Breaking: U.S. CPI Data Shows Inflation At 6.4%; Time For Bitcoin Price To Shine?

The chronically high costs that have burdened the people of the United States have some highly encouraging news this Tuesday morning. The Consumer Price Index (CPI), a crucial economic indicator that tracks the average change in consumer prices for a range of goods & services, showed a significant decline in inflation for the month of December; bringing it to the lowest level in nearly a year. With the latest CPI number coming in at 6.4%, it strengthens the case for lowering inflation, which can drive up cost of volatile assets like Bitcoin’s (BTC) price, which is currently trading at $21,633.

U.S. CPI Reports 6.4% Inflation

The Core CPI, which does not include volatile prices for things like gasoline and food, increased by 0.4% month-over-month and recorded an increase of 5.6 YoY% which was marginally over market predictions. The 6.5% gain in September was the highest since August 1982. According to the closely monitored index by the Bureau of Labor Statistics, the underlying consumer prices increased by the least amount in the past 15 months. This makes it feasible for the Federal Reserve to further cut down on the size of interest rates it has been implementing in the country for the past few months.

According to the Labor Department, increasing housing costs were the main cause of the 0.5% monthly price increase and 60% of the 6.4% annual inflation rate that occurred last month. In January alone, housing costs increased by 0.7%, bringing their annual increase to 7.9%.

Read More: Check Out The Top 10 DeFi Lending Platforms Of 2023

A number of factors came together in the spring of 2021 to trigger a spike in inflation, which resulted in price increases reaching their greatest levels since the stagflationary period of the early 1980s. The pandemic generated a supply and demand imbalance, Russia’s invasion of Ukraine had an effect on energy prices, and billions of dollars in fiscal and monetary stimulus caused an abundance of money to hunt for fewer commodities that were caught up in supply chain issues.

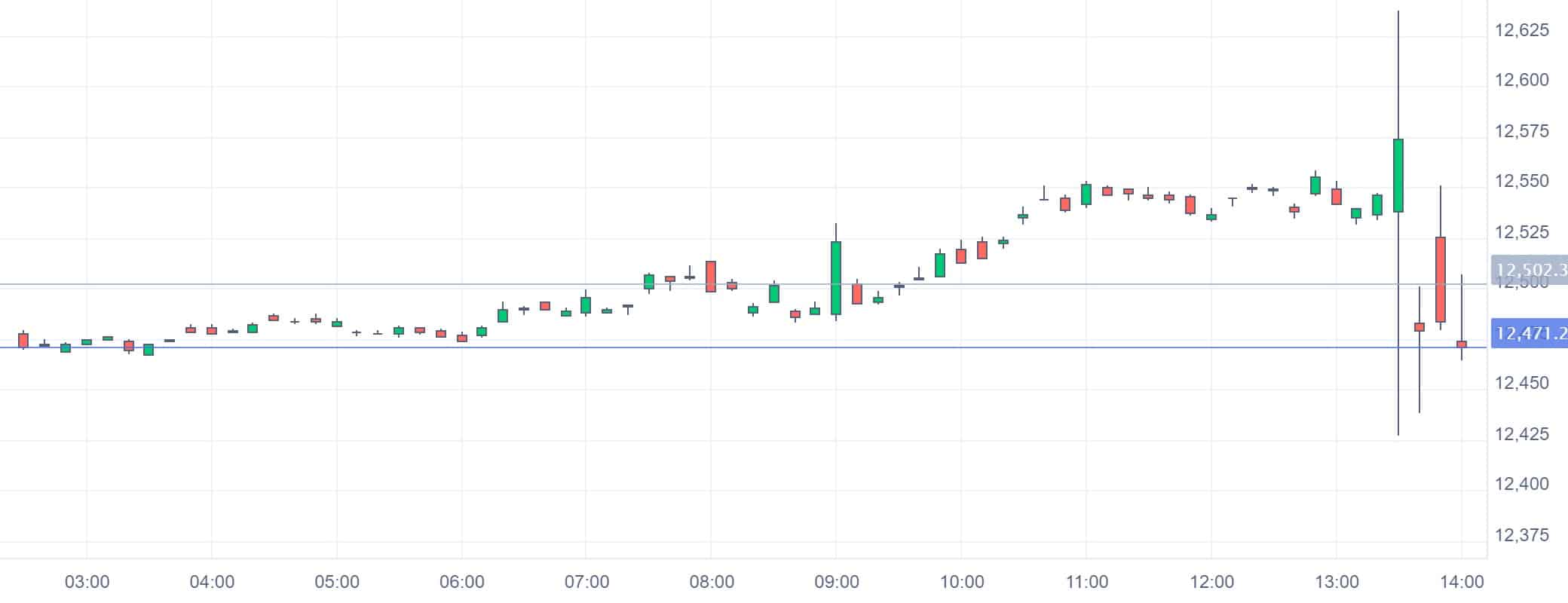

Market Reaction

Stock futures were relatively up as the January consumer pricing report was expected to match market expectations. However, with the release of the U.S. CPI data, the Dow Jones Industrial Average futures contracts decreased by 45 points or 0.26%, futures of the Nasdaq 100 dropped by 0.11% while those of the S&P 500 declined by 0.15% or 5.5 points.

The cryptocurrency market, on the other hand, has experienced conflicting reactions. The flagship cryptocurrency with the highest market capitalization, Bitcoin (BTC), is currently trading at $21,633 which represents a decrease of 0.95% over the last hour while increasing by 0.20% over the past 24 hours. Ethereum (ETH) price, however, is holding on to the $1,500 level at the time of writing.

Also Read: Crypto Prices Drop With Higher Than Expected US CPI Data

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs