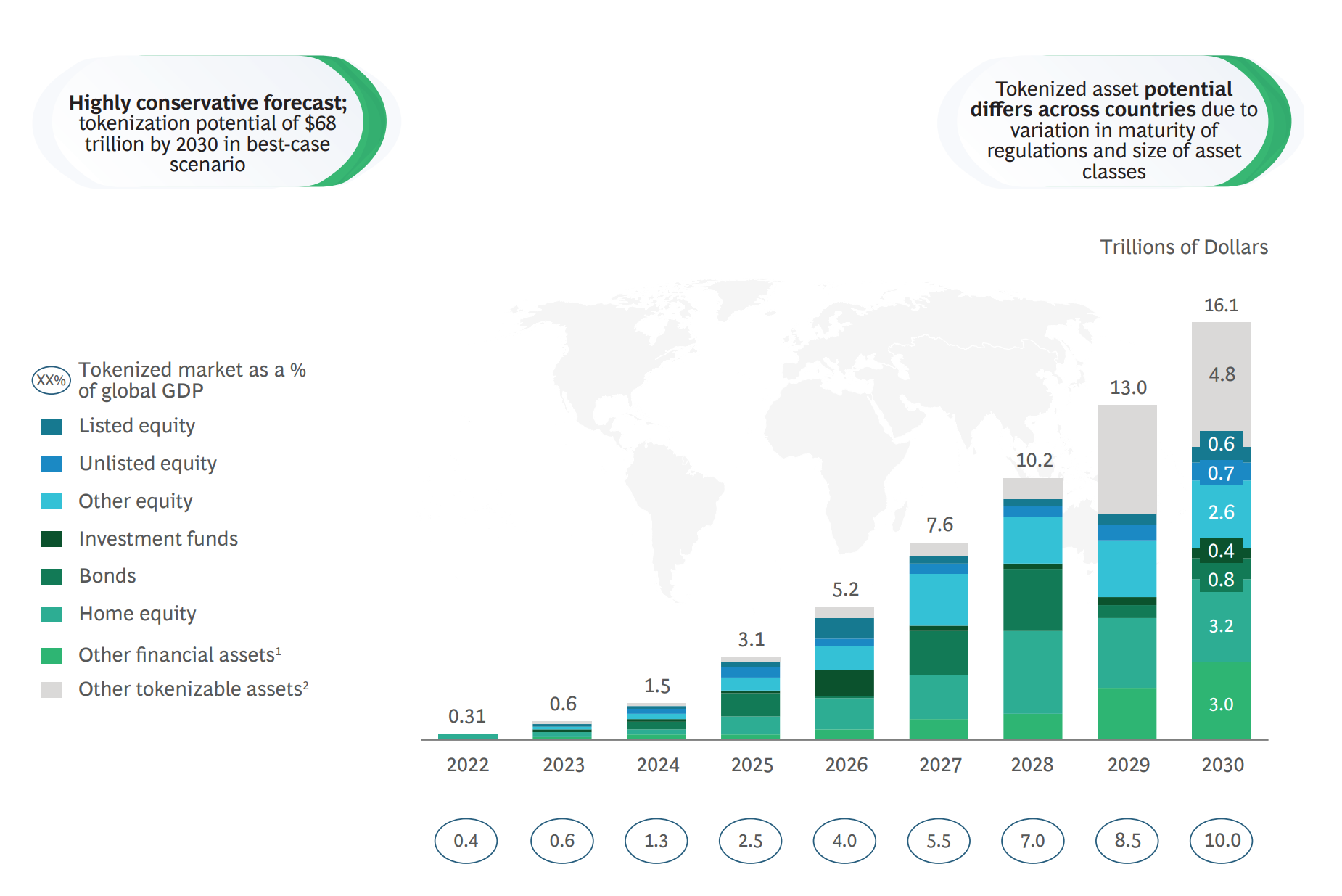

- Real-world asset tokenization is projected to exceed $16 trillion by 2030, revolutionizing traditional investing.

- BitFrac provides fractional mining access, letting anyone own a share of real Bitcoin mining hardware with as little as $100.

- The project opens crypto mining to everyday investors, merging real assets with blockchain transparency.

Real-world asset (RWA) tokenization is fast becoming one of the biggest stories in blockchain. Industry analysts now foresee the market exceeding $16 trillion by 2030, and possibly even more in the years that follow. Yet, one area of this movement, Bitcoin mining infrastructure, hasn’t received nearly as much attention. That’s where BitFrac steps in.

BitFrac is taking a fresh approach by combining RWA tokenization with Bitcoin mining, giving everyday people a way to own a piece of real mining equipment. In other words, it’s opening the door to a trillion-dollar industry that used to be reserved for industrial players.

The $16 Trillion Tokenization Wave

The concept behind tokenization isn’t complicated, but transforming. By turning tangible assets like property, gold, or even Bitcoin miners into blockchain tokens, investors can buy, sell, or hold pieces of high-value assets without having to commit millions of dollars upfront.

A Boston Consulting Group report projects that tokenized assets could be worth around $16 trillion by 2030. Standard Chartered goes even further, suggesting that the number could climb to $30 trillion by 2034. The reason? Investors are hungry for easier access, transparency, and liquidity.

And right in the middle of this movement is BitFrac, which is applying these principles to mining, one of crypto’s oldest and most profitable sectors.

Fractional Mining Ownership, the BitFrac Way

So, how does BitFrac actually work?

Instead of buying and maintaining an entire mining rig, which can cost thousands of dollars, investors can buy BitFrac Tokens ($BFT). Each token represents a fractional share of real, operational mining hardware.

Here’s the idea in simple terms:

You can start small, even a $100 stake in $BFT is enough to get involved. Each token links directly to real Bitcoin mining hardware that BitFrac manages in its own facilities. It’s not a theoretical asset or promise on a roadmap; these are physical machines actively running and earning returns.

You can avoid the hustle of paying energy bills and maintaining rigs by letting BitFrac carry the whole load. All you have to do to earn passive income is to hold your BFT tokens and expect monthly Bitcoin rewards from mining output. Additionally, you will earn USD income from hosting services.

The company’s whitepaper asserts that the project is estimated to reach annual returns of about 45% APY. Payouts are expected to begin in November 2025.

BTF token could be traded freely after the presale closes and the token is listed on Uniswap, with the expectation of securing a place in other major crypto exchanges.

BitFrac assures investors of the safety of their funds by employing Chainlink oracles and storing reserves in multi-signature wallets.

The RWA project is currently in the second stage of its presale, having raised nearly $4 million, with over 2,000 investors already participating.

BitFrac Making Mining More Inclusive

Beyond profits and projections, BitFrac’s mission is about access. It’s taking an industry that was once closed off to ordinary investors and making it attainable to anyone, anywhere.

In regions where access to traditional investments is still out of reach, tokenized mining could be a real opportunity to build digital wealth. That aligns closely with Bitcoin’s original vision, a borderless financial system that creates equal opportunity for all.

Final Thoughts

We’re now watching RWA tokenization connect the dots between traditional finance and the decentralized world. Even the biggest names in banking, such as BlackRock and JPMorgan, are already testing tokenized bonds and investment funds. It’s still early days, but the trend is clearly picking up momentum.

BitFrac’s contribution is unique, bringing real, income-generating assets like Bitcoin mining equipment onto the blockchain.

If even a fraction of that $16 trillion projection materializes, early participants in projects like BitFrac could be part of one of the biggest financial transformations of this decade. This is where real assets meet the transparency and freedom of blockchain.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs