US CPI Estimates By Wall Street And Crypto Analyst Who Predicted Bitcoin $18K

While traders actively await the release of the Consumer Price Index (CPI) for December by the US Bureau of Labor Statistics, the crypto market has already recovered. The move comes as Wall Street banks and crypto analysts expected inflation to have declined in December.

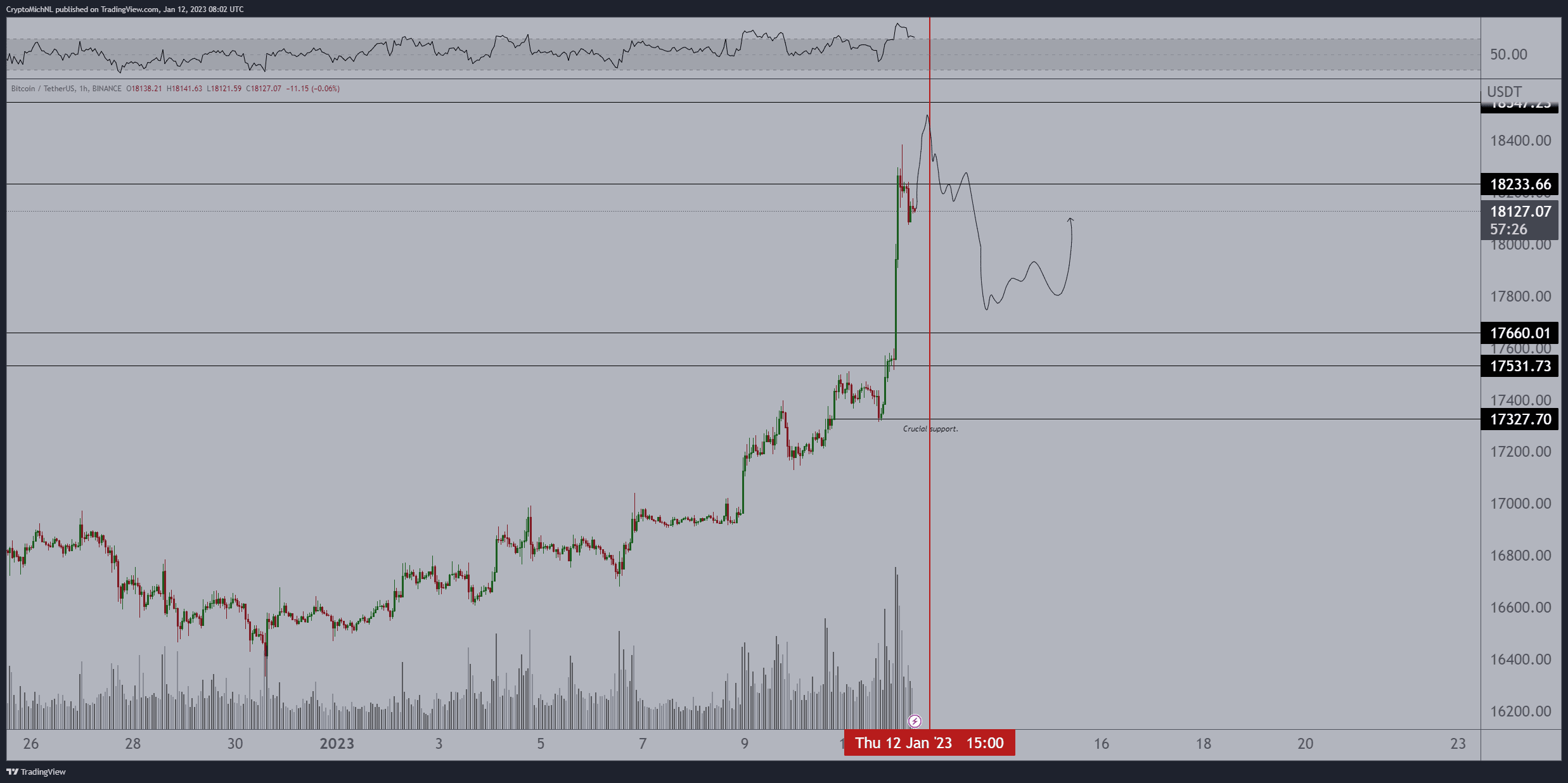

Bitcoin price breakout above $18K for the first time in the last 2 months. The 24-hour low and high are $17,337 and $18,268, respectively. Meanwhile, Ethereum also witnessed a 7% rally in the last 24 hours, hitting a high of $1,408.

Crypto Market Rally to Continue After CPI Data?

Popular analyst Michael van de Poppe in a tweet on January 12 shared his predictions for the crypto market as Wall Street economists expected a drop in the CPI.

As per consensus, the annual inflation rate in the U.S. likely slowed for a sixth straight month to 6.5% in December. It is the lowest since October 2021. The CPI also dropped to 7.1% in November.

Michael van de Poppe believes the CPI will most likely drop further, but the expectations of a massive drop as suggested by other experts are low. He expects the CPI can come in at 6.6% or 6.7%. Thereafter, the crypto market can witness a correction, before continuing the rally.

On January 11, he shared that Bitcoin needed to hold around $17.3K, which it did. Thus, Bitcoin “will likely continue moving higher toward $18.5K.”

Wall Street Expectations on the Consumer Price Index

Wall Street banks expected a drop in the CPI for December. Economists based their reasoning on the lower energy prices in December that contributed the most to the slowdown. Gasoline costs declined nearly 12% from November to December.

CIBC, Wells Fargo, and Nomura expect inflation at 6.3%, whereas Barclays, Bank of America, JPMorgan, Morgan Stanley, and Goldman Sachs have set their expectations to 6.4%. Meanwhile, TD Securities, Citi, Credit Suisse, and BMO anticipate December’s CPI at 6.5%.

Also Read: Will U.S. CPI Data Help Bitcoin (BTC) Price Break This Key Resistance?

- Breaking: ABA Tells OCC to Delay Charter Review for Ripple, Coinbase, Circle

- Brian Armstrong Offloads $101M in Coinbase Stock Amid COIN’s Steep Decline

- MSTR Stock in Focus After CEO Phong Le Signals More BTC Buys

- Cardano Founder Sets March Launch for Midnight as Expert Predicts BTC Shift to Privacy Coins

- U.S. Government Shutdown Odds Hit 84%, Will Bitcoin Crash Again?

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates