Vanguard Trims Stake in MicroStrategy By 10% As MSTR Stock Struggles

Highlights

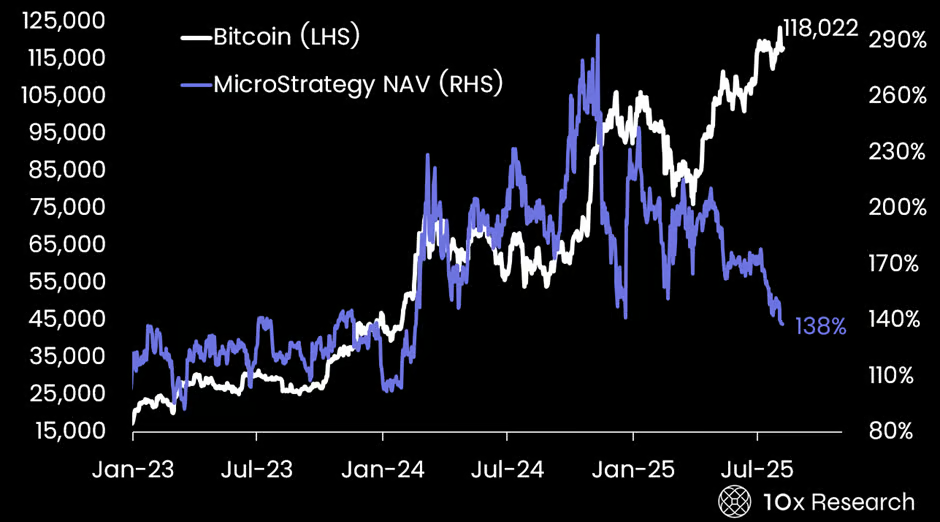

- Analysts warn that falling volatility in both Bitcoin and MicroStrategy reduces the MSTR stock’s leverage effect.

- As hedge funds dominates trading activity for MSTR, As Strategy loses edge to raise capital at premium valuation.

- Michael Saylor signaled more Bitcoin acquisitions for MicroStrategy, even as rivals like Japan-based Metaplanet continue adding BTC.

Asset manager Vanguard has trimmed its stake by 10%, in Michael Sayor’s Strategy (previously MicroStrategy), during the second quarter of 2025. This comes as the MSTR stock has lost its volatility and has been trading in a very tight range over the past four months, finding support at $360. The recent trimming of stake by the largest shareholder, Vanguard, has raised questions on the stock’s near-term trajectory.

Vanguard Cuts Stake in MicroStrategy

Michael Saylor’s MicroStrategy is seeing some major institutional shift, with the largest shareholder, Vanguard, trimming its stake. This comes as the MSTR stock has been trading in a tight range for years, with the $360 support level repeatedly tested over the past four months. This underperformance comes even with the company’s continued BTC purchases.

As long-only investors pulled back, hedge funds have taken the lead in trading activity, making technical levels even more critical. The $360 mark has held through multiple retests, but a breakdown could signal a major shift in sentiment, reported analysts at 10x Research.

The analysts also added that the latest move in MSTR comes as Bitcoin treasury-focused companies lose their competitive edge. Ethereum treasuries and upcoming crypto IPOs are starting to attract fresh capital, diverting attention away from MicroStrategy.

Besides, the analysts also warned that declining volatility in both Bitcoin and MSTR would diminish the stock’s leverage effect relative to Bitcoin. This could further limit the company’s ability to raise additional capital at premium valuations. Michael Saylor’s Strategy reported a strong Q2 with $10 billion in net income, with some analysts believing that the stock can rally to $680.

The analysts at 10x Research noted that MicroStrategy shares have slipped to $366, or 13% on the monthly chart, while Japan-based Metaplanet has fallen to $1,333, or 37%. Both firms have lost the premium advantage that once made them attractive proxies for Bitcoin exposure, they added.

Michael Saylor Hints At More Purchases

In his recent post on the X platform on August 17, Strategy executive chairman Michael Saylor hinted at more BTC purchases. While sharing the company’s BTC acquisition chart, Saylor wrote” Insufficient Orange”.

Insufficient Orange pic.twitter.com/QcRT0RTzEg

— Michael Saylor (@saylor) August 17, 2025

Other publicly listed firms like Metaplanet have also continued with their BTC acquisition plan. Earlier today, Metaplanet announced the purchase of an additional 775 BTC, while taking its total holdings to 18,888 BTC.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

Buy $GGs

Buy $GGs