US SEC Amends Original Complaint Against Binance, Ripple CLO Reacts

Highlights

- US SEC filed a motion to amend the original complaint regarding "crypto asset securities" in Binance lawsuit.

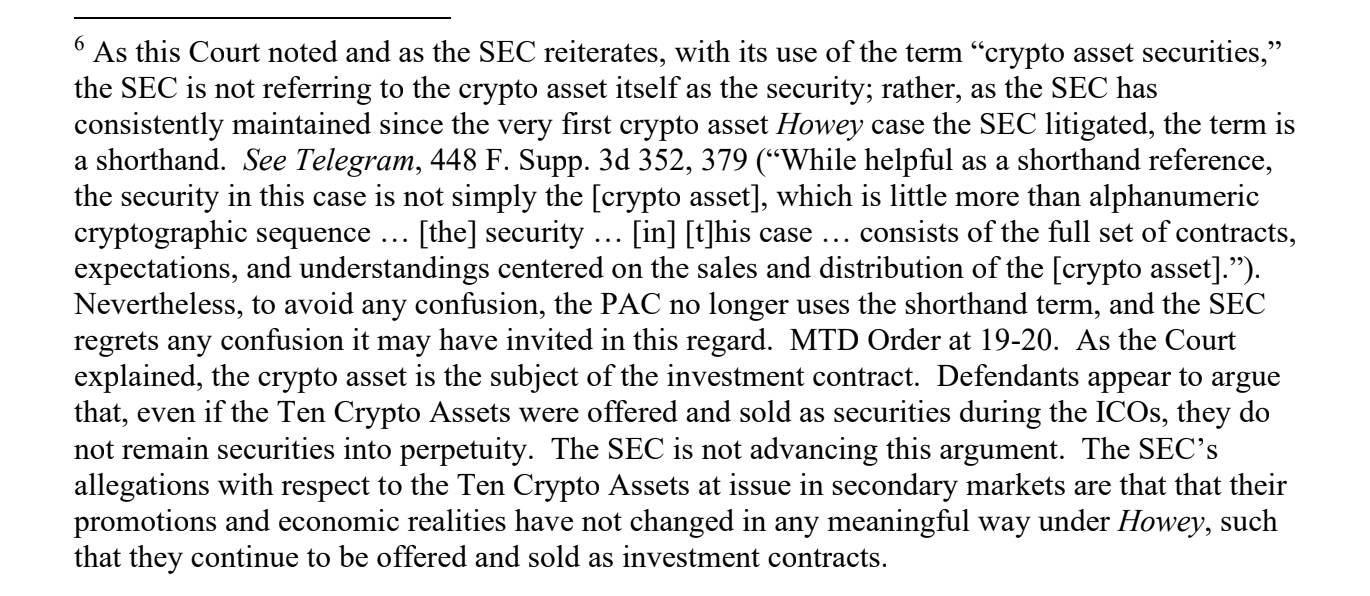

- The SEC regrets using crypto asset securities and agrees that 10 tokens are not securities in themselves.

- Coinbase CLO Paul Grewal explained the SEC will continue to challenge securities allegations against the 10 tokens.

In the latest development in the U.S. SEC lawsuit against Binance, Binance.US, and co-founder Changpeng Zhao, the government agency requested the court to amend its complaint. The filing came in response to a district court order denying crypto exchange Kraken’s motion to dismiss in SEC v. Payward case. Ripple CLO Stuart Alderoty reacts as the agency regrets using “crypto asset securities” in cases and agrees that 10 tokens are not securities in themselves.

US SEC Files to Modify Complaint in Binance Case

In the latest District Court of Columbia filing in SEC vs Binance, the plaintiff the U.S. Securities and Exchange Commission filed a motion for leave to amend the original complaint regarding “crypto asset securities.”

The regulator has submitted the proposed amended complaint (PAC), a redline comparing the PAC to the original complaint, and, for the court’s reference because it is not yet published on widely available legal databases, the order denying defendants’ motion to dismiss in Kraken vs SEC lawsuit.

Binance is required to file either an opposition or notice of their consent to the SEC’s request by October 11 this year. The agency will continue its regulation by enforcement approach to assert control over the crypto industry.

Coinbase & Ripple CLOs React to SEC Filing

Coinbase chief legal officer (CLO) Paul Grewal took to X and shared a footnote in the proposed amended complaint by the SEC against Binance. He pointed out that “The SEC regrets any confusion it may have invited” by falsely and repeatedly stating that 10 tokens including SOL, ADA, MATIC are securities in themselves.

He mentioned Ripple CLO Stuart Alderoty in the post citing a notable shift in the SEC’s approach or clarification on its stance regarding the use of the term “crypto asset securities.” Recently, Ripple CLO challenged the thinking of regulators against crypto regarding money laundering.

He further added that ETH has somehow come out of the SEC’s scrutiny but the 10 tokens have failed to avoid the regulator’s nuanced approach towards crypto. The agency will continue to allege the 10 crypto assets at issue in secondary markets and also that they are sold as investment contracts.

Ripple CLO Stuart Alderoty reacted and said “crypto asset security” is a made-up term. The government agency continued to manipulate the courts with its twisted terms instead of providing clarity.

So the SEC finally admits that 1/ "crypto asset security" is a made up term and 2/ to prove a "crypto asset security" is an investment contract, the SEC needs evidence of a bundle of "contracts, expectations, and understandings"?

Think it's time for @SECgov to admit it has… https://t.co/iJIYTnNvxs pic.twitter.com/E58Pft7irc

— Stuart Alderoty (@s_alderoty) September 13, 2024

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs