US CPI Analysis By Wall Street and Options Data Signal Crypto Market Recovery

Highlights

- Wall Street giants including JPMorgan hinted at cooling CPI inflation data, similar as economists' forecasts.

- Headline CPI came in at 3.3%, slowing from 3.4% estimates.

- Analysts predict rise in Bitcoin price post CPI and FOMC.

- BTC futures and options data indicate early signs of buying for a crypto market recovery.

Crypto traders get clear cues from the latest US Consumer Price Index (CPI) and core CPI data, Bitcoin price jumped over $69,000 to move towards hitting a new all-time high. The U.S. Bureau of Labor Statistics released CPI inflation data for May hours before the US Federal Reserve’s interest rate decision on Wednesday, June 12. The data is crucial after a higher-than-expected US jobs data last week that scaled back bets on Fed rate cuts.

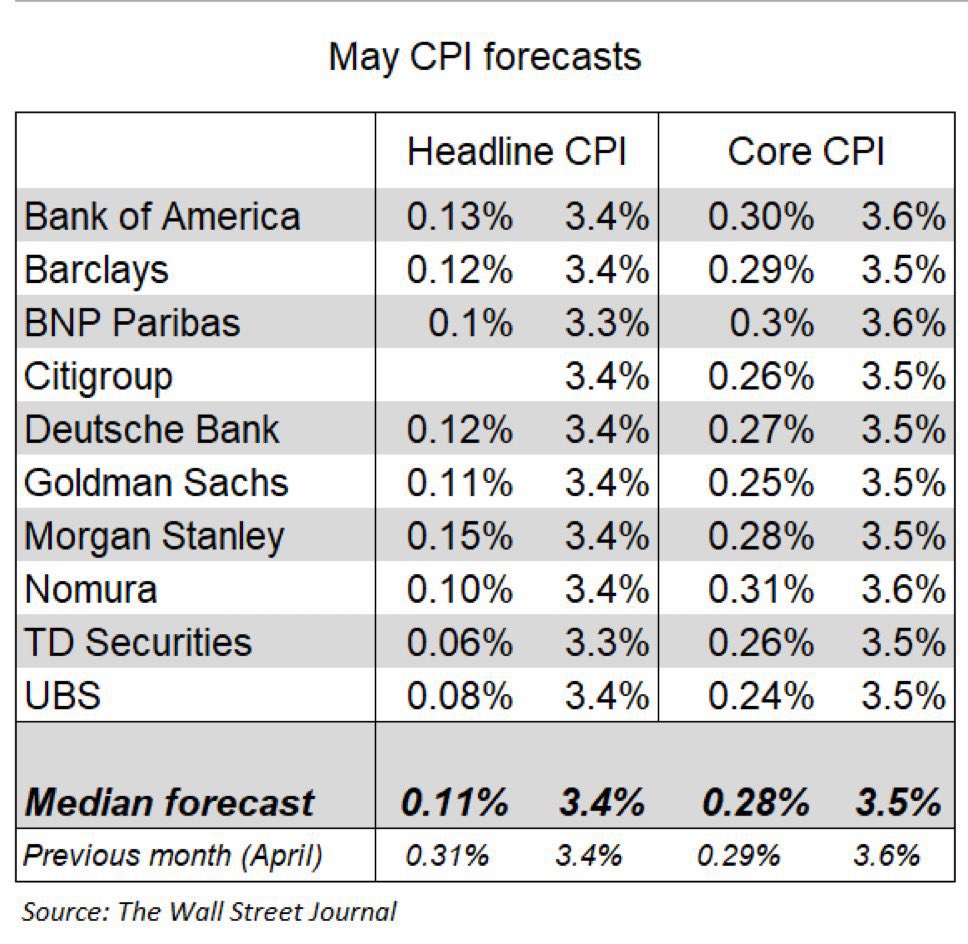

Wall Street giants including JPMorgan, Bank of America, Goldman Sachs, Morgan Stanley, Citigroup, UBS, Nomura, RBC, and Barclays estimated CPI to come in line at 3.4%. Meanwhile, BNP Paribas, TD Bank, and Wells Fargo forecast CPI inflation cooling to 3.3%.

The annual CPI inflation cools to 3.3%, lower than 3.4% estimate and last month. The monthly rate seen slowing to 0.0% from 0.3% last month. Also, the annual Core CPI cools to 3.4% against 3.5% expected and 3.6% last month, and month-on-month core inflation slows to 0.2%, major drop in months.

As CoinGape predicted, both inflation data by Wall Street and economists signaled an overall positive numbers and sentiment for an uptick in the market. US stock futures rose today as investors look for double macro event of CPI and FOMC. Meanwhile, China announced its inflation rate falling below estimates.

Bitcoin Traders Eyes Fed Rate Cuts in September

Banks have predicted Fed rate cuts starting in September. A cooling CPI inflation and PCE inflation to confirm September as an official pivot by the Fed. Meanwhile, Fed Chair Jerome Powell remains bullish on the state of the US economy, still expecting three rate cuts, despite two indicated by Fed swaps.

The US dollar index (DXY) dropped ahead of CPI and Fed rate decision. It’s moving around 105.22, likely to drop below 105 after the key macro events. After the report, it fell to 104.5. As predicted by CoinGape, CPI in line with market estimates or below could raise bets for a rate cut in September, potentially lifting Bitcoin price.

Moreover, US 10-Year Treasury yields (US10Y) pared gains this week amid positive sentiment for market recovery, fading concerns raised after last week’s jobs data. It dropped to 4.293% after CPI cooled. Bitcoin price moves in the opposite direction to the US treasury yields and traders eyeing a further drop with slowing monetary policy tightening.

Also Read: Why The World’s Largest Bank Called Ethereum (ETH) Digital Oil

Bitcoin Price Rebound Post CPI To Bring Crypto Market Recovery

Bitcoin tends to dump into FOMC and CPI as the crypto market overreacts, which should reverse after these events. BTC price is creating a healthy market structure on the bigger timeframe and a buy-the-dip opportunity, said analysts. It has formed an inverse head and shoulders pattern in the lower timeframe, which could bring a recovery in the broader crypto market as BTC rises.

Open interests are increasing once again to hit all-time highs, but met a rough patch due to macro events. Total BTC futures open interest is at $35.47 billion, with fresh hints of buying from the bottom, as per Coinglass data.

Options market data indicate a rebound above $67,500 today and to surpass $69,000 on expiry day on Friday. Options traders have bet Bitcoin to hit highs of $75K and even $80K by the end of June. Traders are bullish after this heavy macro week, as per Deribit.

Meanwhile, spot Bitcoin ETFs saw a $200 million outflow amid macro concerns. Fidelity, Bitwise, ARK 21Shares, VanEck, and GBTC Bitcoin ETFs recorded outflows on Tuesday.

BTC price is trading at $69,905, up over 3% in the last 24 hours. The support level is at $66K, a drop below this will negate the bullish scenario in the short term as traders await the FOMC decision. Furthermore, the trading volume has increased slightly in the last 24 hours, indicating a rise in interest among traders.

Also Read:

- Shiba Inu (SHIB) ETF: Petition Tops 10,500 Supporting Signatures

- Bitcoin Miner Capitulation Can Extend BTC Price Drop to $62,500

- Bitcoin News: BTC ETF To Impact Price Stability In Long Run

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?