Bitcoin Price: Former US Fed Official Hints At FOMC-Led Limitations

Crypto Market News: Ahead of the crucial Federal Open Market Committee (FOMC) meeting scheduled for June 14, 2023, the financial markets are widely anticipating that the US Federal Reserve halt interest rate hikes again. A clear indication to this is seen in the S&P 500 Index behavior, which is at the cusp of closing at a 13 month high on Monday, largely due to the expectation of the central bank pausing the rate hike spree. The S&P 500 rose 0.86% on Monday while the Nasdaq Composite Index jumped 1.3%. However, it remains to be seen whether the markets will have any real deviation if and when the rate hike pause is announced.

Also Read: US Congressman Files Bill To Fire SEC Chair Gary Gensler

Meanwhile, former Fed Vice Chair Roger Ferguson believes the ongoing market optimism resulted in the pricing in of the Fed rate hike pause already. Hence, it may be argued that there may not be much room for bullish environment in the financial markets. However, the same may not necessarily be said about Bitcoin price and crypto markets.

Former Fed Vice Chair: Rate Hike Pause Already Priced In

Speaking to CNBC on Monday, former Fed official Roger Ferguson agreed that the market is right about the Fed pause expectation. However, he said not all is fine about the quantitative easing of the Fed’s monetary policy. Citing tight labor market and rising wages, Ferguson said there was likelihood of further rate hikes in the remaining of 2023, as against the market expectation of a downward path in terms of easing the policy. Hence, this could potentially translate to increased volatility in the crypto market, as risky assets like Bitcoin may be preferred by traders in an uncertain environment.

“I think the market has priced in a pause. Where I disagree with the market is I see not one but a possibility of two more hikes after this one with no reversal this year. I think the market’s generally correct but a little optimistic.”

The CME FedWatch Tool shows that the likelihood that the Fed will change the Federal target rate just around 21%.

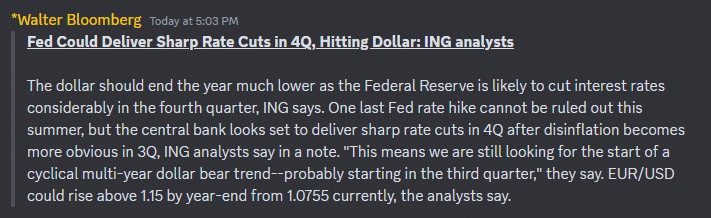

In yet another positive indication for rise in Bitcoin price in the rest of 2023, banking and financial services company ING predicted that the US Dollar could end up in a relatively lower position by the end of the year, as shared by Twitter handle Walter Bloomberg. This is based on a contrarian view that the Fed may cut rates in the fourth quarter.

Also Read: Gary Gensler Warns Crypto Market: “Not Liking Not Same As Not Receiving”

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?