Breaking: US SEC Announces Order on BlackRock Bitcoin Premium Income ETF

Highlights

- US SEC issues major decision on BlackRock Bitcoin Premium Income ETF.

- SEC seeks comments on Nasdaq's proposal to list BlackRock iShares income ETF under for commodity rule.

- The commission delayed the ETF during the government shutdown.

- BTC price holds near $86K ahead of the week's key macro events.

In a major crypto news related to the BlackRock Bitcoin Premium Income ETF, the U.S. Securities and Exchange Commission (SEC) has announced a key decision on the application. Nasdaq’s proposal to list and trade shares of the iShares Bitcoin Premium Income ETF under the Generic listing standards rule was already delayed by the SEC once during the government shutdown.

BlackRock Bitcoin Premium Income ETF Advances

The US SEC has advanced BlackRock Bitcoin Premium Income ETF, instituting proceedings to determine whether to approve or disapprove the application under the Generic listing standards for commodity-based trust shares.

“Institution of proceedings is appropriate at this time in view of the legal and policy issues raised by the proposed rule change,” the SEC stated.

As CoinGape reported earlier, Nasdaq filed to list and trade BlackRock Bitcoin Premium Income ETF under the commodity-based trust rule.

The actively managed ETF will generate income by selling call options on iShares Bitcoin Trust ETF (IBIT) or indices that track spot Bitcoin ETPs. It will invest primarily in spot Bitcoin and IBIT, while holding cash.

Why BlackRock Bitcoin Income ETF Was Delayed by the US SEC?

During the prolonged US government shutdown, the US SEC delayed the BlackRock Bitcoin Premium Income ETF as the Generic listing standards rule only applies to passively managed commodity-based trust shares.

The iShares income ETF is actively managed and may hold OTC options, with no surveillance market yet. However, it meets all other requirements under the Generic listing standards, prompting Nasdaq to seek approval under the 5711(d).

Notably, the SEC has approved amendments to Nasdaq Rule 5711(d) to adopt generic listing standards for commodity-based trust shares.

The SEC has until December 31 to approve, disapprove, or continue proceedings on the proposed rule change. The outcome will determine whether BlackRock Bitcoin Premium Income ETF becomes the latest addition to bitcoin-related investment products available to U.S. investors.

As CoinGape reported, the SEC is deliberating approval of FLEX options on IBIT under the generic listing rules for submissions from multiple exchanges.

