US PCE Inflation Data Sparks Bitcoin and Crypto Market Surge

The U.S. Bureau of Economic Analysis to announce the personal consumption expenditures (PCE) inflation data for November today. The annual PCE inflation is expected to further cool to 2.8% from 3 last month, with no rise in the monthly rate. Also, the Core PCE, the Fed’s preferred gauge to measure inflation, is expected to rise 0.2% month-on-month while the annual rate is predicted to decline to 3.3%, marking its lowest level since 2021.

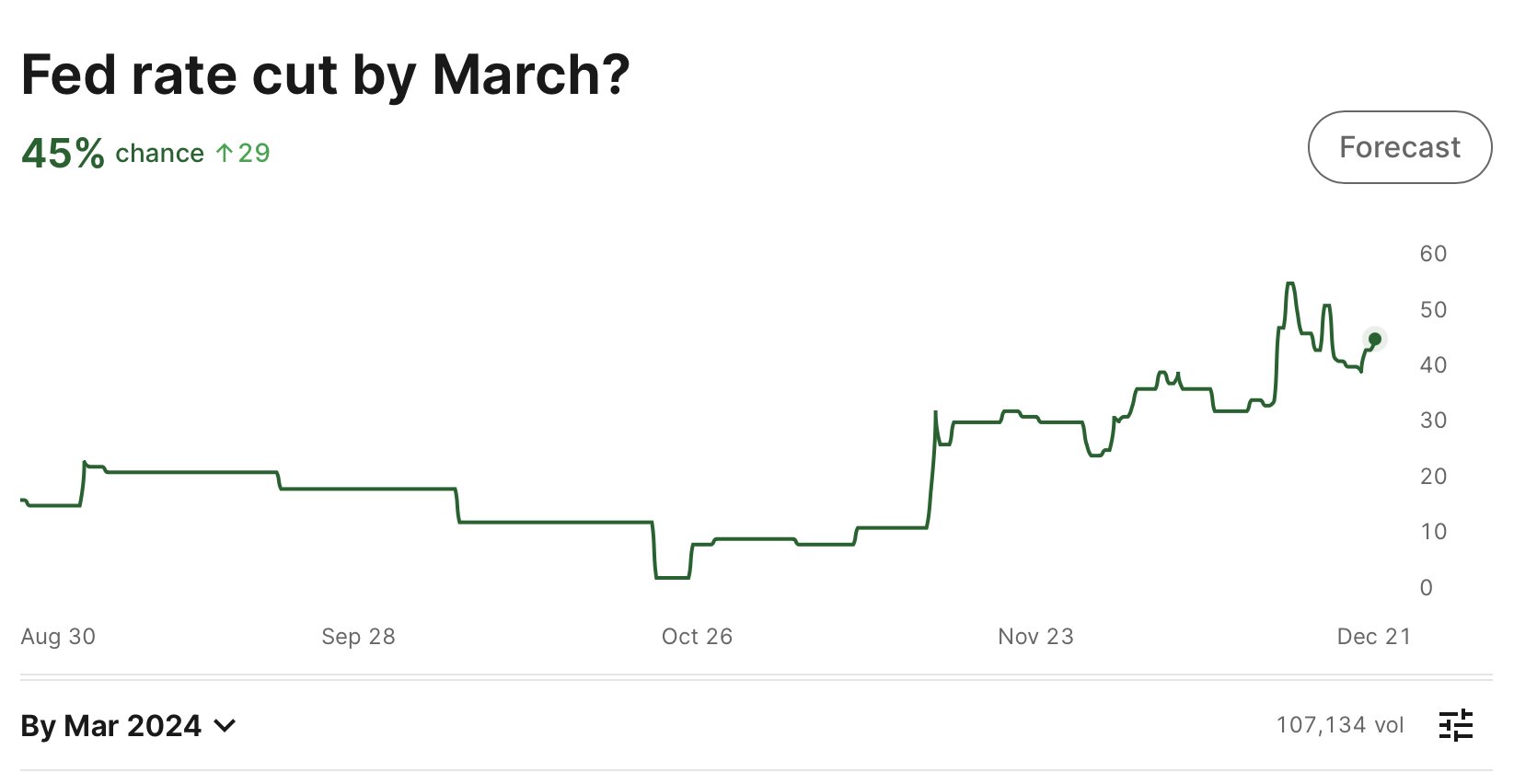

Wall Street estimates are mostly in line with market consensus in response to recent Fed Chair Jerome Powell’s projecting three rate cuts in 2024. The market currently has a 45% chance that the Fed will start rate cuts in March. Moreover, the CME FedWatch shows a 71% probability of a 25 bps rate cut in March.

The monetary policy outlook remains dovish as the US Dollar Index (DXY) steadied around 101.8 on Friday but is still set to decline for the second straight week in anticipation of the Fed rate cuts.

Furthermore, the US 10-year Treasury yield continues to fall after dropping below 4% last week. It is now at 3.89%, slightly up as traders brace for inflation data.

The Fed rate cuts and other macro factors confirm a further recovery in Bitcoin price and the crypto market. Traders and investors also consider spot Bitcoin ETF approval and Bitcoin halving factors in anticipation of a major bullish rally.

Also Read: Bloomberg Analyst Says Spot Bitcoin ETF Approvals To Begin By End Of 2023?

Bitcoin and Crypto Market Rally

Bitcoin, Ethereum, and top altcoins such as Solana (SOL), BNB, XRP, Cardano (ADA), Avalanche (AVAX) and others are up today in anticipation of a Santa Claus rally.

Since everyone is bullish, I tried to find some bearish factors but couldn't find any.

— Ki Young Ju (@ki_young_ju) December 22, 2023

At press time, the BTC price is trading between the 24-hour range of $43,441 and $44,367 on CoinGecko. The coin has experienced a slight decline of 0.45% in the last 24 hours, with a trading volume of $20 billion. Over the past week, BTC has seen a price increase of 4%.

However, the market can see some profit booking because of Friday’s expiry. 25,000 BTC options of a notional value of $1.11 billion are set to expire with a put call ratio of 0.70, a max pain point of $42,000. 217,000 ETH options of a notional value of $490 million are about to expire with a put call ratio of 0.60, and a max pain point of $2,200.

Also Read: BitMEX’s Arthur Hayes Dumps Solana & Predicts Ethereum To Hit $5000

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?