BTC Price Action Muted Near $86K

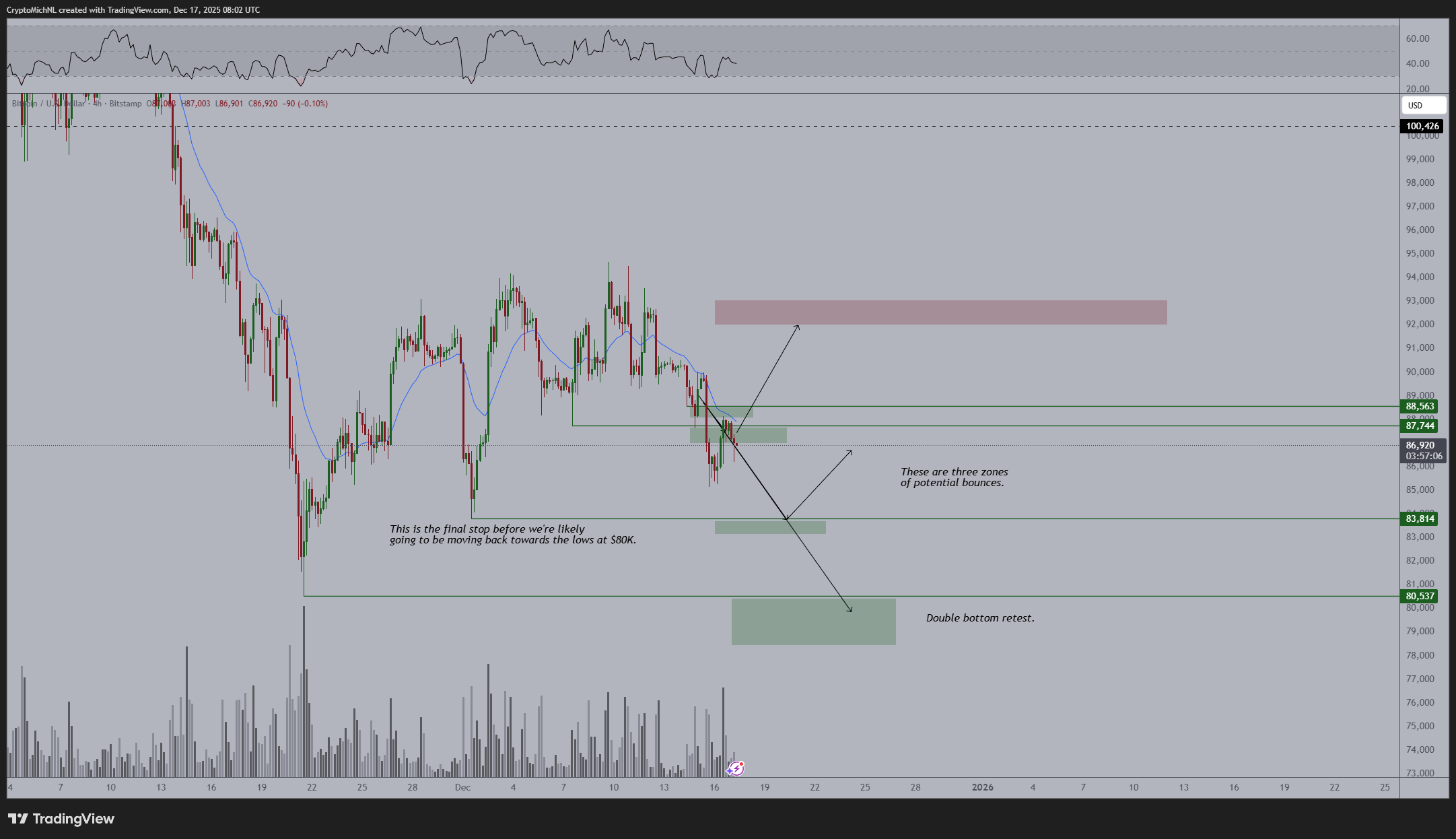

Crypto analyst Michael van de Poppe claimed Bitcoin downtrend is still intact on lower timeframes. BTC price can test $80K levels if bulls fail to break above $88K for a strong upward momentum.

“Given that there’s a lot of macroeconomic events taking place over the course of this week, I wouldn’t be surprised if we’re getting any of those tests,” he added.” The Bank of Japan’s rate hike will likely crash the crypto market.

Notably, CME Futures Open Interest is about half what it was during the peaks in the year. Tax loss harvesting and up to $20 billion in crypto hedge fund redemptions could significantly increase selling pressure in Bitcoin.

BTC price currently trades at $86,467, down nearly 4% in the past 24 hours. The intraday low and high are $85,304 and $89,982, respectively. Furthermore, trading volume has increased by 50% over the last 24 hours.

- Bitcoin Adoption Hits New Levels as Bhutan Commits $1B BTC to Develop Its Economic City

- Fed Chair Drama Heats Up as Trump Eyes Christopher Waller Amid “Lower Rate” Ambitions

- Hyperliquid Eyes HYPE Token Recovery with Massive Burn Proposal

- Bitcoin Crash Incoming? Peter Schiff Adds to Bearish Warnings as Gold and Silver Rally

- Bitcoin to Drop to $10K? Bloomberg Analyst Makes Bold Prediction

- DOGE Whales Add 138M Coins in 24 Hours: Will Dogecoin Price Rebound Above $0.15?

- Ethereum Price Outlook Hinges on Whale Moves: Dump Below $2,800 or Reclaim Above $3K Next?

- Solana Price Outlook After Charles Schwab Adds SOL Futures — What Next?

- Pi Network Stares at a 20% Crash as Whale Buying Pauses and Demand Dries

- Here’s How Dogecoin Price Could Rise After Crossing $0.20

- Is XRP Price Headed for $1.5 as Whales Dump 1.18B XRP in Just Four Weeks?